Key takeaways:

-

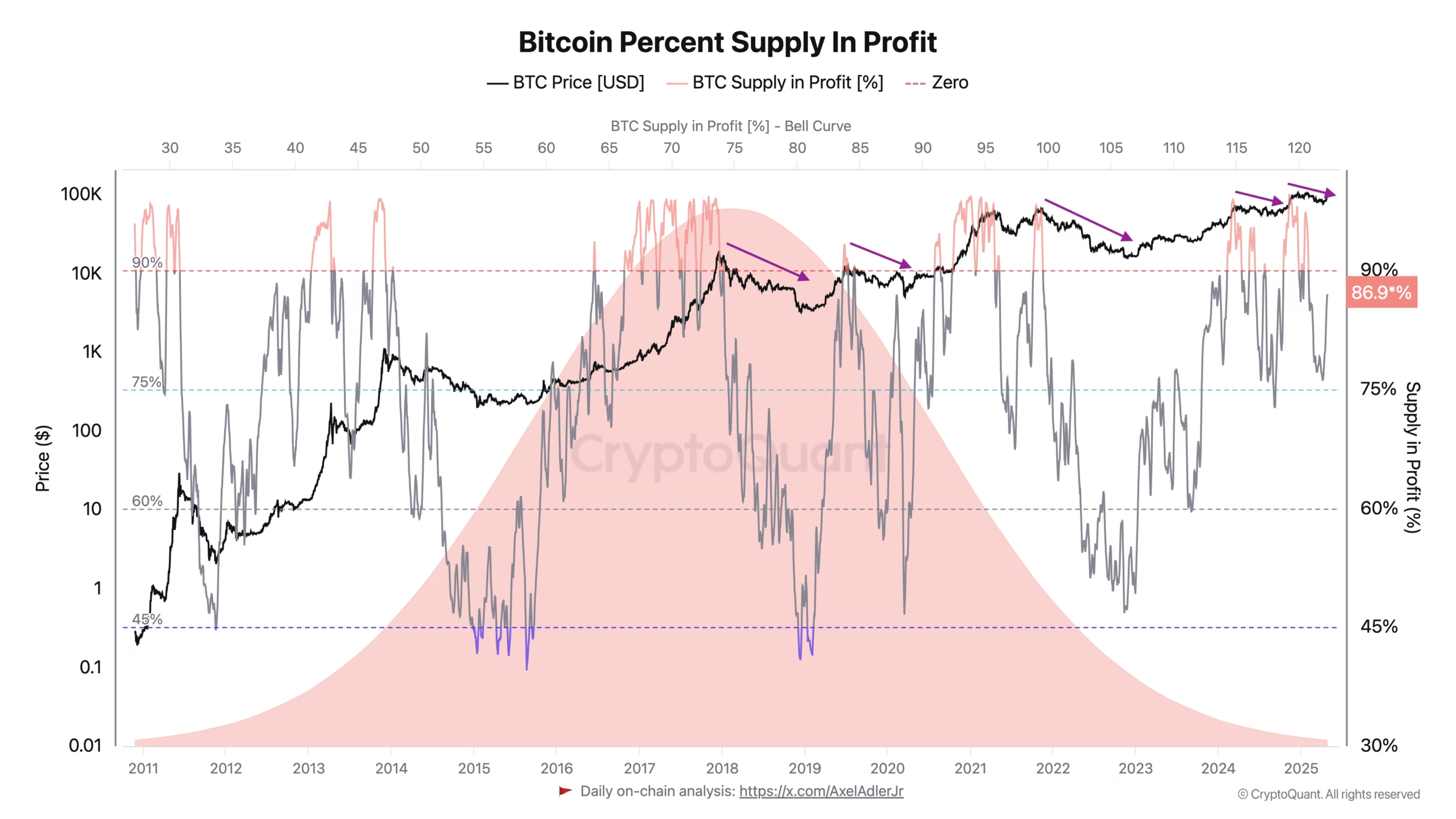

Bitcoin supply in profit has climbed back above 85%, nearing the classic euphoric area.

