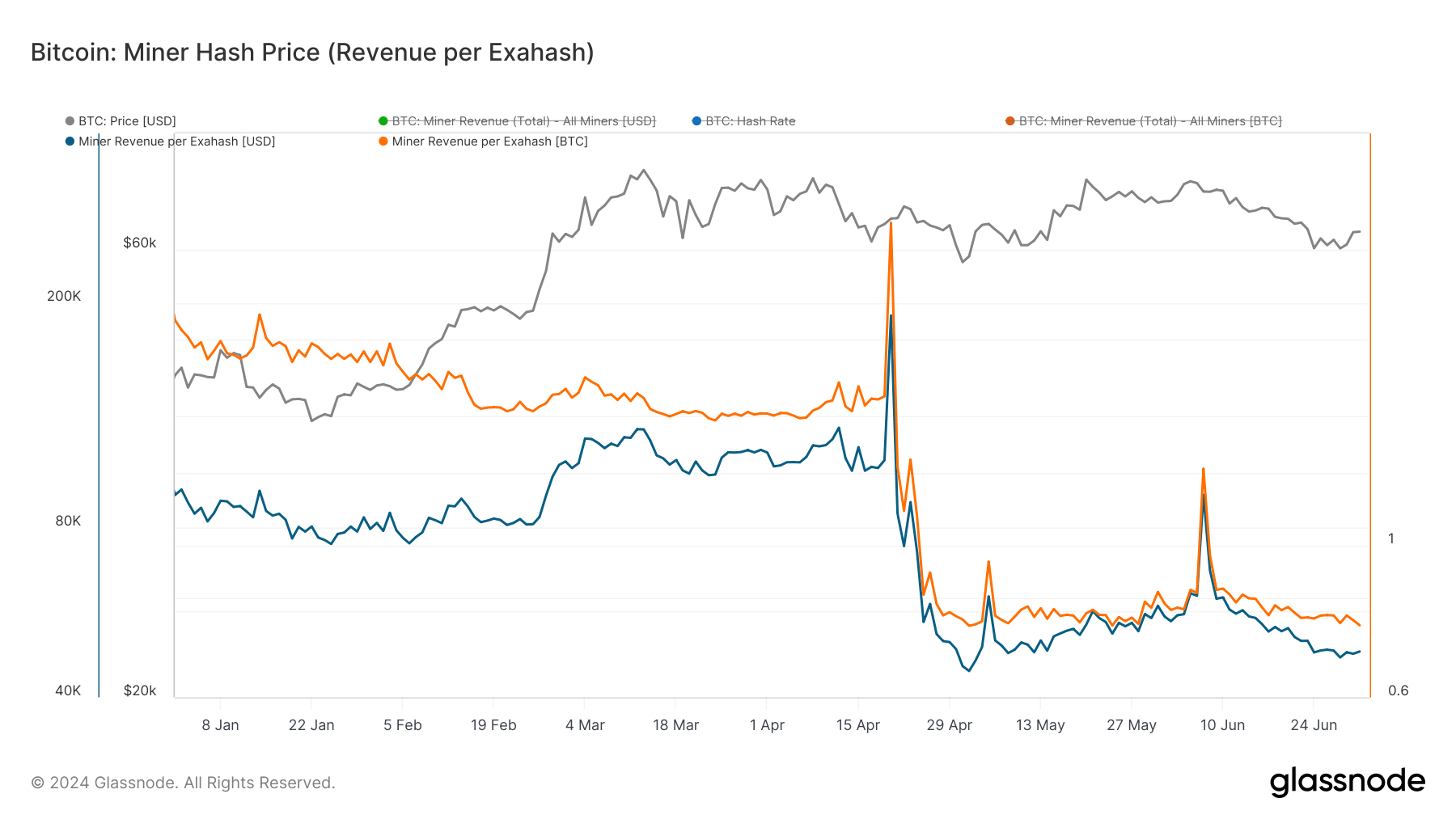

Miner revenue per exahash measures miners’ daily income relative to their contribution to the network’s hash rate, showing how much miners earn per unit of computational power they contribute. This metric is important because it reflects the profitability and economic viability of Bitcoin mining, directly influencing decisions on resource allocation, investment, and operational strategies. Given the size of the Bitcoin mining sector and the performance of public mining companies, these metrics become even more significant.

Since Bitcoin’s fourth halving on April 20, miner revenue per exahash has declined steeply. While this decline was anticipated and miners have been preparing for it, it caused significant economic pressure for miners. Initially, on April 20, the miner revenue per exahash was $190,620 or 2.96 BTC. However, by May 2, it had plummeted to an all-time low of $44,538 or 0.76 BTC.

