Bitcoin’s (BTC) price action has closely mirrored that of the US equity market in recent years, particularly the tech-heavy Nasdaq and the benchmark S&P 500.

Now, as fund managers stage a historic exodus from US stocks, the question arises: could Bitcoin be the next casualty?

Fund managers dump US stocks at record monthly pace

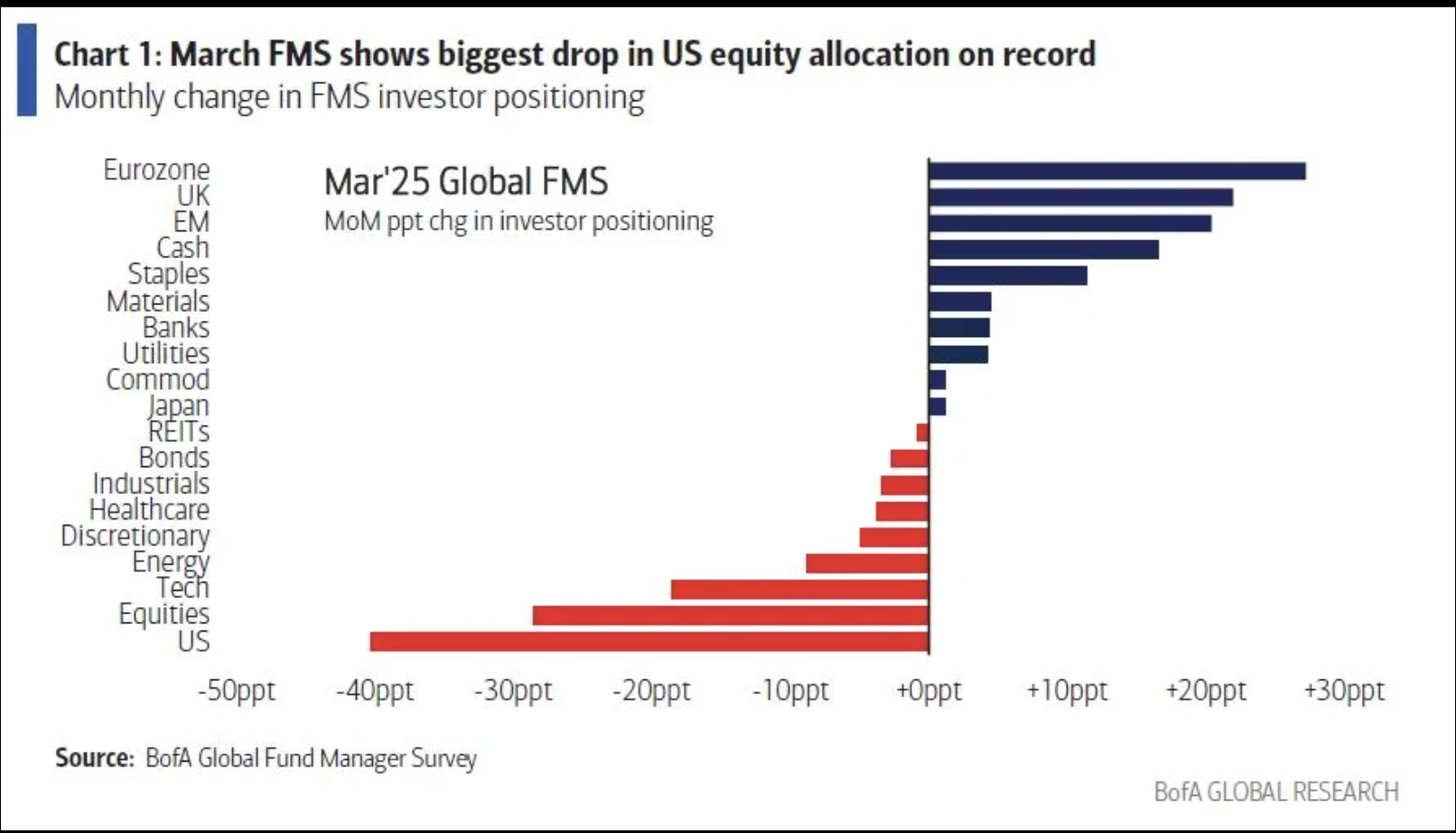

Investors slashed their exposure to US equities by the most on record by 40-percentage-points between February and March, according to Bank of America’s latest survey.

This is the sharpest monthly decline since the bank began tracking the data in 1994. The shift, dubbed a “bull crash,” reflects dwindling faith in US economic outperformance and rising fears of a global downturn.

With a net 69% of surveyed managers declaring the peak of “US exceptionalism,” the data signals a seismic pivot that could ripple into risk assets like Bitcoin, especially given their persistent 52-week positive correlation over the years.

Bitcoin and S&P 500 index 52-week correlation coefficient chart. Source: TradingView

More downside risks for Bitcoin and, in turn, the broader crypto market arise from investors’ rising cash allocations.

BofA’s March survey finds that cash levels, a classic flight-to-safety signal, jumped to 4.1% from February’s 3.5%, the lowest since 2010.

BofA Global Fund Manager March survey results. Source: BofA Research

Adding to the unease, 55% of managers flagged “Trade war triggers global recession” as the top tail risk, up from 39% in February, while 19% worried about inflation forcing Fed rate hikes—both scenarios that could chill enthusiasm for risky assets like Bitcoin.

Conversely, the survey’s most crowded trades list still includes “Long crypto” at 9%, coinciding with the establishment of the Strategic Bitcoin Reserve in the US.

Meanwhile, 68% of managers expect Fed rate cuts in 2025, up from 51% last month.

Related: ‘We are worried about a recession,’ but there’s a silver lining — Cathie Wood

Lower rates have previously coincided with Bitcoin and the broader crypto market gains, something bettors on Polymarket believe is 100% certain to happen before May.

Bitcoin price hangs by a thread

Bitcoin’s price has declined by over 25% two months after establishing a record high of under $110,000 — a dropdown many consider a bull market correction, suggesting that the cryptocurrency may recover in the coming months.

“Historically, Bitcoin experiences these types of corrections during long-term…

Click Here to Read the Full Original Article at Cointelegraph.com News…