Key takeaways:

-

Historical chart patterns and the Fibonacci Retracement metric hint at a Solana price rally to $300.

-

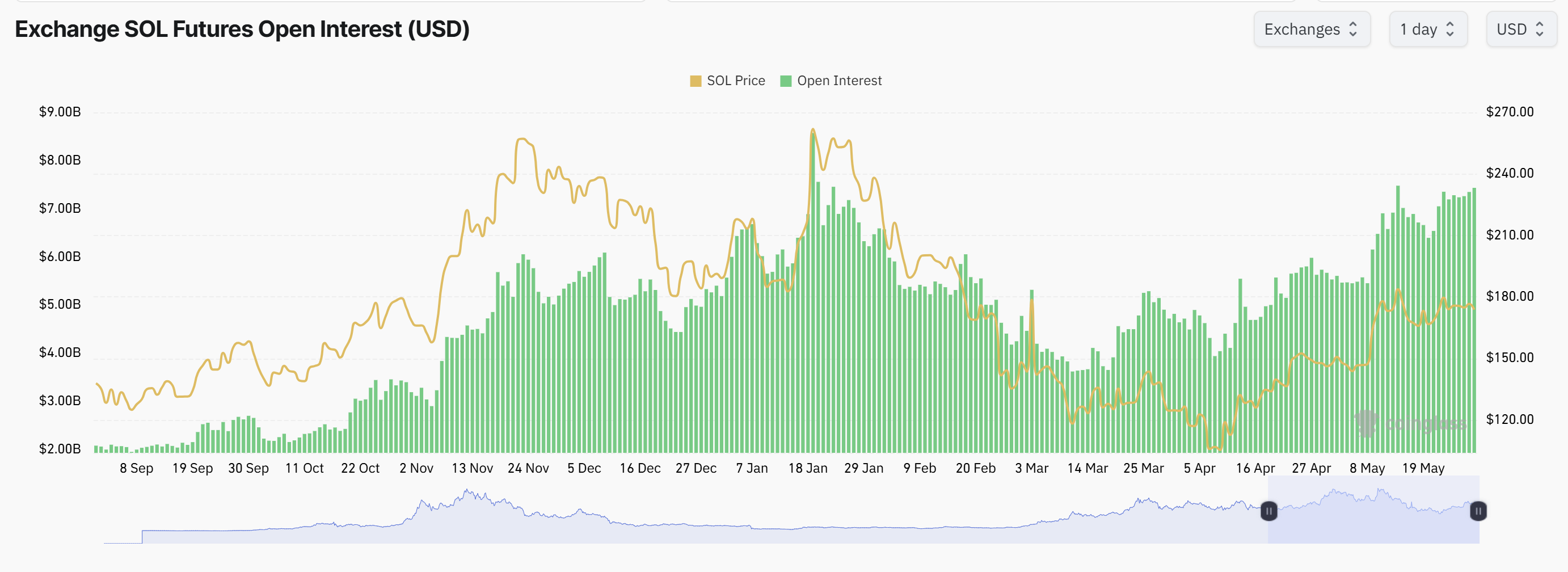

Solana’s $7.5 billion in futures open interest and negative funding rates could be a sign that a powerful short squeeze is in the making.

Solana (SOL) price tested the $180 resistance level on May 11, but it has since consolidated below this key threshold and appears unable to establish a sustained bullish position. However, the altcoin has maintained a positive signal by closing above the 50-week exponential moving average (EMA) for three consecutive weeks. This critical level has historically acted as a catalyst for significant price rallies.

In late 2023, SOL broke through the 50-week and 100-week EMAs, solidifying its position above these levels before surging 515% by March 2024. The relative strength index or RSI on the weekly chart is currently at 52.60, indicating growing buying pressure.

This setup mirrors past patterns where SOL broke above the 50-week EMA and rallied significantly. With current technicals aligning, SOL appears poised to retest the $300 level by late 2025, a key psychological and historical resistance.

Using trend-based Fibonacci (FIB) extensions, SOL’s potential upside could be more compelling. The FIB extension, taken to the January highs of $295 from the recent swing lows near $95, outlines an immediate target of around $300, or a 70% increase.

Once SOL price enters price discovery, bullish momentum could target the 1.618 extension, suggesting SOL could reach as high as $418. However, failure to hold the 50-week EMA could cause SOL retest the lower support near $157.

Related: Solana may be a memecoin ‘one-trick pony’ — Standard Chartered

Solana traders debate SOL’s next breakout catalyst

While Solana continues to trade nearly 40% below its all-time high, SOL futures market activity remains robust. According to CoinGlass, Solana futures open interest (OI) stands at $7.5 billion — just $1 billion short of its Jan. 19, 2025, peak of $8.5 billion. Elevated OI levels typically signal heightened speculative interest and suggest that traders are positioning for significant price volatility.

Funding rates across exchanges have also turned negative, indicating a tilt toward short positions as SOL struggles to reclaim the key $180…

Click Here to Read the Full Original Article at Cointelegraph.com News…