Key Takeaways:

-

Bitcoin’s year-over-year return and realized price metric signal strong long-term support from holders and suggest that BTC is currently undervalued.

-

Standard Chartered estimates a Bitcoin price target in the $110,000–$120,000 zone by Q2 2025.

-

Positive funding rates point to a potential long squeeze to $90,500.

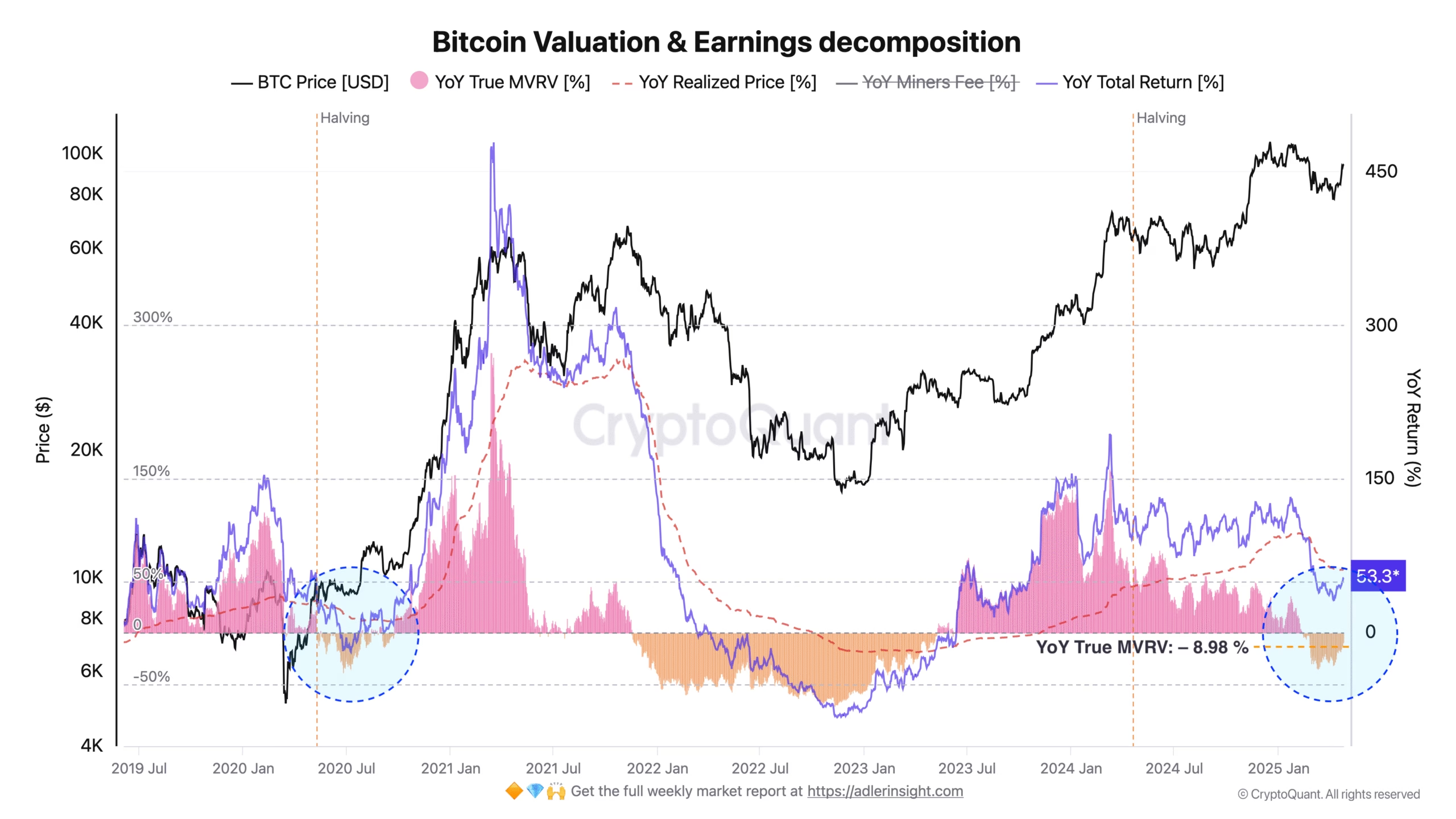

Bitcoin’s (BTC) weekly close near $94,000 delivered an impressive year-over-year total return of 53.61%. Since the last halving in 2024, the market has shifted from the early 2024 euphoric phase to a “mature bull trend” based on onchain growth, rather than speculative frenzy.

Bitcoin fundamentals triumph over fear and speculation

Bitcoin researcher Axel Adler Jr. pointed out that the year-on-year (YoY) realized price, a measure of the average price at which BTC was last moved, has surged 61.82%, outperforming the YoY market value to realized value’s (MVRV) decline of 8.98%. This indicates long-term holders are raising the base price faster than speculative price increases, a healthy signal for the cycle.

The negative MVRV suggests that Bitcoin is trading below its fundamental value compared to a year ago, a pattern that precedes significant rallies. This compression of value leaves room for further upside, with analysts eyeing new highs above $110,000 if demand accelerates.

Similarly, Bitcoin’s realized price by cohort shows a cooling speculative premium, as one-month holders’ cost basis is 5% below the six-month cohort. The current market resembles past accumulation phases, leaving only five to six weeks until the average 180-day point when momentum often accelerates.

This bullish timeline parallels Standard Chartered’s head of digital assets research, Geoffrey Kendrick’s prediction that Bitcoin will hit a new all-time high of $120,000 in Q2 2025, driven by strategic reallocation from US assets. Kendrick noted that a high US Treasury term premium, correlating with BTC’s price, and time-of-day trading patterns indicate US investors are seeking non-US assets since President Donald Trump’s trade war began on April 2.

Related: Bitcoin could hit $210K in 2025, says Presto research head

Bitcoin futures market hints at “long squeeze” below $91,000

Bitcoin’s funding rate has turned positive, signaling a dominance of long positions…

Click Here to Read the Full Original Article at Cointelegraph.com News…