What is the GENIUS Act?

The GENIUS Act is a United States federal law that creates a comprehensive regulatory framework for stablecoins.

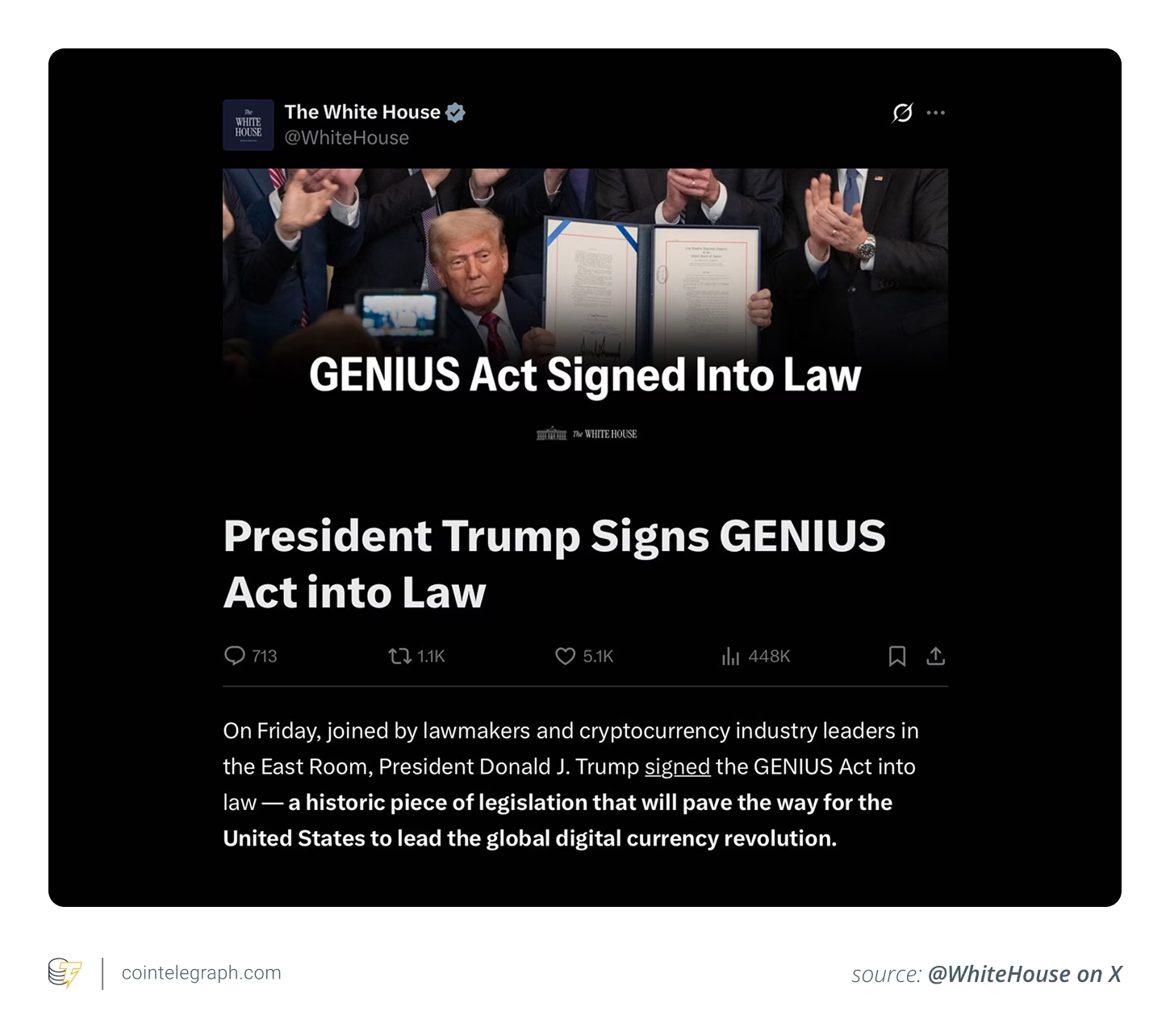

The Guiding and Empowering Nation’s Innovation for US Stablecoins Act, better known as the GENIUS Act, is the United States’ first federal law focused exclusively on payment stablecoins. The White House categorically states it is a historic piece of legislation that will pave the way for the US to lead the global digital asset revolution.

Signed into law by President Donald Trump on July 18, 2025, the act sets strict requirements around who can issue stablecoins, how they must be backed and what disclosures are required.

On the signing day, the White House’s official X account described the GENIUS Act as “a watershed moment for crypto and the US dollar.”

Why was the GENIUS Act needed?

While stablecoins rapidly gained traction across crypto markets, regulatory frameworks lagged behind, creating a fast-growing sector with no unified legal playbook.

Until the advent of this law in 2025, stablecoins existed in a legal gray zone, heavily used but largely unregulated at the federal level in the US. But they have shown robust growth; stablecoins surged past $230 billion in mid-2025 in circulating supply. Lawmakers have often expressed concerns about:

- Systemic financial risk from unregulated issuers

- Lack of consumer protections or redemption guarantees

- The US dollar facing competition from foreign-issued stablecoins

- The European Union created a unified regulatory framework with Markets in Crypto-Assets (MiCA) that could give EU-issued stablecoins a competitive edge and pressure US regulators to catch up.

The GENIUS Act aimed to fix all this by introducing a clear, national rulebook. The GENIUS Act provides:

- A clear legal framework for who can issue stablecoins in the US

- Strict consumer protections, including full asset backing and independent audits

- A licensing pathway through the Office of the Comptroller of the Currency (OCC) for banks and qualified non-banks

- Exclusions for “non-payment” tokens (like algorithmic stablecoins or DeFi-native collateralized assets) will be studied separately.

In short, the GENIUS Act turns what was once a regulatory gray zone into a legally defined, federally overseen financial category.

Did you know? This is the first US law that explicitly defines what a…

Click Here to Read the Full Original Article at Cointelegraph.com News…