The United Kingdom’s Financial Conduct Authority (FCA) has lifted the ban on retail access to cryptocurrency exchange-traded notes (cETNs).

Companies in the UK will soon be able to offer retail consumers cETNs, with regulatory changes effective Oct. 8, according to an FCA announcement on Friday.

The new development in the UK’s regulatory approach on crypto comes after the FCA banned crypto ETNs in January 2021, citing the extreme volatility of crypto assets and a “lack of legitimate investment need” for retail consumers.

“Since we restricted retail access to cETNs, the market has evolved, and products have become more mainstream and better understood,” David Geale, FCA executive director of payments and digital finance, said in the announcement.

What are crypto ETNs?

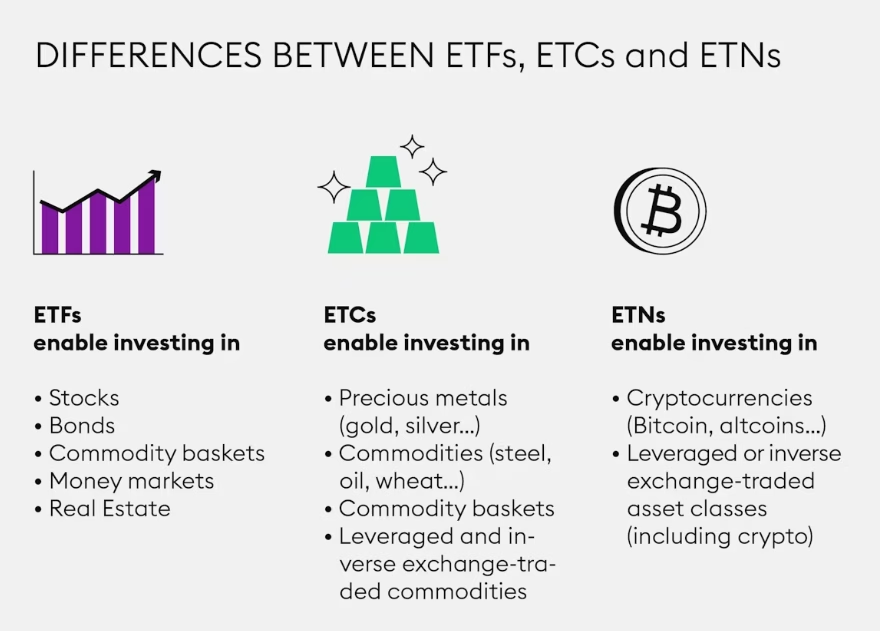

Unlike cryptocurrency exchange-traded funds (ETFs), which track the price of underlying assets like Bitcoin (BTC) in custody, crypto ETNs are not backed by any underlying assets and represent debt securities.

“Instead of equity in the fund, each traded note of an ETN represents an obligation from a legal entity holding the underlying asset as collateral,” according to the ETN description by the Austrian crypto trading platform Bitpanda.

By investing through an ETN tracking crypto, investors can obtain exposure to physical crypto assets via their regular brokers or banks.

ETNs are associated with risks like limited control over their assets, which underscores the importance of purchasing ETNs from reputable institutions to ensure safety, Bitpanda said.

Crypto derivatives still banned

While allowing crypto ETNs, the UK FCA is yet to make a decision on whether to allow retail investors to access crypto derivatives, which the authority banned alongside ETNs in 2021.

“The FCA will continue to monitor market developments and consider its approach to high-risk investments,” the regulator stated.

Related: ‘Everything is fine’: Coinbase mocks UK financial system in new video

Crypto derivatives, or products such as crypto futures, options and perpetual contracts, have shown resilience in the second quarter of 2025, with volumes netting $20.2 trillion, according to the crypto analytics platform TokenInsight.

In contrast, centralized exchanges’ (CEXs) volumes plummeted by 22%, showing a big contrast to cryptocurrency ETFs.

US allows in-kind for crypto ETFs: No impact on retail

Cryptocurrency ETFs have seen…

Click Here to Read the Full Original Article at Cointelegraph.com News…