Bitcoin’s (BTC) richest traders and investors are increasingly bullish on BTC despite facing downside risks from unfavorable macroeconomic factors, the latest onchain data suggests.

Bitcoin whales absorbing 300% of new supply

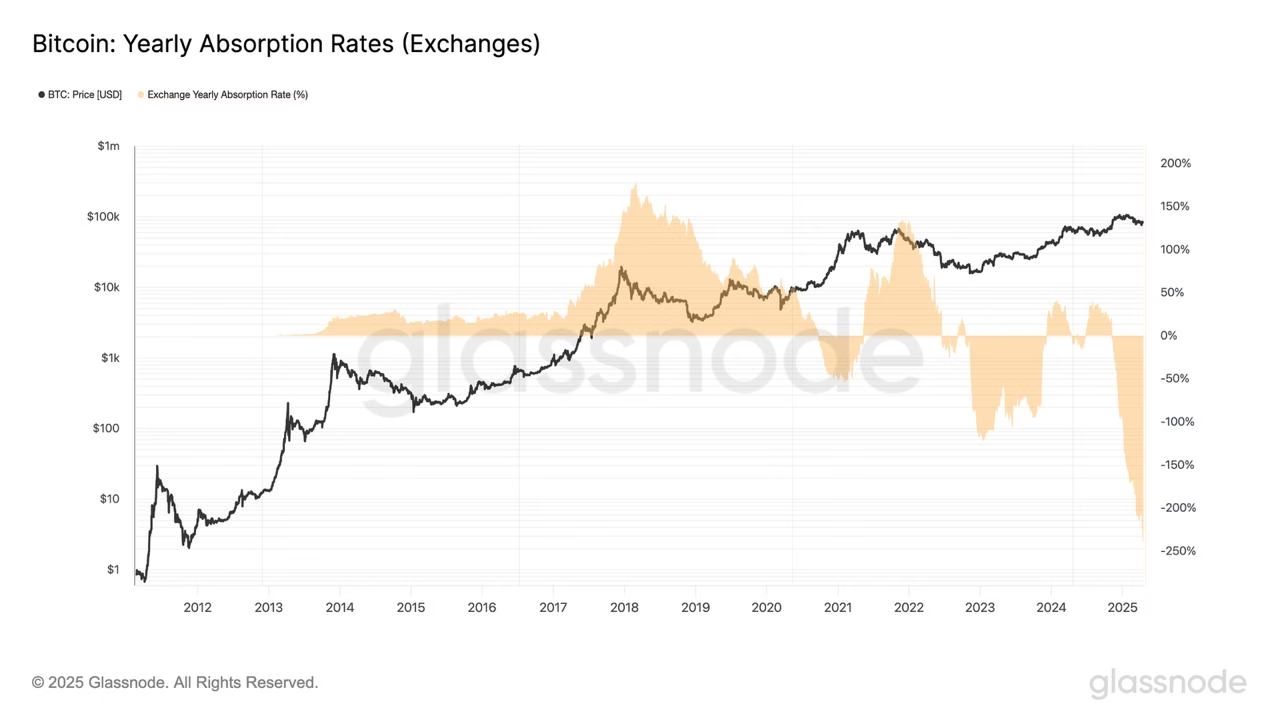

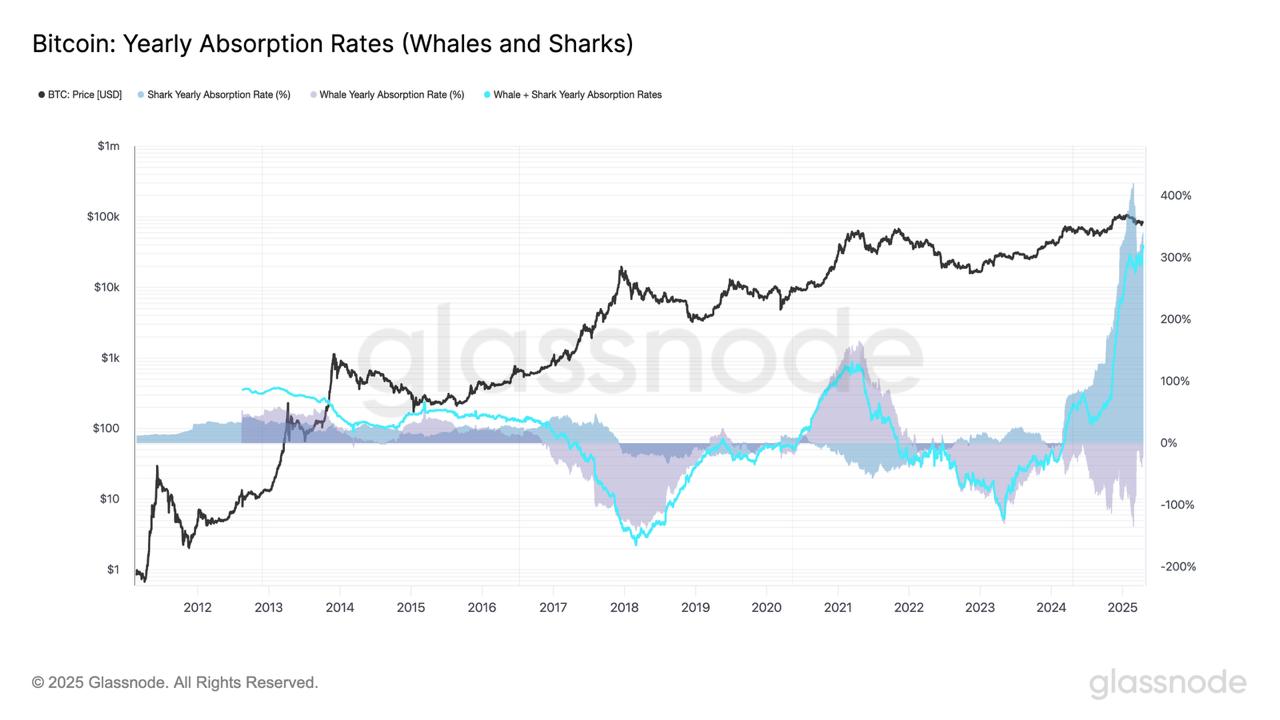

Bitcoin whales and sharks are now absorbing BTC at record rates—over 300% of yearly issuance—while exchanges are losing coins at a historic pace, according to Glassnode.

