Key takeaways:

-

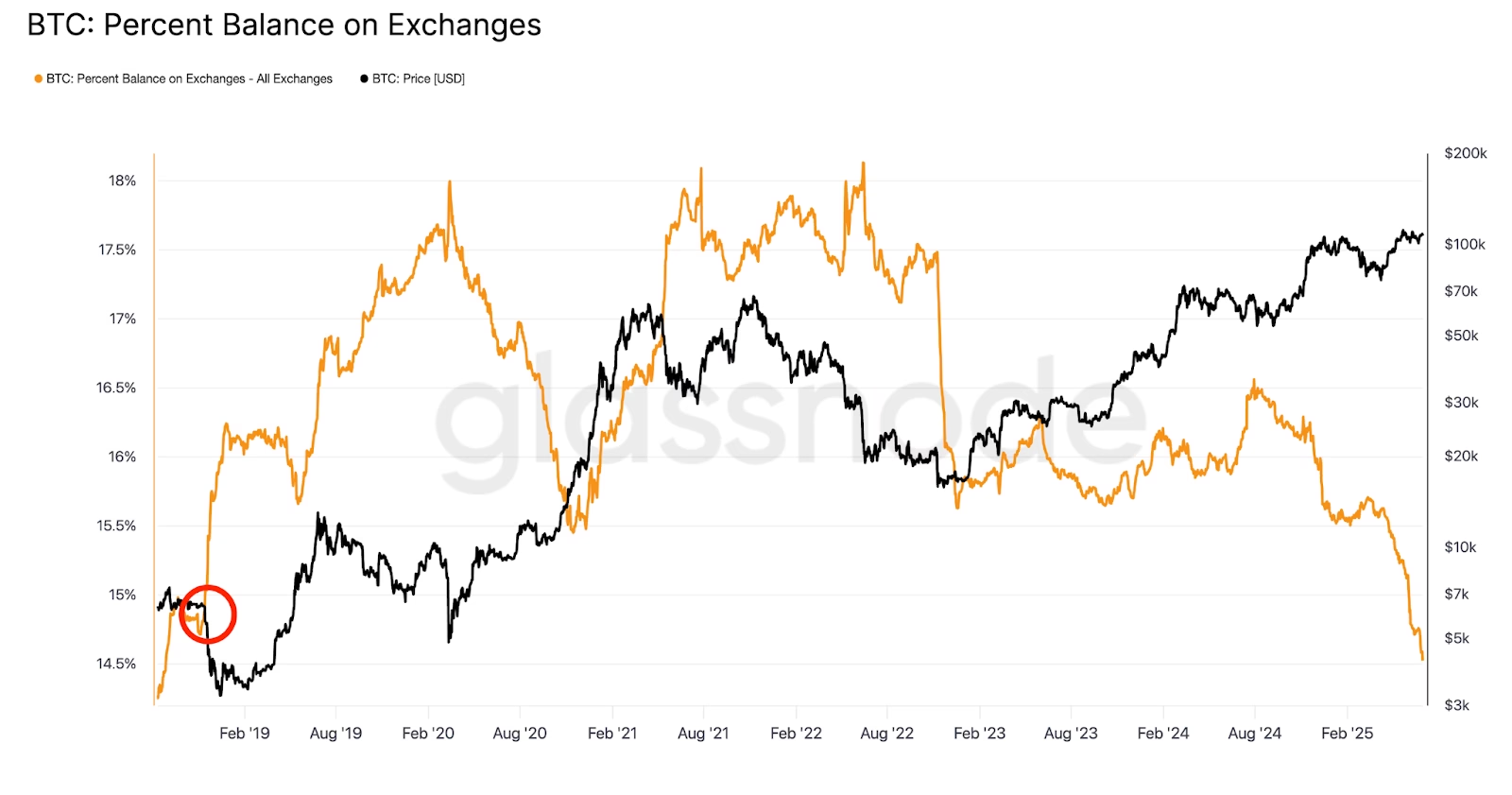

Bitcoin’s percent supply on exchanges has dropped below 15% for the first time since 2018.

-

Depleting exchange supply and OTC balances, pointing to “supply shock” and long-term accumulation.

-

BTC price must remain above $100,000 to secure the upside.

Bitcoin exchange reserves have fallen below 15%, suggesting a supply shock as institutional demand from exchange-traded funds (ETFs) grows.

Percentage of BTC on exchanges drops to seven-year lows

Bitcoin (BTC) percent supply on exchanges has dropped to near seven-year lows, falling to 14.5% for the first time since August 2018, Glassnode data shows.

Diminishing Bitcoin supply on exchanges may signal an incoming price rally fueled by a “supply shock,” which occurs when strong buyer demand meets decreasing available BTC.

Related: Bitcoin hashrate down 15%, 26 firms add BTC to balance sheets: June in charts

This trend usually signals rising investor confidence and a shift toward long-term holding. For example, BTC is typically transferred to cold storage or self-custody wallets, reducing the liquid supply available for trading.

Whales often withdraw BTC after buying, signalling ongoing accumulation. With fewer coins available for sale, short-term sell pressure diminishes.

Over-the-counter Bitcoin balances hit all-time lows

Over-the-counter (OTC) desks, which facilitate large, private cryptocurrency trades, are also experiencing a tightening supply. These desks typically match buyers and sellers but depend on maintaining BTC reserves for swift and reliable trade execution.

The cumulative balance of BTC held in known OTC addresses is at historic lows. CryptoQuant data shows a 21% decline in OTC address balances linked to miners since January, now down to an all-time low of 155,472 BTC.

This figure reflects inflows from over two unique “1-hop” addresses tied to mining pools, excluding miners and centralized exchange addresses.

This increasing scarcity on exchanges and OTC desks can amplify price surges as demand outstrips supply.

“The Bitcoin balance available OTC is in freefall,” Crypto Chiefs said in a recent X post, adding:

“We have never seen such a divergence between balance and price! You are witnessing a supply problem play out.”

Bitcoin is resilient on “strong institutional demand”

Bitcoin remained strong above the key $100,000 psychological support, a level it has held since May 28,…

Click Here to Read the Full Original Article at Cointelegraph.com News…