Bitcoin (BTC) price dropped from $87,241 to $81,331 between March 28 and March 31, erasing gains from the previous 17 days. The 6.8% correction liquidated $230 million in bullish BTC futures positions and largely followed the declining momentum in the US stock market, as the S&P 500 futures fell to their lowest levels since March 14.

Despite struggling to hold above $82,000 on March 31, four key indicators point to strong investor confidence and potential signs of Bitcoin decoupling from traditional markets in the near future.

S&P 500 index futures (left) vs. Bitcoin/USD (right). Source: TradingView / Cointelegraph

Traders fear the global trade war’s impact on economic growth, especially after the March 26 announcement of a 25% US tariff on foreign-made vehicles. According to Yahoo News, Goldman Sachs strategists cut the firm’s year-end S&P 500 target for the second time, lowering it from 6,200 to 5,700. Similarly, Barclays analysts reduced their forecast from 6,600 to 5,900.

Regardless of the reasons behind investors’ heightened risk perception, gold surged to a record high above $3,100 on March 31. The $21 trillion asset is widely considered the ultimate hedge, especially when traders prioritize alternatives over cash. Meanwhile, the US dollar has weakened against a basket of foreign currencies, with the DXY index dropping to 104.10 from 107.60 in February.

Bitcoin metrics show strength, while long-term investors are unfazed

Bitcoin’s narratives of being “digital gold” and an “uncorrelated asset” are being questioned, despite a 36% gain over 6 months while the S&P 500 index fell 3.5% during the same period. Several Bitcoin metrics continued to show strength, indicating that long-term investors remain unfazed by the temporary correlation as central banks pivot to expansionist measures to prevent an economic crisis.

Bitcoin’s mining hashrate, which measures the computing power behind the network’s block validation mechanism, reached an all-time high.

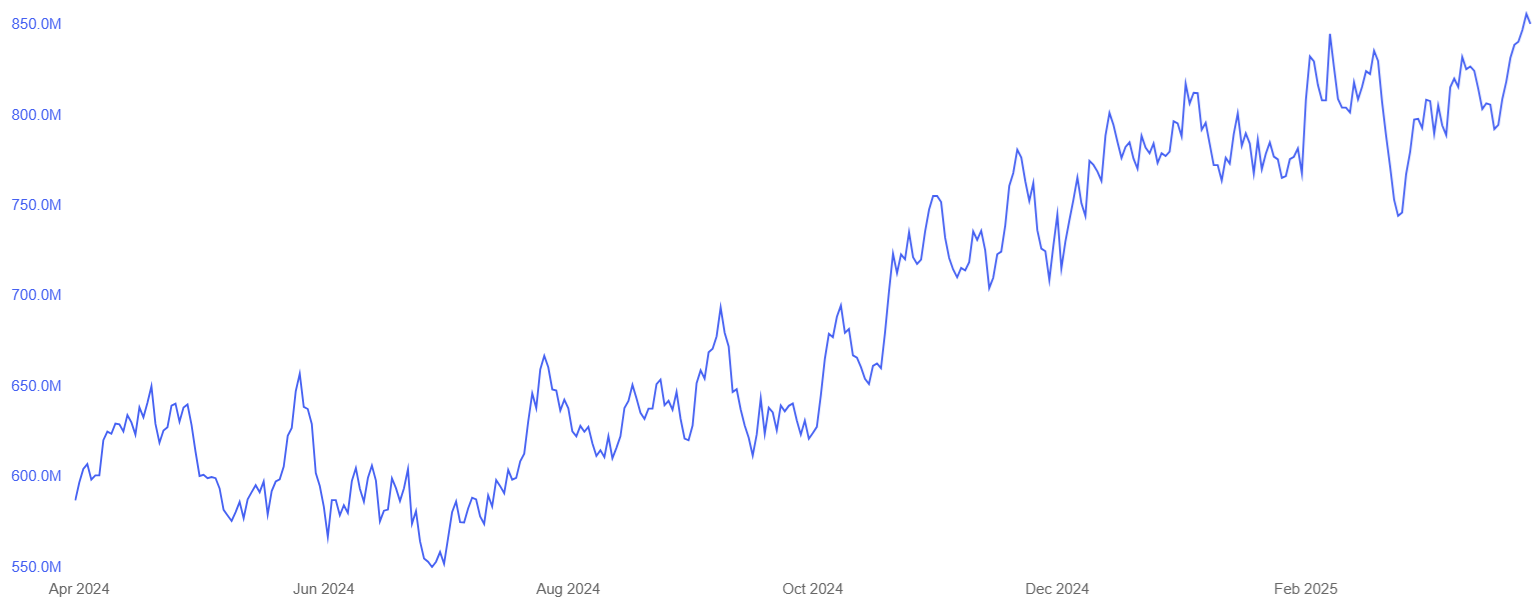

Bitcoin mining estimated 7-day average hashrate, TH/s. Source: Blockchain.com

The 7-day hashrate reached a peak of 856.2 million terahashes per second on March 28, up from 798.8 million in February. Hence, there are no signs of panic selling from miners, as shown by the flow of known entities to exchanges.

In the past, BTC price downturns were associated with periods of FUD regarding the “death spiral,” where miners were forced to sell when becoming unprofitable. Additionally, the 7-day…

Click Here to Read the Full Original Article at Cointelegraph.com News…