Stablecoin companies operating in Hong Kong posted double-digit losses on Friday amid local regulatory shifts and a broader market correction.

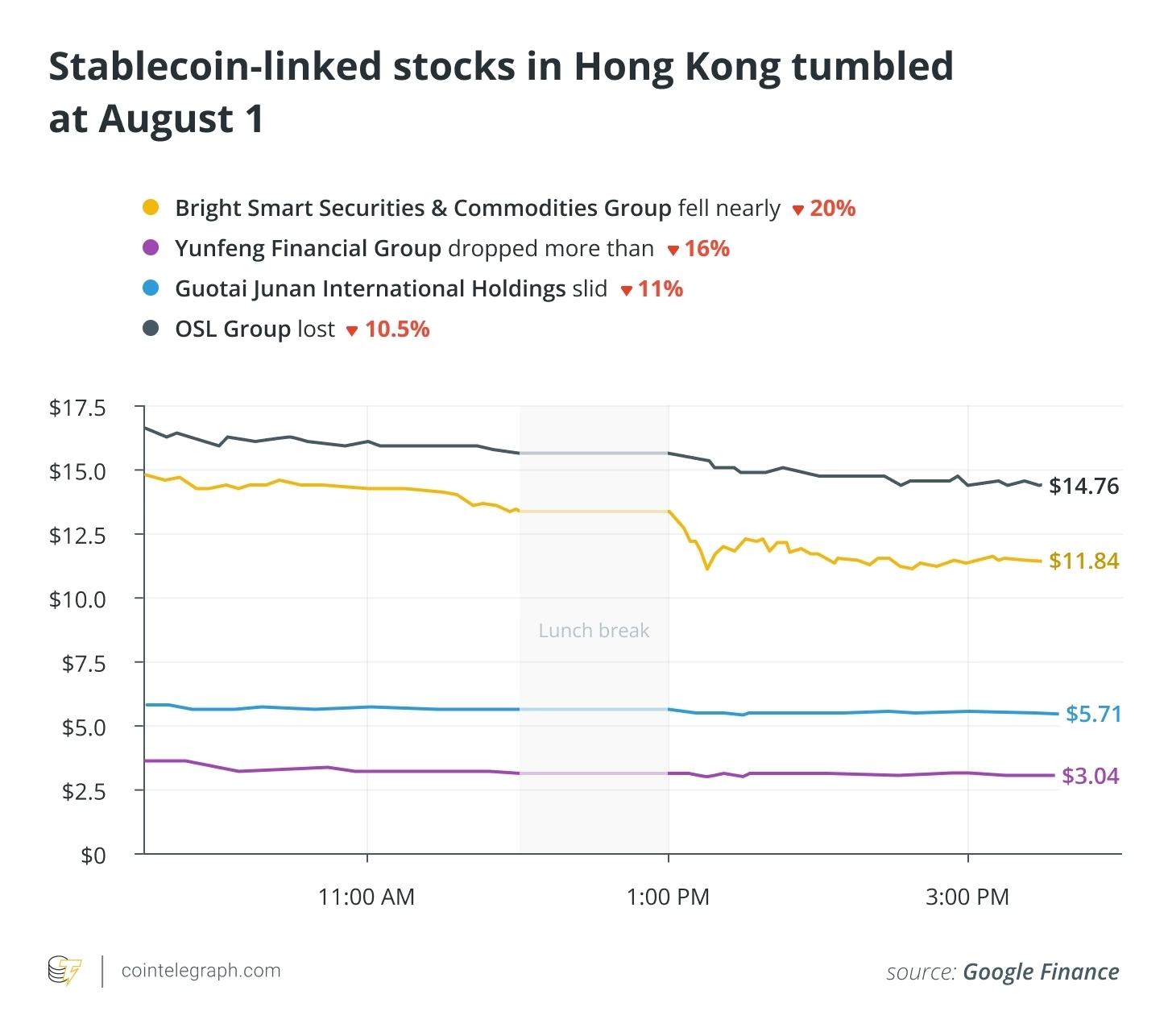

Bright Smart Securities & Commodities Group fell nearly 20% on Friday, according to Google Finance data. Yunfeng Financial Group dropped more than 16% during the trading session, while Guotai Junan International Holdings slid 11% and OSL Group declined 10.5%.

These companies are referred to as “Hong Kong stablecoin-concept companies,” with share prices driven by exposure to stablecoin issuance, custody, trading, or related infrastructure. Still, some local experts view the correction as a positive market adjustment.

It’s “a healthy correction,” said Allen Huang, a senior stablecoin policy researcher at the Hong Kong University of Science and Technology. “There are signs that the stablecoin frenzy has spilled over to other financial markets including the equity market,” Huang told Cointelegraph.

The correction comes amid a broader downturn in Hong Kong’s financial markets. The Hang Seng Index closed down more than 1% on Friday, while the Hang Seng SmallCap Index fell 1.54% during the session. The Hang Seng Tech Index lost 1.02%.

Related: Pyth Network brings Hong Kong stock prices onchain for global access

A healthy market correction

The fall in stocks follows Hong Kong’s entry into a six-month transition period with special rules as it transitions to its new stablecoin framework. The new regulations also come amid plans to criminalize unlicensed stablecoin promotion in the region.

Huang is far from the only expert who believes that this sell-off was just a sane market dynamic.

“The sell-off in ‘stablecoin concept’ stocks is a rational market correction following months of speculative over-enthusiasm,” said Xu Han, director of Liquid Fund at Hong Kong-licensed exchange HashKey Group.

He explained that regulatory rigor, including requiring a one-to-one full reserve, one-day redemptions and a minimum capital of 25 million Hong Kong dollars ($3.18 million), “is a deliberate strategy to prioritize systemic stability and credibility.” He concluded:

“The correction filters out short-term speculation, allowing fundamentally strong players to anchor Hong Kong’s reputation as a globally trusted digital asset hub.“

“Today’s sell-off in ‘stablecoin concept’ shares is likely a healthy correction after speculative gains,” said Niko Demchuk, head of compliance at crypto forensics firm with…

Click Here to Read the Full Original Article at Cointelegraph.com News…