Ether’s (ETH) price has been consolidating within a roughly $130 range over the last seven days as $2,000 remains strong overhead resistance.

Data from Cointelegraph Markets Pro and Bitstamp shows that ETH price oscillates within a tight range between $1,810 and $1,960.

ETH/USD daily chart. Source: Cointelegraph/TradingView

Ether price remains pinned below $2,000 for several reasons, including declining Ethereum’s weak network activity and decreasing TVL, negative spot Ethereum ETF flows, and weak technicals.

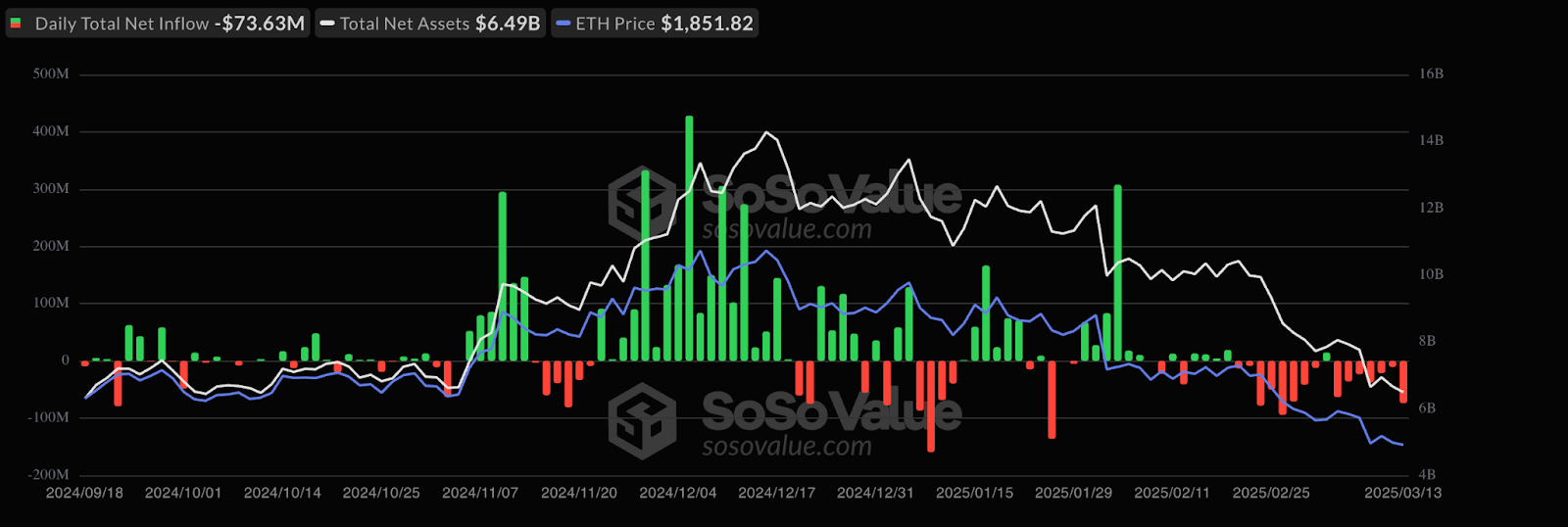

Negative spot Ethereum ETF outflows

The underperformance in Ether’s price can be attributed to investors’ risk-off behavior, which is visible across the spot Ethereum exchange-traded funds (ETFs). ETH outflows from these investment products have persisted for more than two weeks.

US-based spot Ether ETFs have recorded a streak of outflows for the last seven days, totaling $265.4 million, as per data from SoSoValue.

Ether ETF flow chart. Source: SoSoValue

At the same time, other Ethereum investment products saw outflows totaling $176 million. This brings month-to-date outflows out of Ether ETPs to $265 million, in what CoinShares’s head of research, James Butterfill, described as the “worst on record.”

He noted:

“This also marks the 17th straight day of outflows, the longest negative streak since our records began in 2015.”

