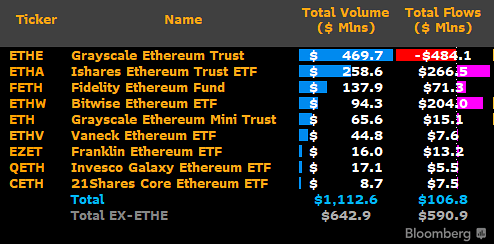

- The US spot Ethereum exchange-traded funds market saw $106.7 million in net inflows on their first trading.

- BlackRock’s ETHA led with $266.5 million in inflows, while Grayscale’s ETHE recorded the most outflows.

Having received the nod from the Securities and Exchange Commission following final regulatory filings, nine spot ETFs went live on July 23.

Together, they raked in more than $1 billion in trading volume as BlackRock led inflows with its iShares Ethereum Trust fund. As expected, Grayscale’s Ethereum Trust recorded significant outflows.

ETH spot ETFs see $106 million in net inflows

According to market data, BlackRock’s ETHA registered most demand with investors scooping $266.5 million on day one.

Meawhile, Bitwise had the second most inflows with $204 million for its ETHW product. Fidelity saw the third highest inflows for its FETH, with $71.3 million recorded on the ETFs trading debut.

While Grayscale’s ETHE saw outflows of $484.1 million, the firm’s Ethereum Mini Trust ETH recorded a modest $15.1 million in inflows. The other four funds saw $13.2 million for Franklin Templeton’s EZET, $7.6 million for VanEck’s ETHV, $7.5 million for 21Shares’ CETH and $5.5 million for Invesco Galaxy’s QETH.

Trading volume surpassed $1 billion

The ETFs saw a combined total volume of over $1.1 billion, data that Bloomberg ETF analyst James Seyffart shared showed. Excluding ETH trading volume of over $469 million, the total for the other eight that all saw inflows comes to around $642 million.

Meanwhile, total inflows minus the ETH outflows reached over $590.9 million.

Commenting on the overall performance of the US Ethereum spot ETFs, Seyffart called it a “very solid first day,”

According to data from SoSoValue, the total net assets in the ETFs was $10.24 billion as of July 23. The value accounted for about 2.45% of the Ethereum market cap, which stood at $413 billion at the time of writing.