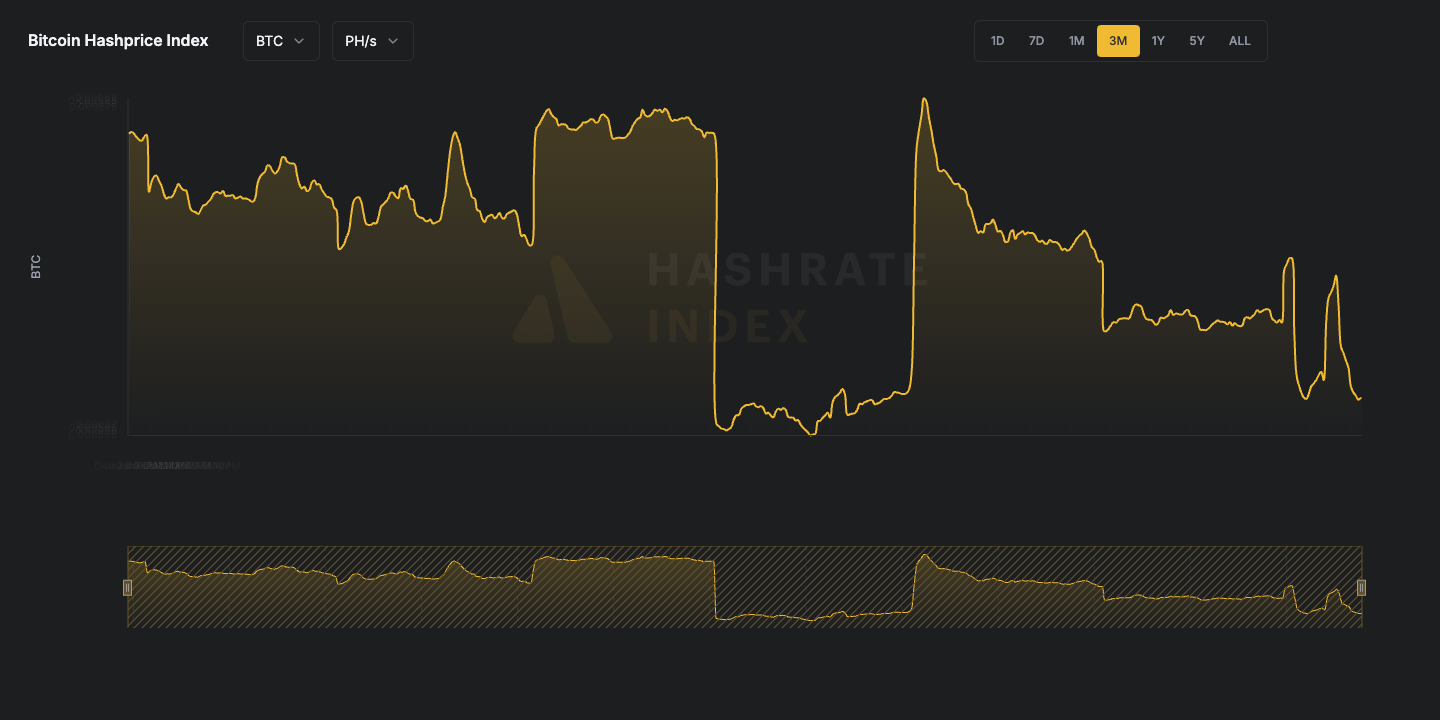

Bitcoin’s hashprice, a measure of daily miner revenue per terahash, experienced significant volatility in the past three months.

From late December 2024 through the end of March 2025, the USD-denominated hashprice declined from over $55 to under $49, with a peak of $61.74 on Jan. 30 and a low of $45.84 on Mar. 10. This 25% drop over the quarter illustrates the tightening margin environment miners are navigating as the market consolidates.

Hashprice reflects a miner’s expected revenue per unit of computational power (TH/s) per day. It is typically quoted in USD and BTC. The USD price is sensitive to both Bitcoin’s market price and the network’s difficulty, while the BTC price isolates profitability relative to block rewards and transaction fees.

Monitoring hashprice provides a real-time view into miner economics and market stress. A declining hashprice implies reduced profitability, which can drive capitulation among less efficient miners and influence selling behavior. It also affects network security, as prolonged periods of unprofitability can lead to hash rate declines and changes in block production. Conversely, a rising hashprice reflects improved miner margins, often due to higher BTC prices or slower difficulty growth.

From Dec. 28, 2024, to Mar. 28, 2025, the USD hashprice averaged $53.90, with notable variability. It began the period at $55.51 and climbed to a peak of $61.74 on Jan. 30.

This rise followed the strong performance in Bitcoin’s spot price, as BTC-denominated hashprice remained relatively stable during this time, hovering around 0.000587 BTC.

Following the January peak, hashprice began a steady decline, reaching a low of $45.84 on Mar. 10. This drawdown followed a slight drop in BTC-denominated hashprice to 0.000566 BTC, suggesting minor network difficulty adjustments or reduced fee revenue. However, the bulk of the decline in USD hashprice appears tied to weaker Bitcoin spot prices, which compressed miner revenue even as the network’s revenue from fees remained mostly unchanged.

The final weeks of March showed a modest recovery, with the hashprice rebounding to $48.66 by Mar. 28. This 6% uptick from the monthly low reflects improving conditions, possibly due to a short-term price recovery or favorable difficulty…

Click Here to Read the Full Original Article at Cryptocurrency Mining News | CryptoSlate…