-

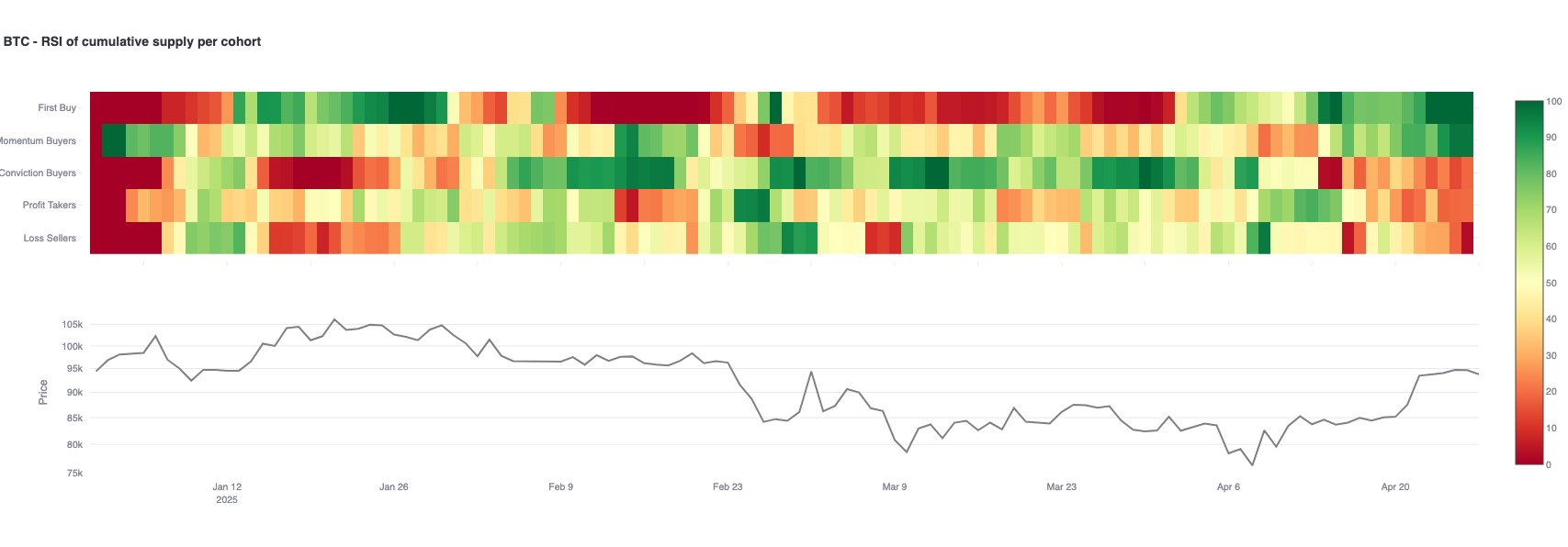

Onchain data shows strong accumulation from new and momentum buyers with minimal profit-taking.

-

Bitcoin could rally toward $110,000–$115,000 helped by a “max buying” zone.

Bitcoin (BTC) is charging toward a potential new all-time high near $115,000, as a surge in profitable supply signals growing bullish momentum and a classic setup for market euphoria.

Nearly 87% of Bitcoin supply in profit

As of April 28, approximately 86.9% of all Bitcoin coins were in profit, according to on-chain data resource CryptoQuant.

Historically, the metric’s climb into the 85–90% range has signaled a transition from healthy optimism to speculative euphoria among traders.

Between October and December 2024, for instance, Bitcoin’s price climbed from around $80,000 to over $100,000, a rally coinciding with Bitcoin’s profitable supply rising from under 80% to as high as 99%.

In his April 28 post, CryptoQuant-based analyst DarkFrost reminded that Bitcoin’s euphoric phases may not last for longer timeframes, leading to sharp corrections as holders begin realizing gains.

BTC’s price established a record high of nearly $110,000 in January, with its profitable supply hitting 99%. But the cryptocurrency dropped by over 30% afterward. Similar profit-taking behaviors have led to price corrections in the past, as shown above.

“Currently, the supply in profit has climbed back above 85%, which is fairly positive,” DarkFrost writes, noting that its recovery from the recent bottom of 75% is still better when compared to 45-50% lows witnessed during bear market corrections.

Besides, the BTC supply in profit still remains below 90%. Crossing above 90% has historically preceded profit-taking behavior among traders, suggesting that there’s more room to grow for BTC prices in the coming days.

DarkFrost argues:

“Of course, there are certain levels that are more “comfortable” than others, but generally, an increase in the supply in profit tends to fuel bullish phases.”

Additional onchain data also supports the bullish outlook. Bitcoin’s First Buyers and Momentum Buyers are actively accumulating, while Profit Takers remain relatively quiet, according to Glassnode metric tracking BTC’s cumulative supply per cohort.

This means fresh demand is coming…

Click Here to Read the Full Original Article at Cointelegraph.com News…