Key takeaways:

-

ETH failed to reclaim $2,600 as futures and options data show weak conviction from traders.

-

Ethereum’s layer-2 growth hasn’t translated into increased demand for ETH due to low rollup transaction fees.

-

The Solana ETF launch undermined ETH’s altcoin leadership and reduced the odds of a rally above $3,200.

Ether (ETH) gained 9% between Tuesday and Thursday but failed to break above the $2,600 mark. As the price rallied, traders pointed to a bullish technical formation known as a “golden cross” that could push ETH to $3,200, a level last reached in January. However, derivatives data suggests ETH traders are not feeling as bullish.

X user MerlijnTrader pointed out that the golden cross formation on Wednesday is “where bull markets tend to begin,” noting that technical analysis shows short-term momentum strengthening relative to the longer-term average. For MerlijnTrader, ETH is “sending a clear signal,” suggesting that the next bull run may be approaching.

ETH derivatives signal low confidence amid increased competition

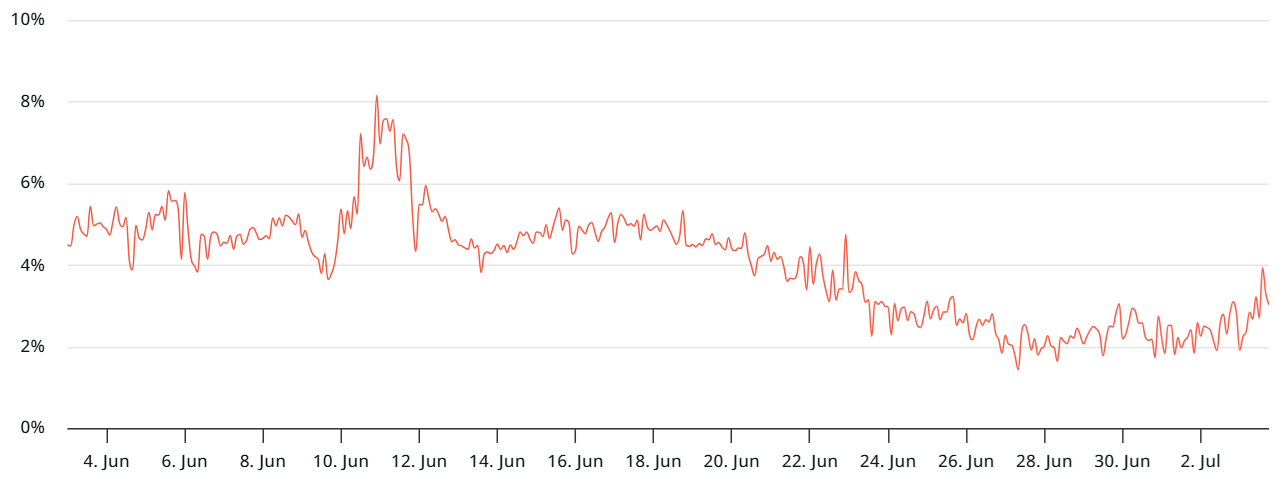

Despite ETH’s jump to $2,600 on Thursday, there was no significant uptick in demand for leveraged long positions. In a neutral market, monthly contracts typically trade at a 5% to 10% annualized premium over spot prices to reflect the extended settlement period.

Currently, the Ether futures premium remains below the 5% neutral threshold, even after recent price gains. The last time this indicator signaled a bullish stance was Jan. 26, when ETH traded near $3,300. Notably, that date aligns with the launch of the Official Trump (TRUMP) memecoin on Solana, which boosted that blockchain’s volumes and revenue.

