Key takeaways:

-

The dominance of Ether’s futures volume surpassed Bitcoin for the first time since 2022.

-

Tron-ecosystem stablecoin activity rose, pointing to capital inflows into the altcoin ecosystem.

Ether (ETH) has gained everyone’s attention over the past few weeks, with new data showing a clear shift away from Bitcoin (BTC) as the biggest altcoin by market capitalization rallied more than 50% in a month. According to Glassnode, Ether perpetual futures volume dominance has overtaken Bitcoin for the first time since 2022, marking the “largest” volume skew in ETH’s favor on record. The analytics platform noted that this shift “confirms a meaningful rotation of speculative interest toward the altcoin sector.”

Ether’s open interest dominance has also climbed to nearly 40%, the highest level since April 2023. Historically, only around 5% of days have seen a higher reading, suggesting that traders are increasingly positioning around ETH rather than BTC. This increases the probability of a growing appetite for risk and continued capital rotation into altcoin markets.

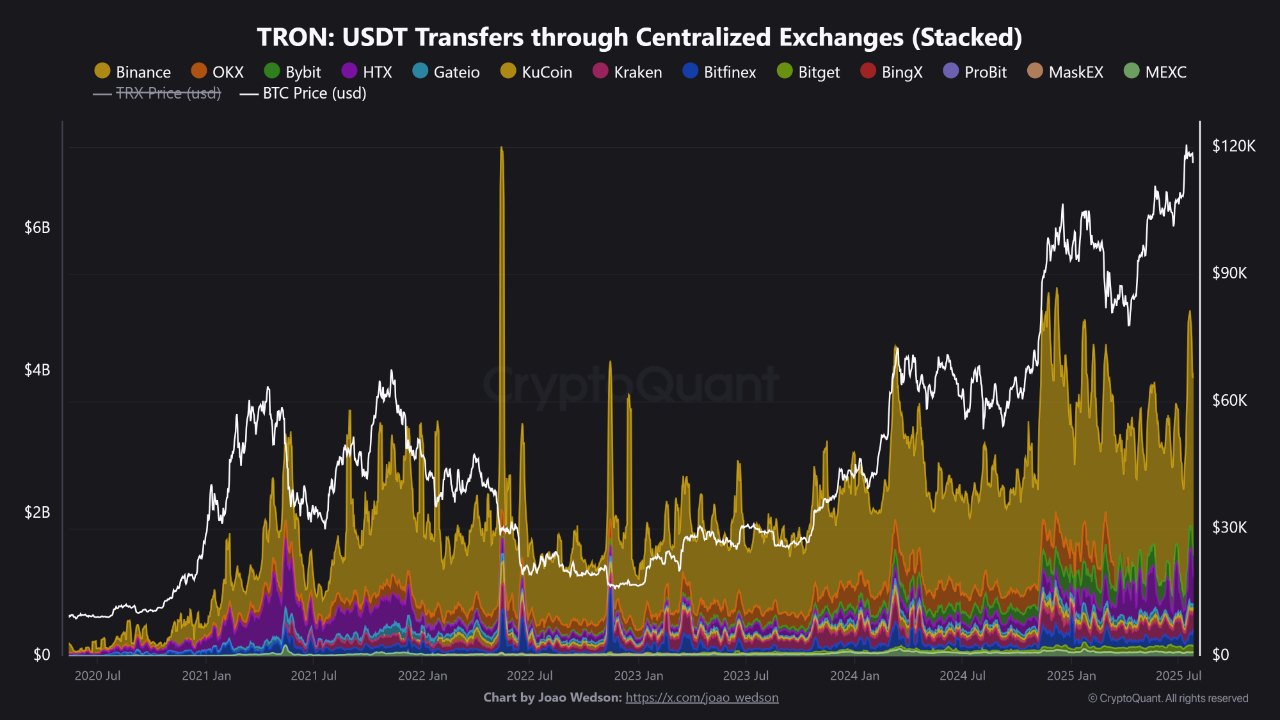

Supporting the narrative, onchain data shows a sharp increase in USDT transfers on the Tron network, with Binance driving the flow. Binance accounts for approximately 62% of all TRON-based USDT transfers, with daily volumes ranging between $2.5 to $3 billion. These large stablecoin movements typically precede periods of elevated market volatility, especially when tied to institutional positioning.

The growing concentration of stablecoin liquidity on Tron and Binance suggests these platforms remain the preferred infrastructure for high-frequency and high-volume trading, with liquidity possibly entering the altcoin market.

Related: Ethereum ‘ready to explode’ as ETH price reclaims $3.8K, analysts say

BNB joins altseason signal as stablecoin reserves fall

Crypto analyst Timo Oinonen noted that Binance’s native token BNB (BNB) has climbed 7.4% over the past week, significantly outperforming Bitcoin. This relative strength positions BNB as another leading indicator of the market’s shift toward altcoins.

The analyst explained that institutional activity supports this trend. Nasdaq-listed Nano Labs recently disclosed a $105 million BNB treasury, totaling 128,000 tokens. This marks a strategic move to…

Click Here to Read the Full Original Article at Cointelegraph.com News…