Key points:

-

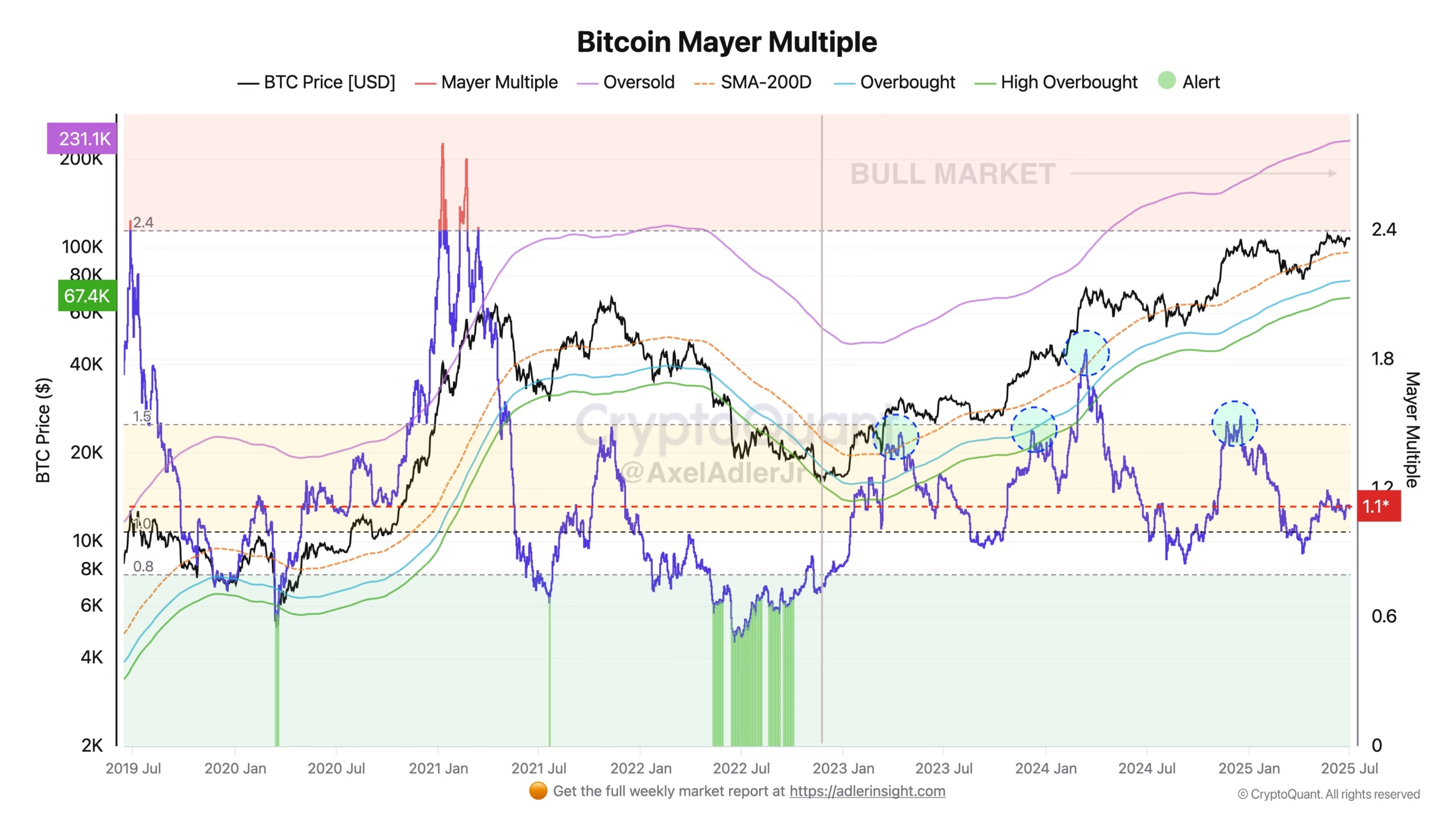

Bitcoin’s classic Mayer Multiple metric is far from overheated despite price being inches from all-time highs.

-

BTC price action could enjoy a “new upward impulse” as a result, says analysis from a popular CryptoQuant contributor.

-

October 2025 is gaining favor as the point of the next bull market top.

Bitcoin (BTC) is “undervalued” despite staying near all-time highs, new analysis of a classic BTC price metric says.

In an X post on July 8, Axel Adler Jr., a contributor to onchain analytics platform CryptoQuant, revealed promising signals from Bitcoin’s Mayer Multiple.

Bitcoin Mayer Multiple “significantly below overbought thresholds”

Bitcoin may be circling $108,000 after 90% gains over the past year, but the Mayer Multiple is far from ready to call a BTC price top.

The Multiple compares BTC/USD to its 200-day simple moving average, and the resulting value can be used as a strength gauge when compared to similar periods in previous market cycles.

“Currently, the metric stands at 1.1х (price to 200-day moving average), which falls within the neutral zone (0.8–1.5х) and is significantly below overbought thresholds (1.5х),” Adler wrote.

“Today’s Mayer Multiple indicates that Bitcoin is trading at a discount to its historical bull rallies and is rather undervalued than overvalued – a good fuel reserve for a new upward impulse.”

While the Multiple does not offer strict buy or sell signals, it forms one of a large number of onchain metrics which have yet to signal a bull market top.

As Cointelegraph reported, a giant list of thirty “bull market peak” indicators from monitoring resource CoinGlass remains 100% in “hold” territory.

BTC price top in October, say analysts

However, estimates of when the current uptrend may encounter its “blow-off top” vary.

Related: ‘False move’ to $105K? 5 things to know in Bitcoin this week

An increasingly popular target is October 2025, with that date flagged by popular trader and analyst Rekt Capital, also as a result of historical comparison.

“If Bitcoin is going to peak in its Bull Market in September/October 2025 as per historical Halving cycles… That’s only 2-3 months away,” he reiterated over the weekend.

This week, fellow trader Jelle agreed on the time frame for a cycle top, revealing that profit-taking had already begun.

Happy profit-taking day by the way – I just sold…

Click Here to Read the Full Original Article at Cointelegraph.com News…