Corporations and Wall Street entities are starting to recognize Ether as the next emerging treasury asset as the world’s second-largest cryptocurrency and blockchain network celebrates its 10th anniversary on Wednesday.

Ethereum went live on July 30, 2015, introducing smart contract functionality and laying the foundation for the decentralized finance (DeFi) ecosystem. The network has maintained 10 years of uninterrupted uptime.

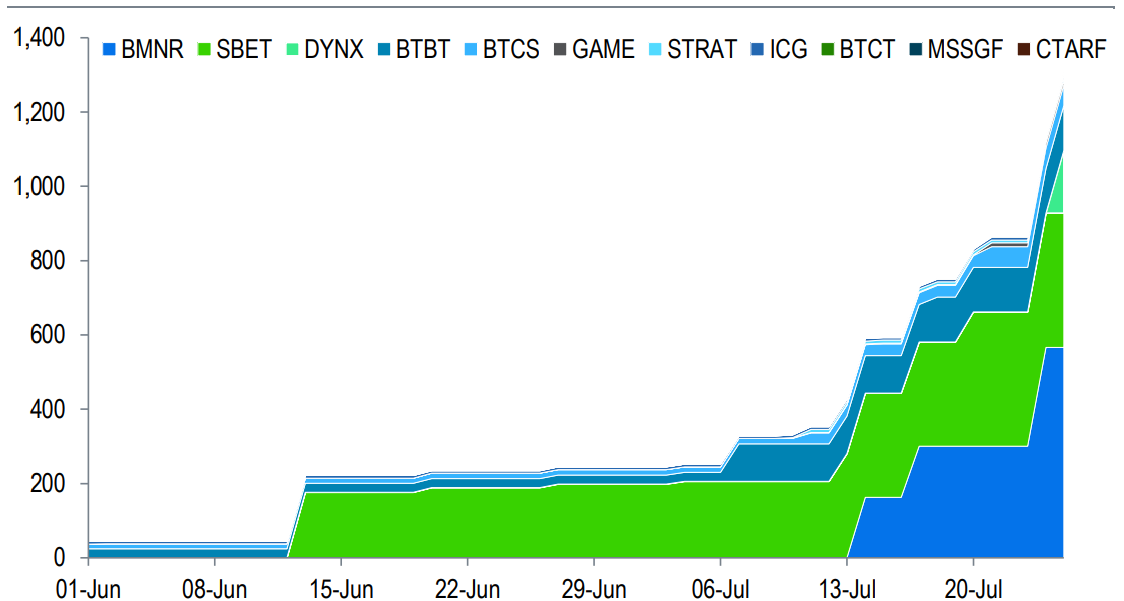

To mark the milestone, Cointelegraph reviewed the five largest corporate Ether (ETH) holders, underscoring Ether’s rising status as a strategic reserve asset among public companies.

Publicly-listed Bitcoin (BTC) mining company, BitMine Immersion Technologies, is the largest ETH treasury firm, holding 625,000 ETH or 0.52% of the total circulating ETH supply. The miner previously announced plans to acquire up to 5% of Ether’s supply, signaling more incoming investments after the firm announced a $1 billion stock repurchase program on Tuesday.

In second place is Nasdaq-listed Sharplink, which holds 438,190 ETH as its “primary” treasury reserve asset. The firm purchased $290 million worth of Ether between July 21 and July 27 at an average price of $3,756.

Related: Ether Machine taps demand with $1.5B institutional ETH vehicle: Finance Redefined

Bit Digital follows as the third-largest corporate ETH holder, with a total of 100,603 ETH in its holdings. On July 7, the firm announced its transition to an Ethereum treasury strategy, which included a $172 million public equity raise and the conversion of its balance sheet from Bitcoin to Ether.

Ethereum node validator BTCS Inc. comes in fourth place, with 70,028 in total ETH holdings. BTCS announced the closing of a $10 million convertible note issuance program on Monday, bringing the firm’s total raised capital to $207 million for 2025 alone.

GameSquare Holdings Inc., a media and tech firm, rounds out the top five with 12,913 ETH. The company has earmarked $250 million for a broader crypto treasury management strategy.

Related: 35 companies now hold at least 1,000 Bitcoin as corporate adoption booms

Wall Street is “warming up” to Ether as a treasury reserve asset

According to Gracy Chen, CEO of crypto exchange Bitget, institutions increasingly view Ethereum as the next major digital reserve asset.

“Given the high likelihood that the world’s assets will be tokenized on the…

Click Here to Read the Full Original Article at Cointelegraph.com News…