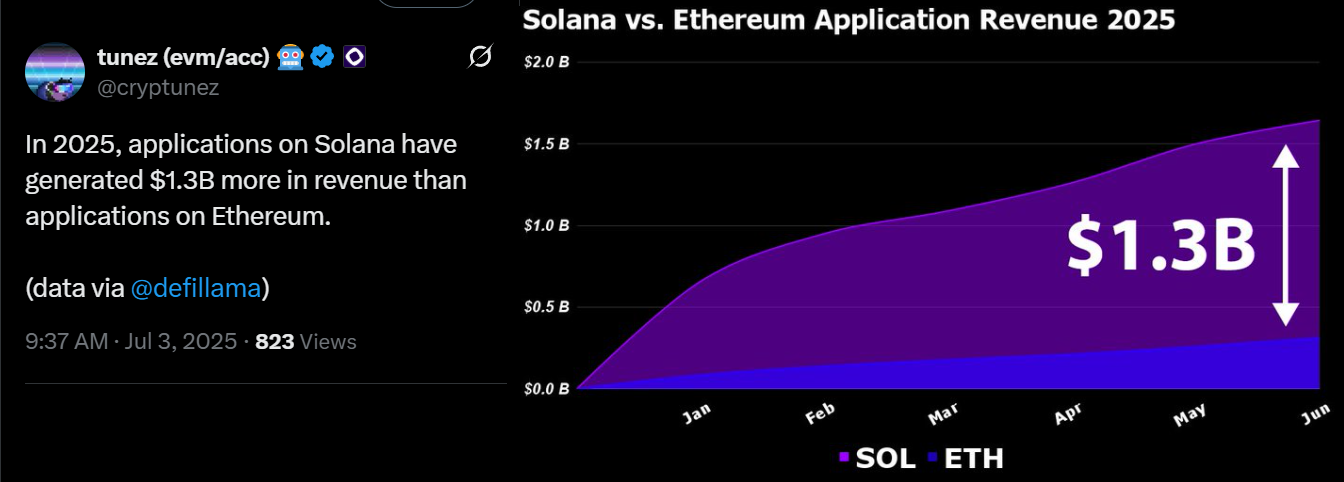

X user cryptunez observed that decentralized applications (DApps) on Solana generated $1.3 billion more in revenue than those on Ethereum.

However, this narrow analysis overlooks Ethereum’s strategic shift toward layer-2 scaling. Much of the ecosystem’s DApp revenue now flows to Base, Arbitrum, Polygon, Optimism and Unichain. Additionally, Solana has faced criticism for its maximal extractable value (MEV) practices, which allow validators to reorder transactions for profit.

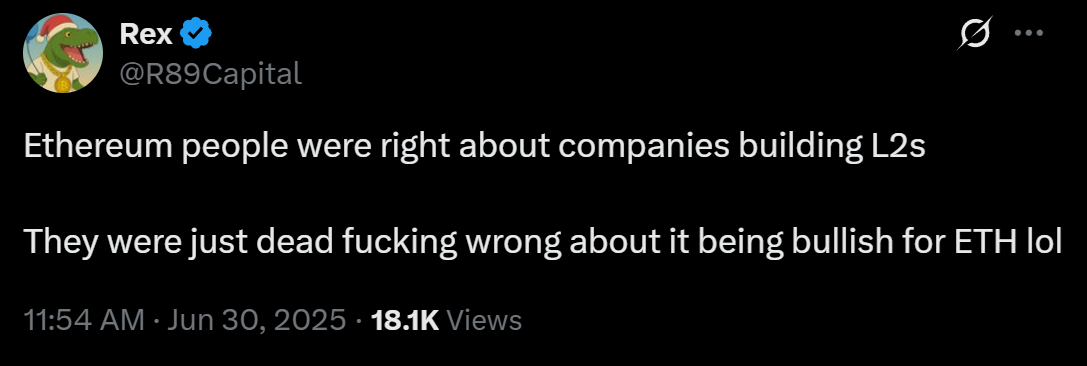

X user R89Capital aptly captured investor sentiment, noting that Ethereum supporters “were right about companies” building on the layer-2 ecosystem but “wrong about it being bullish for ETH.” Essentially, rollups…

Click Here to Read the Full Original Article at Cointelegraph.com News…