An Ethereum developer has issued a proposal to cut the network’s block time in half — from 12 seconds to six seconds — in time for the Glamsterdam update in 2026.

Ethereum Improvement Proposal 7782, discussed on June 21 by core developer Barnabé Monnot, suggests cutting the slot time — how often new blocks are created — to six seconds by adjusting the timing of various blockchain operations, with the aim of improving transaction confirmation time and user experience.

“Shorter slot times make the confirmation service better, and so have the potential to raise the service price beyond where it is today,” Monnot explained.

Ethereum’s “service price” refers to the economic value that the network can capture for providing its core service as a settlement and confirmation layer.

The developer seeks the proposal, originally created in October 2024, to be included in the Glamsterdam update scheduled in late 2026.

“By then, we will have done a lot of healthy scaling” and likely reached blocks with three times the current gas limit and eight times the blob supply, he added.

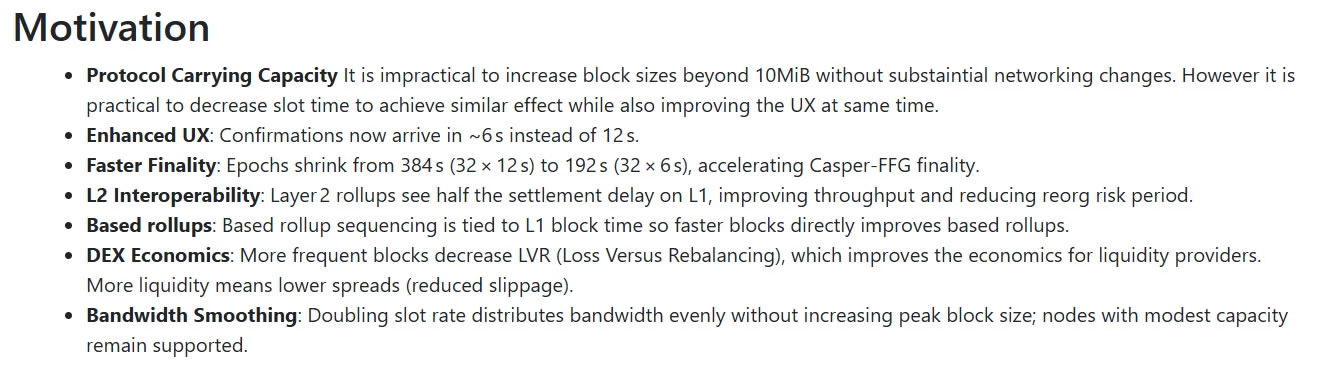

Benefits of faster Ethereum slots

The team at Ethereum staking protocol Everstake explained on Monday that new blocks could be proposed twice as often, speeding up the network and providing several benefits.

Shorter slot times mean faster transaction inclusion, which would improve the user experience with a more responsive chain.

Wallets would display fresher data following transaction inclusion, and onchain data would update more frequently. This would result in smoother experiences across wallets, DApps, and layer-2 networks.

It would also make it harder for anyone to censor transactions since there are more block producers per minute.

DeFi and fee improvements

There would also be several advantages for trading and decentralized finance, such as faster price updates on decentralized exchanges and reduced losses due to arbitrage traders who exploit price differences.

Related: Ethereum and the battle for yield: What is ETH’s future?

Trading fees would come down as markets become more efficient, and there would be more liquidity in automated market makers, Monnot said.

“Faster slots lead to more liquidity, which means lower trading fees for users and increased network effects for Ethereum.”

However, there could be some tradeoffs, such as impacts on slower or poorly connected validators, which may struggle with the…

Click Here to Read the Full Original Article at Cointelegraph.com News…