Notably, Bitcoin’s yearly absorption rate by exchanges has plunged below -200% as outflows continue. This signals a growing preference for self-custody or long-term investment.

Meanwhile, larger holders (100–1,000+ BTC) are scooping up more than three times the new issuance, marking the fastest rate of accumulation among sharks and whales in Bitcoin’s history.

This marks a structural shift as traditional finance increasingly adopts BTC, particularly with the approval spot Bitcoin ETFs last year. The result is less BTC supply on crypto exchanges and long-term bullish conviction among big holders.

Most cohorts are buying the BTC price dip

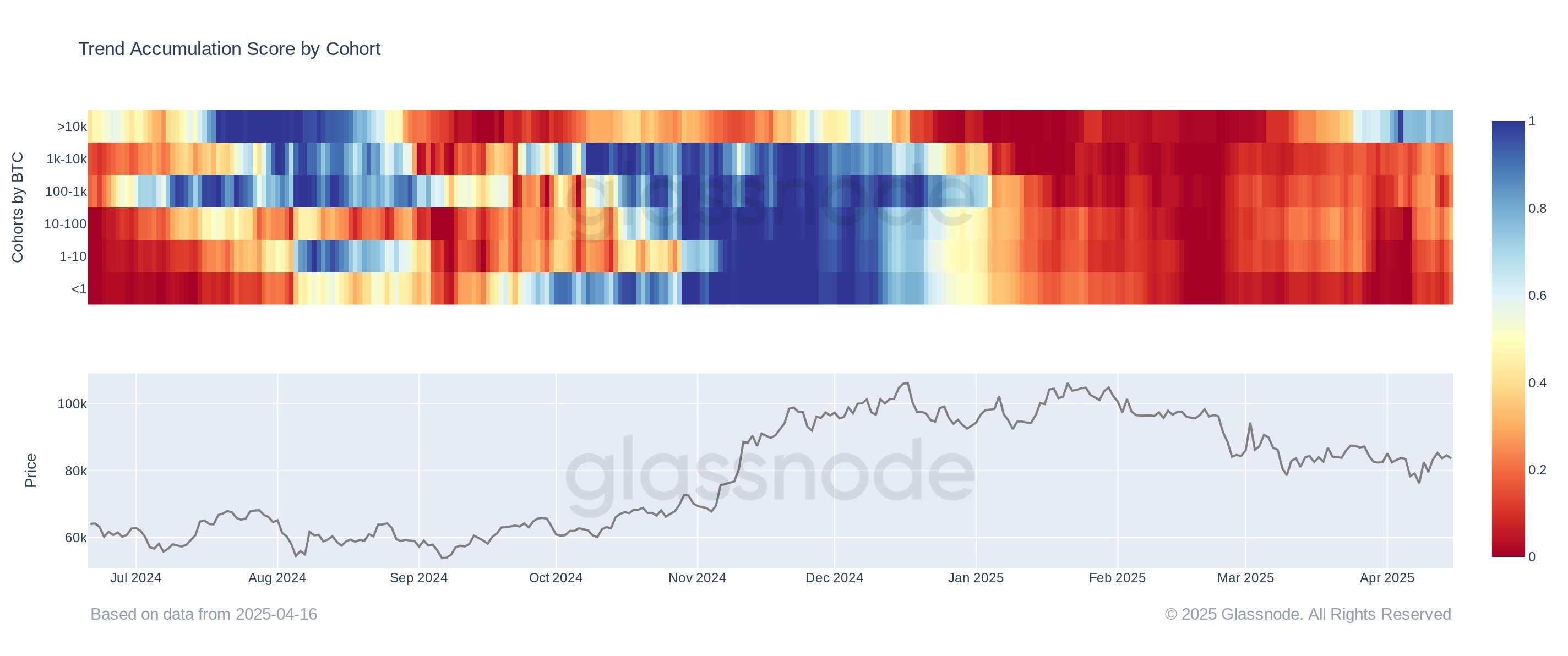

Bitcoin whales holding over 10,000 BTC remain in strong accumulation territory, with their Trend Accumulation Score at around 0.7 as of April 18, according to Glassnode.

This metric quantifies cohort behavior from distribution (0) to accumulation (1). The score implies confidence among the largest holders of Bitcoin.

In contrast, the sell-off in smaller cohorts that have been distributing earlier in the year appears to be slowing down. That includes the 10–100 BTC and the 1-100 BTC groups, whose scores have climbed back to a neutral zone at around 0.5.

Even the smallest cohort (less than 1 BTC), largely composed of retail participants, is no longer in deep distribution mode, indicating a broader pivot back toward accumulation among most Bitcoin groups.

Onchain analyst Mignolet adds that the whale behavior is similar to what preceded Bitcoin’s 2020 bull run.

Bitcoin falling wedge breakout hints at $100K

Bitcoin has broken out of a multimonth falling wedge pattern, signaling a potential bullish reversal that could drive its price toward the $100,000 mark by May.

A falling wedge forms when price action contracts between two downward-sloping trendlines and resolves with an upside breakout. Traders typically measure the wedge’s upside target by…

Click Here to Read the Full Original Article at Cointelegraph.com News…