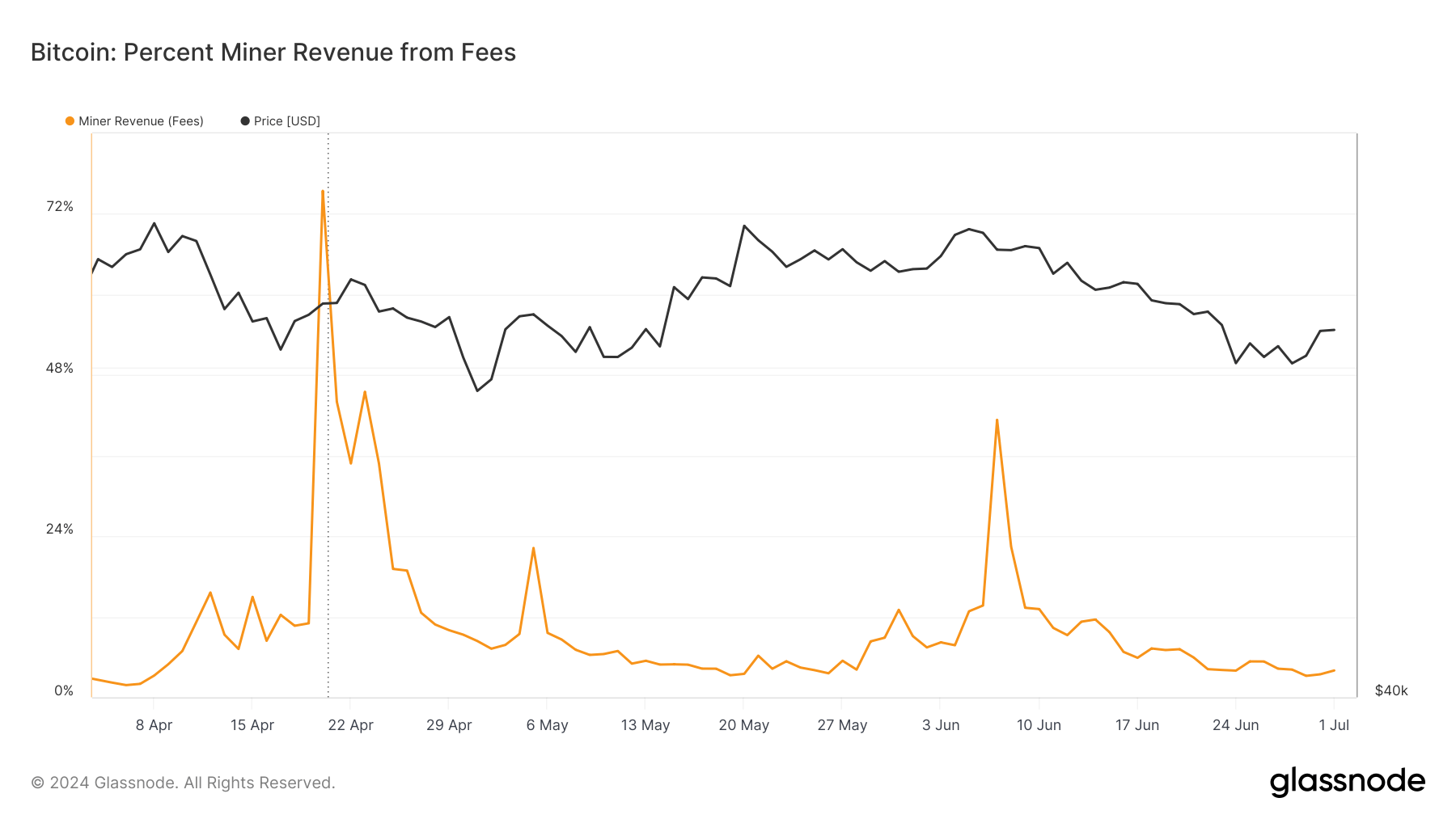

Glassnode’s data showed a brief revenue recovery peaking on June 7 with $91,774 or 1.29 BTC per exahash. This temporary increase was driven by a significant surge in transaction fees due to network congestion, with fees comprising 41.335% of miner revenue on that day, a substantial rise from just 7% three days earlier. This peak shows the occasional spikes in miner revenue due to network activity and highlights the importance of transaction fees as a supplementary income stream for miners, significantly when block rewards diminish.

As of July 1, miner revenue per exahash stands at $48,230 or 0.76 BTC, indicating a lower stabilization level than pre-halving figures. This prolonged period of reduced revenue poses challenges for miners, particularly those with higher operational costs or less efficient hardware.

In comparing miner revenue against the yearly average, we see that total daily USD revenue paid to Bitcoin miners has remained below the 365-day simple moving average since April 25, except for the spike on June 7. This significant trend marks a departure from the previous 15 months, where miner revenue generally exceeded the yearly average. Sustained revenue below the annual average suggests a period of reduced profitability for miners, which could lead to broader implications for the mining industry and the…

Click Here to Read the Full Original Article at Cryptocurrency Mining News | CryptoSlate…