- Senator Lummis has introduced a bill to include crypto in mortgage approvals.

- The bill targets young buyers and aligns with FHFA’s recent crypto directive.

- Critics cite crypto’s volatility as a mortgage default risk.

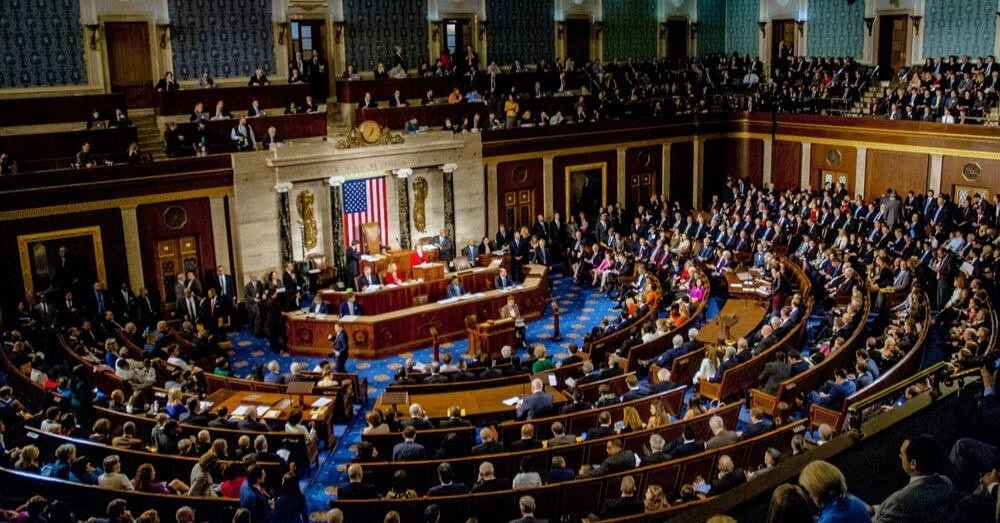

US Senator Cynthia Lummis of Wyoming has proposed legislation that, if passed, would require housing finance agencies to consider digital assets in evaluating mortgage loan applications.

The bill has sparked debate on Capitol Hill, with supporters viewing it as a step toward financial modernisation and critics warning of potential risks.

Bill tied to recent Federal Housing directive

The proposed legislation, known as the 21st Century Mortgage Act, aims to codify a recent order issued by the Federal Housing Finance Agency (FHFA).

That order directed Fannie Mae and Freddie Mac, two key mortgage purchasers in the US, to factor in cryptocurrencies as part of asset evaluations for single-family mortgage loans.

Senator Lummis announced the bill shortly after the FHFA directive, stating that congressional action was needed to ensure the order becomes permanent law.

According to the senator, the bill reflects a modern approach to wealth-building, especially for younger Americans who are more likely to own digital assets than traditional property or savings.

Targeting the younger generation of buyers

Citing US Census Bureau data, Lummis noted that homeownership among Americans under 35 stood at just 36% in the first quarter of 2025.

For many in this demographic, crypto represents a significant portion of their net worth.

Therefore, the bill seeks to address a growing need to consider all forms of personal wealth — not just fiat or traditional assets — during the mortgage approval process.

The bill would allow borrowers to retain their cryptocurrency holdings without being forced to liquidate them into US dollars for mortgage consideration.

This approach, Lummis argues, keeps pace with how wealth is evolving and acknowledges the financial reality of modern young adults.

Pushback from Democratic lawmakers

Despite its potential to expand financial inclusion, the bill has faced early resistance.

Several Senate Democrats have expressed concern over the FHFA order, and by extension, the proposed legislation.

In a…