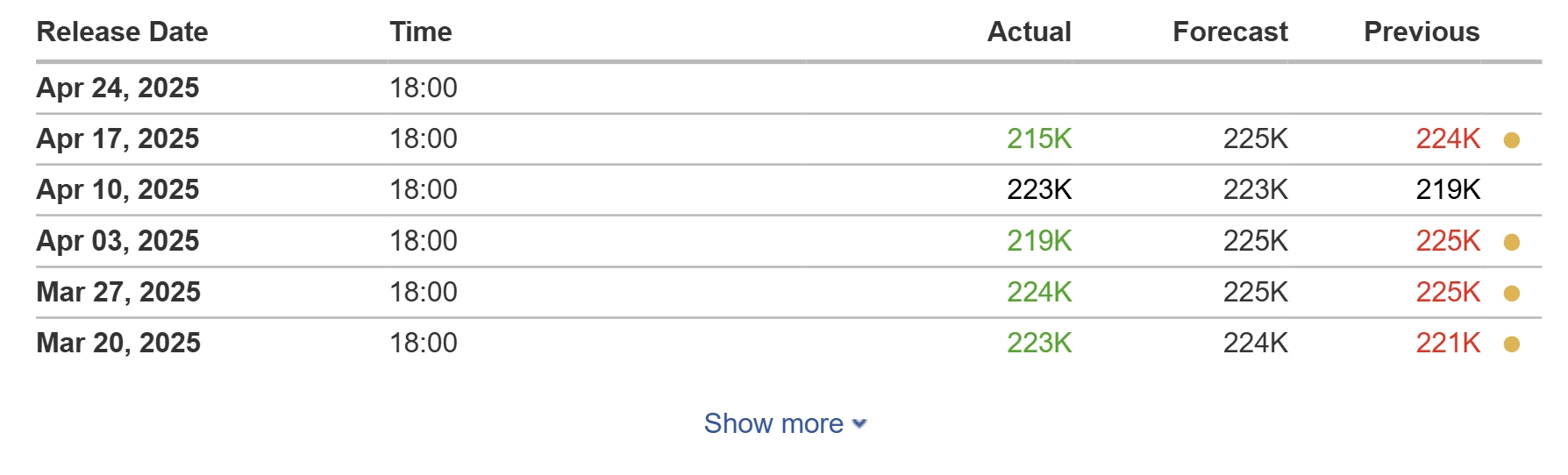

The latest US initial jobless claims data came at 215,000, below the estimated expectation of 225,000, on April 17. The dip in jobless claims indicated that the US labor market remained stable, with fewer people being affected by the uncertainty of US tariffs. Initial jobless claims are a leading economic indicator that measures the health of the US economy and it often impacts investor sentiment around risk assets like Bitcoin (BTC).

Resiliency in the labor market comes on the back of Federal Reserve Chair Jerome Powell’s recent comment about the impact of tariffs. In a press conference at the economics club of Chicago on April 16, Powell said,

“The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

The Fed Reserve Chair also stated that the Fed has no plans to intervene with market bailouts or implement rate cuts in the near future. This stance aligns with his earlier comments from April 4, 2025, when he noted it was “too soon” to consider rate reductions, reflecting the Fed’s cautious approach amid ongoing economic uncertainty.

However, the European Central Bank cut interest rates to 2.25% from 2.50% in order to combat economic pressure from US trade tariffs. According to data, the ECB has taken borrowing costs to its lowest level since late 2022, with the current rate cut marking its seventh reduction in a span of a year.

Related: Bitcoin gold copycat move may top $150K as BTC stays ‘impressive’

Bitcoin remains at an inflection point, says analyst

For risk assets like Bitcoin, the recent US jobless claims data leans bearish in the short term, as a strong labour market reduces the likelihood of rate cuts, which supports speculative investments.

BTC prices have consolidated in a tight range over the past few days, failing to break above the $86,000 level. In light of that, anonymous crypto trader Titan of Crypto said that Bitcoin is at an “inflection point”.

An inflection point in trading is a critical juncture where the market’s direction or momentum may shift significantly. It’s a moment where the balance between buyers and sellers reaches a tipping point, often leading to a reversal or acceleration in the trend. The trader said,

“Bitcoin Inflection Point. On the 1H chart, BTC is contracting within a…

Click Here to Read the Full Original Article at Cointelegraph.com News…