Key takeaways

-

While companies like Strategy and Tesla made headlines, many others have discreetly added Bitcoin to their treasuries.

-

Firms use Bitcoin to hedge against inflation, fiat devaluation and macroeconomic shocks. Its fixed supply, digital scarcity and 24/7 liquidity make it appealing.

-

Firms like Arkham and Glassnode trace Bitcoin ownership through address clustering and timing correlation.

Bitcoin is making a significant shift. From a speculative investment, it has become a part of corporate treasuries. While companies like Strategy and Metaplanet gained attention for large Bitcoin (BTC) purchases, others have quietly followed. Spanning diverse industries like technology and healthcare, these firms have strategically allocated portions of their balance sheets to Bitcoin reserves, often without public announcements.

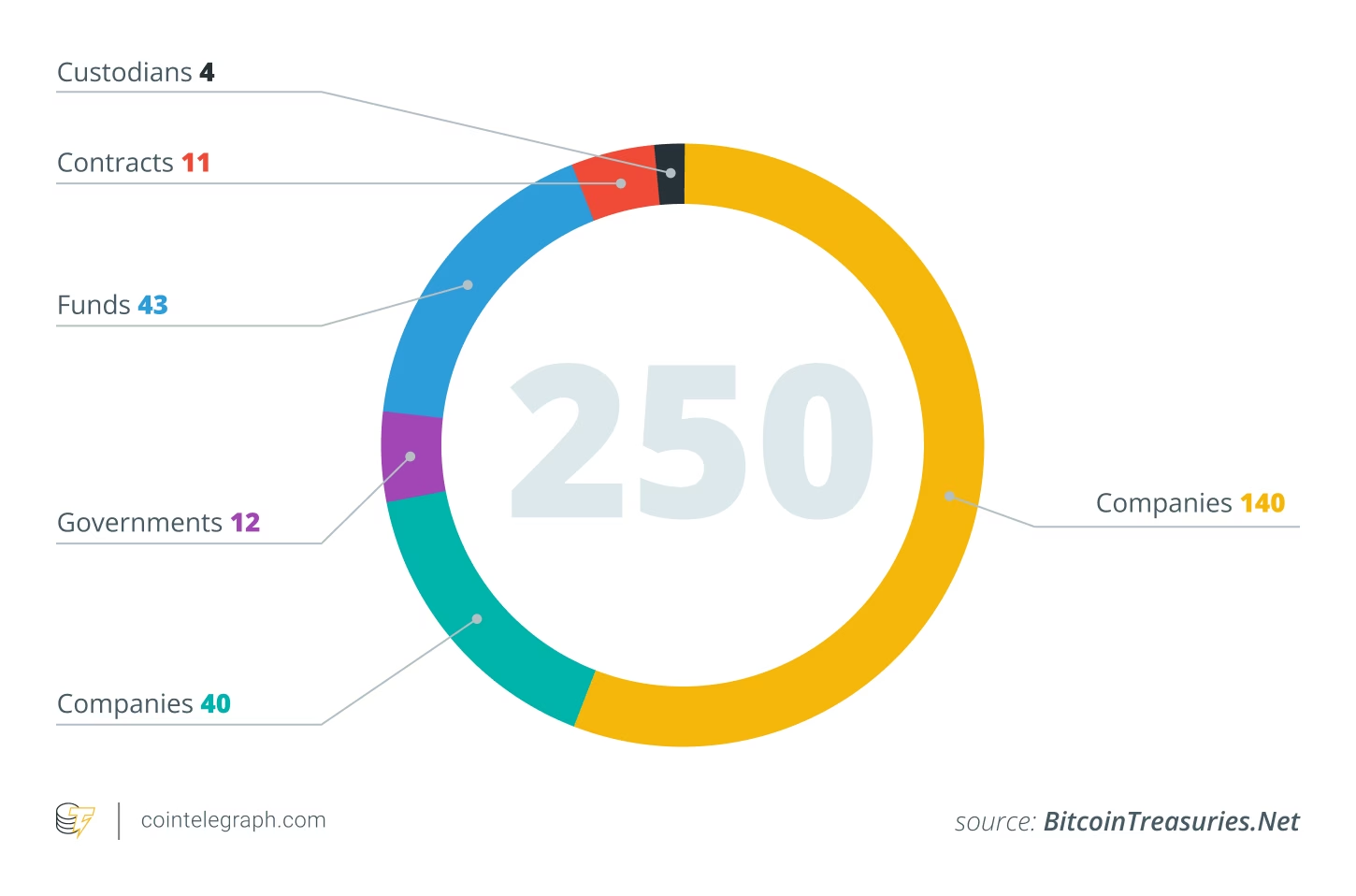

This low-profile approach shows a growing trend among businesses aiming to protect against inflation, diversify assets or align with the digital economy. An increasing number of companies are incorporating Bitcoin into their balance sheets, inspired by the success of Strategy, led by Michael Saylor. According to BitcoinTreasuries.Net, 26 companies started holding Bitcoin in June 2025, bringing the total number of companies holding Bitcoin to 250 as of July 4, 2025.

This article explores why companies are adopting Bitcoin as part of their corporate treasury and discusses 10 public companies that have quietly adopted Bitcoin as a financial strategy. It also sheds light on the role of blockchain analytics in revealing holdings, risks associated with a Bitcoin-heavy corporate strategy and various outcomes of Bitcoin accumulation by companies.

Why companies are turning to Bitcoin

Companies are increasingly incorporating Bitcoin into their treasury strategies for several compelling reasons. These factors collectively drive the growing inclusion of digital assets in corporate treasury strategies:

-

Protection against inflation and currency devaluation: Bitcoin serves as a potential hedge against inflation and the devaluation of fiat currencies. Unlike traditional money, which can lose value due to monetary expansion, Bitcoin’s fixed supply of 21 million coins makes it an attractive store of value during inflationary periods.

-

Digital scarcity and liquidity: Bitcoin offers a unique combination of digital scarcity and 24/7 liquidity, providing the growth potential of long-term investments while maintaining the accessibility of short-term…

Click Here to Read the Full Original Article at Cointelegraph.com News…