Key takeaways

-

A crypto inheritance plan is vital because losing private keys or seed phrases can permanently make assets like Bitcoin, Ether and NFTs unrecoverable.

-

A strong inheritance plan includes asset inventories, secure access instructions and a trusted executor, ensuring heirs can safely and legally access holdings.

-

Privacy must be protected using encrypted files, sealed documents or decentralized identity tools rather than exposing sensitive details in public wills.

-

Balancing custodial and non-custodial solutions helps secure assets while simplifying transfers, avoiding mistakes like storing everything on exchanges or sharing keys insecurely.

If you hold digital currencies like Bitcoin (BTC) and Ether (ETH), it is essential that you create a clear and well-thought-out inheritance plan to prevent your crypto from going down the drain once you are not around.

Unlike traditional bank accounts, cryptocurrencies are controlled entirely by private keys and seed phrases (regardless of whether they’re stored in hot or cold wallets), and losing these keys means the assets become permanently unrecoverable. Each year, cryptocurrency worth millions of dollars is lost due to forgotten passwords, misplaced wallets or heirs unsure how to proceed with crypto assets.

Traditional wills often fail to adequately address digital assets, resulting in possible legal complications or permanent loss. A carefully designed crypto inheritance plan addresses these challenges, ensuring your assets remain secure and accessible to your beneficiaries as you intend.

This article discusses what makes it imperative for you to have a crypto inheritance plan, components of such a plan, ways to protect privacy while planning, crypto death protocols and a lot more.

Why you need a crypto inheritance plan

If you own cryptocurrency, creating a crypto inheritance plan is essential. Unlike traditional bank accounts, cryptocurrencies are often self-custodied, meaning only you hold the private keys or seed phrases. If you pass away without sharing this information, your assets could be lost forever. A digital asset will ensure proper sharing of altcoins and Bitcoin private keys after death.

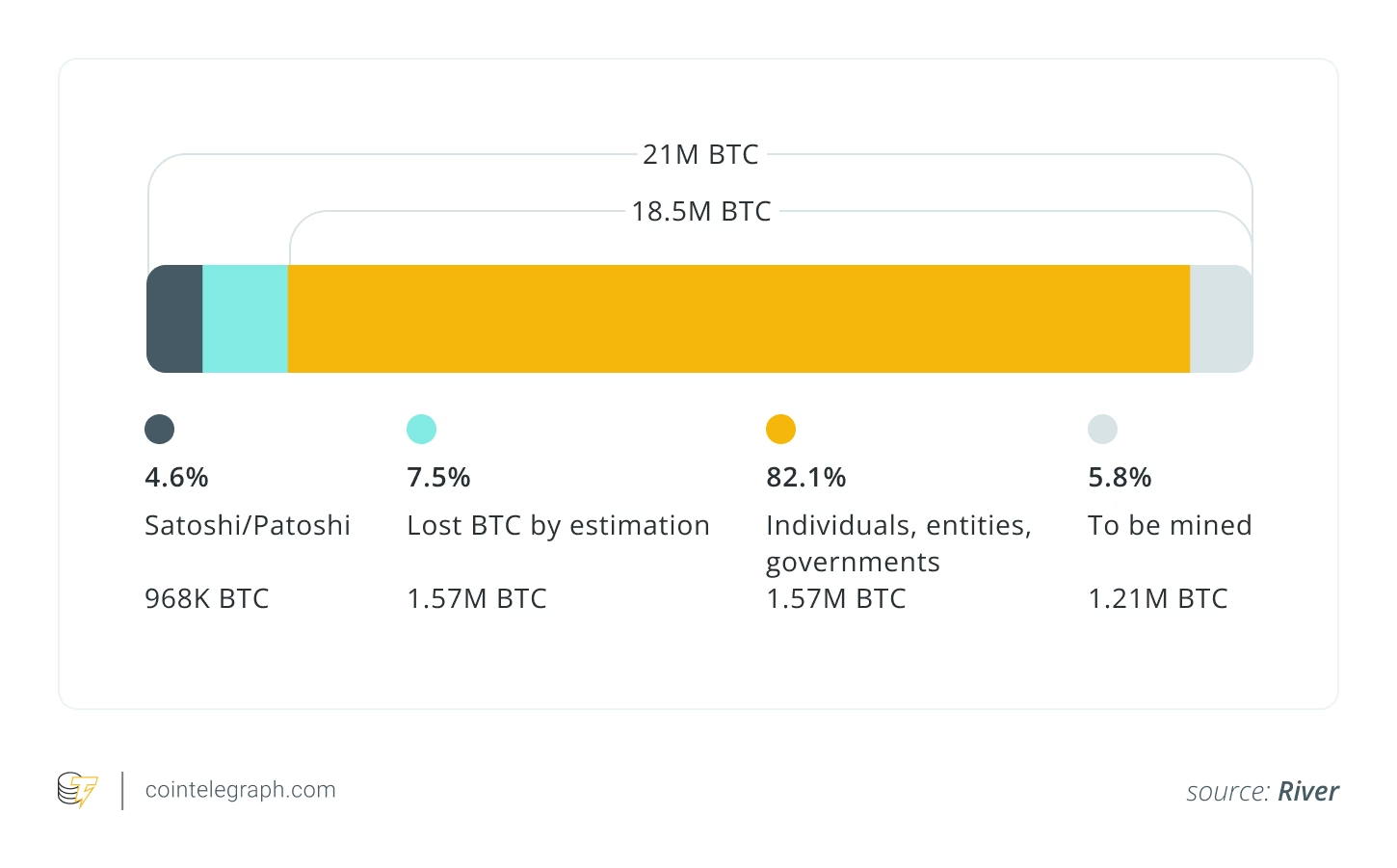

Around 1.57 million Bitcoin are likely lost, which is approximately 7.5% of the total supply of Bitcoin (it has a fixed upper limit of 21 million BTC). Traditional wills often fail to address cryptocurrency-related requirements, and heirs may lack the technical skills to access or manage digital wallets.

Click Here to Read the Full Original Article at Cointelegraph.com News…