- Michael Saylor personally holds $1 billion in Bitcoin, owning 17,732 BTC.

- MicroStrategy holds 226,500 BTC, valued at over $12 billion, with a $37,000 average cost.

- Saylor views Bitcoin as a superior, secure asset and advocates continuous investment.

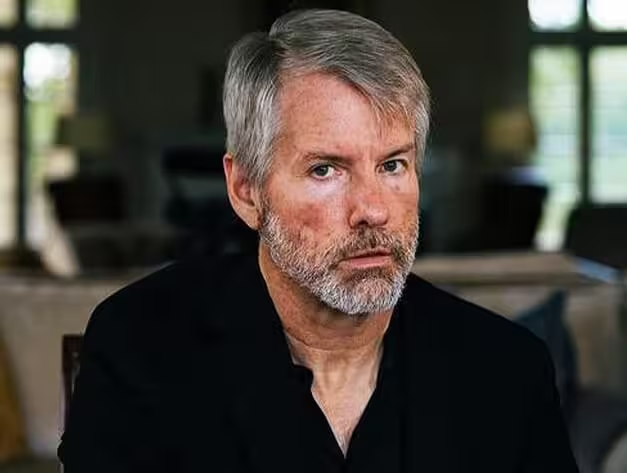

In a recent interview on Bloomberg Television, Michael Saylor, the Chairman of MicroStrategy, revealed he holds Bitcoin worth approximately $1 billion.

This makes him one of the most prominent BTC holders in the world, joining the ranks of figures such as Binance Founder Changpeng Zhao, the Winklevoss Twins, and Satoshi Nakamoto.

Michael Saylor has not sold any of his BTC holdings

Saylor’s endorsement of Bitcoin as a capital investment asset is both passionate and unwavering. In his discussion with Bloomberg’s Sonali Basak on August 7, Saylor confirmed that he possesses a significant personal stack of Bitcoin, which he first disclosed four years ago.

At that time, he announced owning 17,732 BTC, a figure that has only grown since.

Some have asked how much #BTC I own. I personally #hodl 17,732 BTC which I bought at $9,882 each on average. I informed MicroStrategy of these holdings before the company decided to buy #bitcoin for itself.

— Michael Saylor⚡️ (@saylor) October 28, 2020

Despite the significant appreciation of Bitcoin’s value over the years, Saylor has not sold any of his holdings, continuously acquiring more of the cryptocurrency.

Seeing Bitcoin as a generational wealth asset

For Saylor, Bitcoin represents more than just a speculative investment. He describes it as a revolutionary financial tool, superior to both physical and traditional financial capital.

According to Saylor, Bitcoin is an unparalleled asset that offers generational wealth potential for individuals, families, corporations, and even countries. His commitment to Bitcoin is rooted in its perceived stability and security, as well as its ability to preserve value over time.

During the interview, Saylor emphasized his belief that “there is never a bad time to buy Bitcoin.” He likened Bitcoin to “cyber Manhattan,” suggesting that investing in it is akin to acquiring prime real estate in the most coveted location.

This analogy highlights his conviction that Bitcoin, as a scarce and desirable asset, will always hold significant value, regardless of market fluctuations.