- Crypto cards offer lower fees, stability, and exclusive discounts for travelers.

- Many crypto cards also provide rewards, cashback, and enhanced security for global travelers.

- The Mountain Wolf crypto card features a secure multi-currency wallet and instant payments.

A growing number of travelers are favoring cryptocurrency cards over traditional travel money cards, according to new trend data, with these growing crypto adoption rates driven in large part by travelers under the age of 35.

With the allure of lower transaction fees, enhanced security, and exclusive discounts, crypto cards are increasingly revolutionizing how people manage their finances both at home and abroad.

In this article, we delve into the benefits of using crypto cards for travel and highlight the rise of platforms like Mountain Wolf, which are leading the charge in this digital payment transformation.

The rise of crypto cards in travel

As technology evolves, traveling in 2024 has become increasingly digital, and cryptocurrency is at the forefront of this shift.

Traditional travel money cards, while still popular, are losing ground to the more innovative and cost-effective crypto cards.

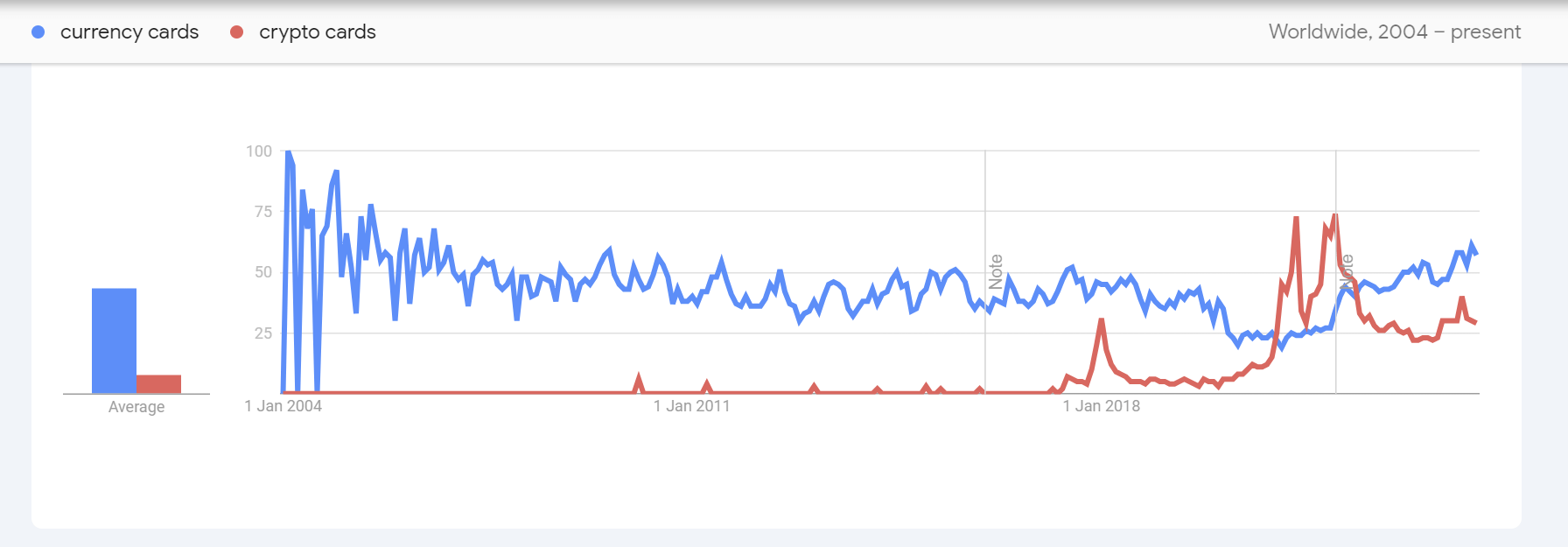

In fact, Google Trends data reveals that demand for crypto cards surpassed demand for currency cards for the first time ever in the spring and summer of 2021, and that trend could be set to recur in the upcoming summer vacation period.

One of the primary reasons for this shift is the significant reduction in transaction fees. Traditional credit and debit cards often incur high fees and unfavorable exchange rates when used abroad.

In contrast, cryptocurrency operates on a decentralized system with much lower transaction fees. For instance, Bitcoin and Ethereum transactions generally have lower fees compared to international credit card transactions, making them a more economical choice for travelers.

Moreover, crypto cards offer protection against currency fluctuations, a feature particularly appealing in regions with volatile currencies.

By using stablecoins like USDT or USDC, travelers can avoid the risks associated with sudden exchange rate changes, ensuring better control over their travel budget. This stability is a significant advantage over traditional travel money cards, which are subject to the whims of the foreign exchange market.

Another compelling reason for…