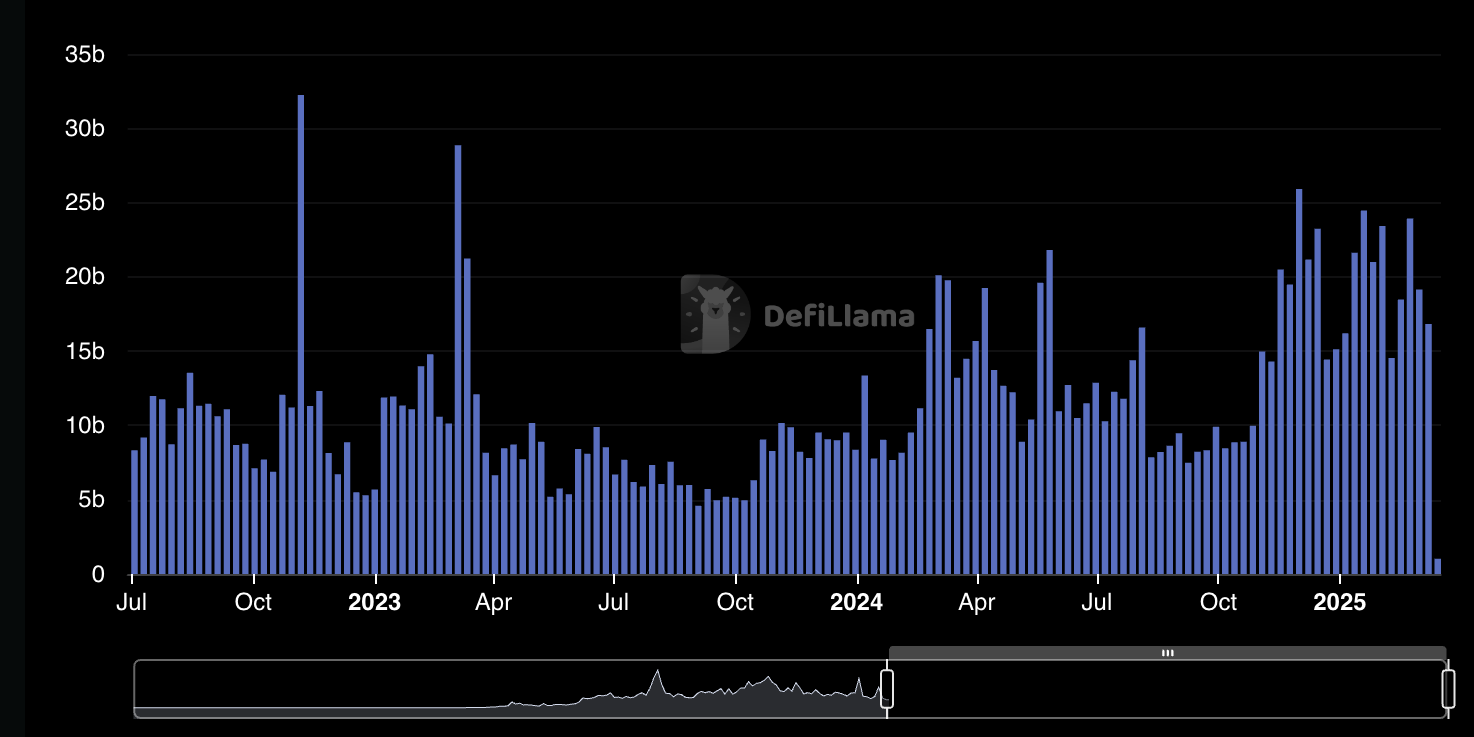

Weak onchain activity hurts ETH price

To understand the key drivers behind Ether’s weakness, it is essential to analyze Ethereum’s onchain metrics.

The Ethereum network maintained its leadership based on the 7-day decentralized exchange (DEX) volume. However, the metric has been declining over the last few weeks, dropping by approximately 30% in the last seven days to reach $16.8 billion on March 17.

Ethereum: 7-day DEX volumes, USD. Source: DefiLlama

Key weaknesses for Ethereum included an 85% drop in activity on Maverick Protocol and a 45% decline in Dodo’s volumes.

Similarly, Ethereum’s total value locked (TVL) decreased 9.3% month-to-date, down 47% from its January high of $77 billion to $46.37 billion on March 11.

Ethereum: total value locked. Source: DefiLlama

Lido was among the weakest performers in Ethereum deposits, with TVL dropping 30% over 30 days. Other notable declines included EigenLayer (-30%), Ether.fi (-29%), and Maker (-28%).

Ether’s bear flag target is at $1,530

Meanwhile, Ether’s technicals show a potential bear flag on the four-hour chart, which hints at more downside in the coming days or…

Click Here to Read the Full Original Article at Cointelegraph.com News…