Key takeaways:

-

XRP breaks out of a “pennant” on the weekly chart, hinting at 40% gains to $3.20.

-

Several positive developments and increasing open futures open interest signal XRP’s ability to break out of consolidation.

XRP (XRP) price confirmed a “pennant” pattern on the weekly chart, a move associated with strong upward momentum. Key developments surrounding Ripple and a surge in XRP futures demand may signal the start of a rally to $3.20 or higher.

Increasing OI backs XRP price uptrend

XRP rose in tandem with the wider crypto market on Thursday, fueled by a number of factors, including, Ripple’s application for a US banking licence, the SEC’s approval of Grayscale’s Digital Large Cap Fund (GDLC) conversion into a spot ETF, the recent partnership with OpenPayd, and elevated odds of a spot ETF approval.

Riding with the wave, XRP price rose as much as 7.2% to an intraday high of $2.31 on Thursday from a low of $2.15 the previous day.

Related: Watch these XRP levels as price meets ‘turning point’

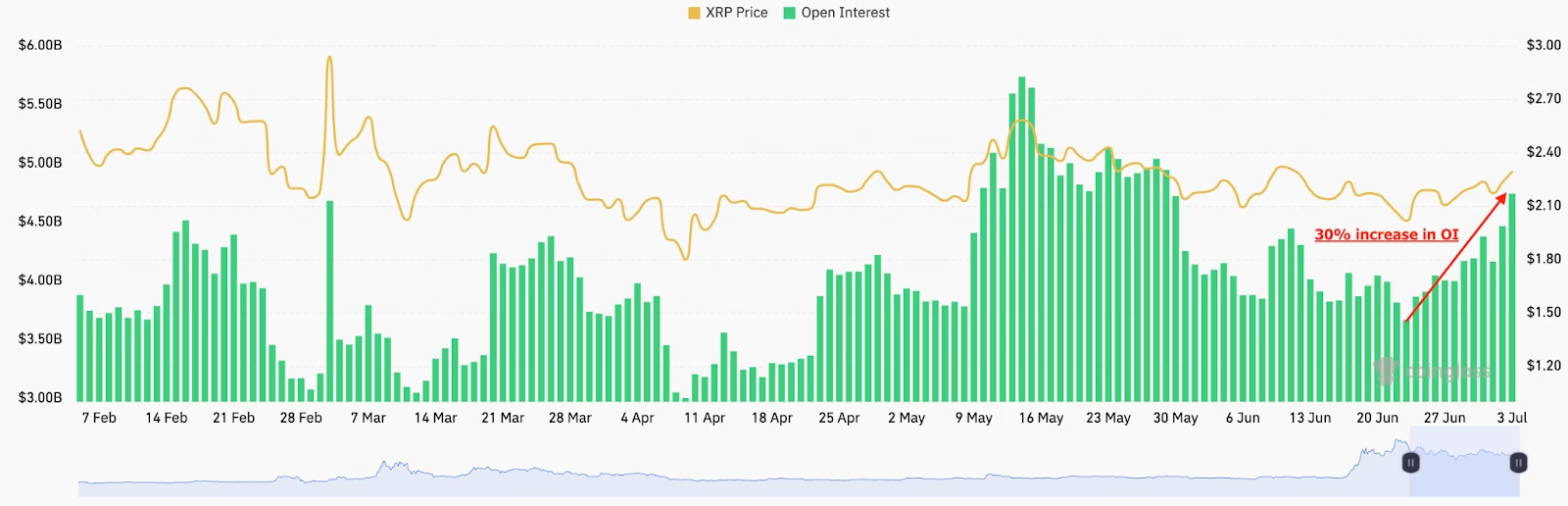

The altcoin’s open interest surged 11% over the last 24 hours and 30% over the last 10 days to $4.75 billion today, signaling the return of derivatives traders.

Futures OI increasing alongside the price indicates a growing interest from institutional investors, which is generally seen as positive, as it tends to increase liquidity and attract more trading capital.

Historically, significant leaps in OI have preceded major rallies in XRP price.

For example, the current scenario mirrors the XRP price rise when US President Trump announced a 90-day tariff pause, leading to a 91% jump in OI to $5.75 billion from $3 billion between April 9 and May 14. This accompanied a 65% rise in XRP price to a high of $2.65 from a low of $1.61 over the same period.

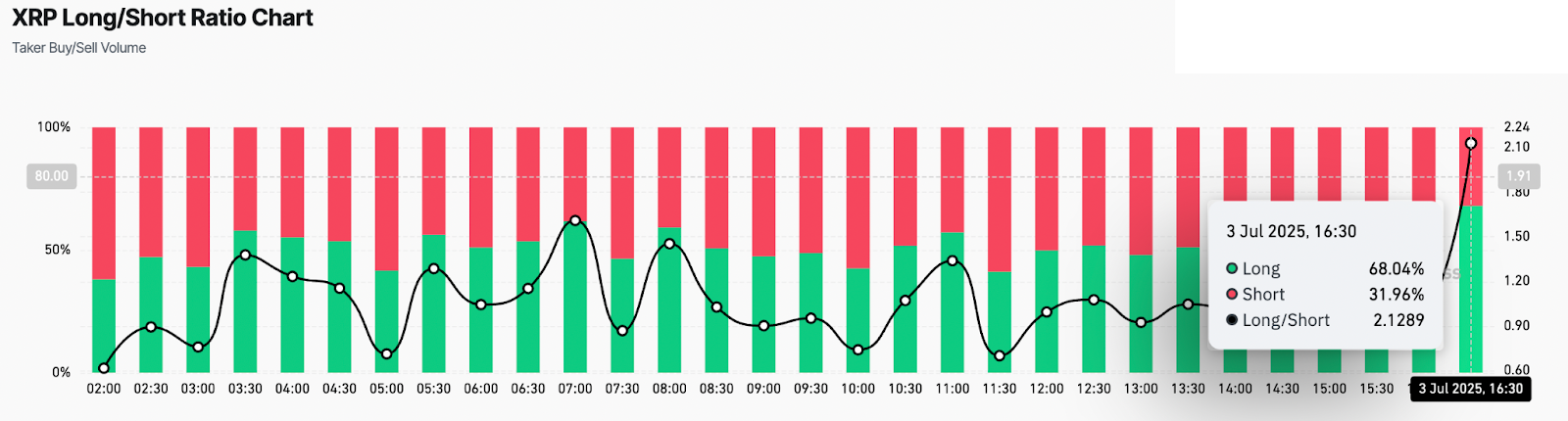

Meanwhile, XRP’s long/short ratio across all exchanges is currently skewed toward bullish positions at 68%. While this introduces long liquidation risk, it underscores rising confidence in XRP’s upside potential.

XRP price eyes a 40% rally to $3.20

The XRP/USD pair is expected to resume bullish momentum after breaking out of a multimonth pennant.

XRP’s price action between December 2024 and July 2025 has led to the formation of a pennant on the weekly chart, as shown in the figure below. The price broke above the pennant’s descending trendline at $2.21 on July 3, signaling the start of a significant…

Click Here to Read the Full Original Article at Cointelegraph.com News…