Corporations are increasingly viewing Ethereum as a critical infrastructure component, fueling a surge in ETH allocations within corporate treasuries, according to Ray Youssef, CEO of finance app NoOnes.

“Ethereum starts to look like a hybrid between tech equity and digital currency. This appeals to treasury strategists looking beyond passive storage,” Youssef told Cointelegraph.

Top corporate Ethereum treasuries have purchased at least $1.6 billion worth of Ether (ETH) in the past month. On Monday, BitMine, chaired by Fundstrat’s Tom Lee, revealed that it holds 163,142 ETH, valued at around $480 million.

SharpLink Gaming, founded by Ethereum co-founder Joseph Lubin, leads corporate ETH holdings with over 280,000 ETH as of Sunday, totaling over $840 million. It has acquired large amounts in recent days.

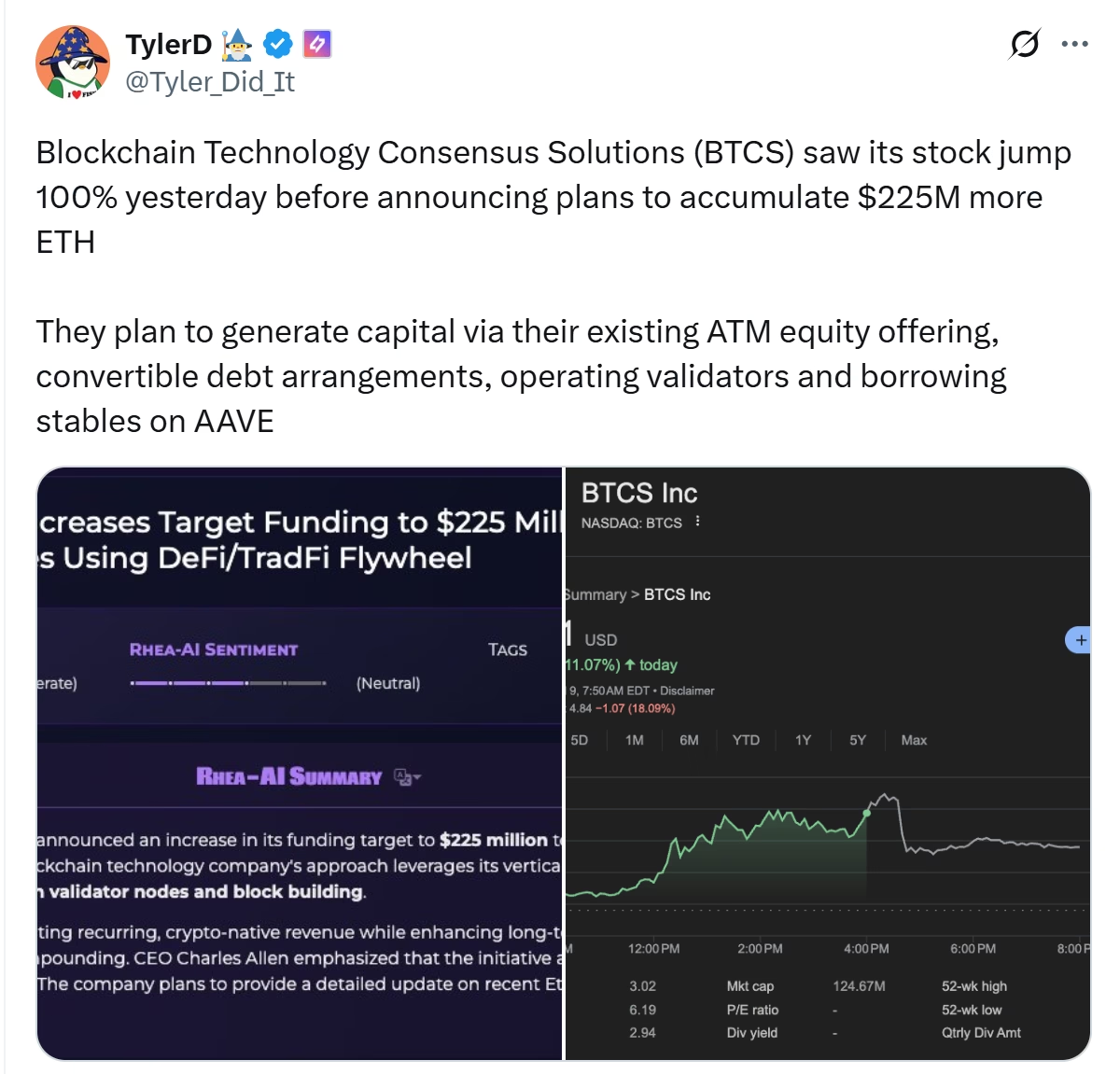

Other notable corporate buyers include Bit Digital, which has more than 100,000 ETH, and Blockchain Technology Consensus Solutions (BTCS), which increased its holdings to 29,122 ETH following a $62.4 million raise. GameSquare also announced a $100 million ETH treasury plan.

Youssef said the shift shows utility now rivals narrative in driving institutional choices. “Bitcoin has long held the title of digital gold standard, but Ethereum is gradually winning over institutions that seek to align their balance sheet with the networks that drive tokenized finance,” he said.

Related: Ethereum investors pile into ETH amid massive weekly surge

ETH’s yield, compliance drive institutional appeal

Youssef said ETH’s staking yield, programmability and compliance-friendly roadmap have made the cryptocurrency appealing to “forward-looking companies, especially those already involved in the digital economy.”

He predicted that Ethereum’s influence will continue to grow. “Ethereum increasingly becomes the digital rail for tokenized assets, stablecoins, and smart contract execution, becoming a preferred reserve cryptocurrency for firms operating in these areas.”

Most stablecoins and real-world asset (RWA) protocols are built on Ethereum or Ethereum-compatible chains. According to RWA.xyz, Ethereum dominates the RWA market with 315 projects valued at $7.76 billion, commanding a 58.1% market share.

Following behind is the Ethereum layer-2 solution ZKsync Era, hosting 37 projects worth $2.27 billion and holding nearly 17% of the market. Solana ranks third with 79 projects valued at…

Click Here to Read the Full Original Article at Cointelegraph.com News…