Bitcoin’s 4th halving event is scheduled to occur on April 22nd, at event block height 840,000. As each block, containing executed transactions, is mined, it is stamped with a block height, noting how many blocks have been generated before the latest one.

This way, block heights create a chronologically ordered digital ledger, granting Bitcoin its mantle of decentralized transparency and security against double-spending. This also makes it instrumental in imposing the embedded halving logic on the entire Bitcoin network, occurring every 210,000 blocks.

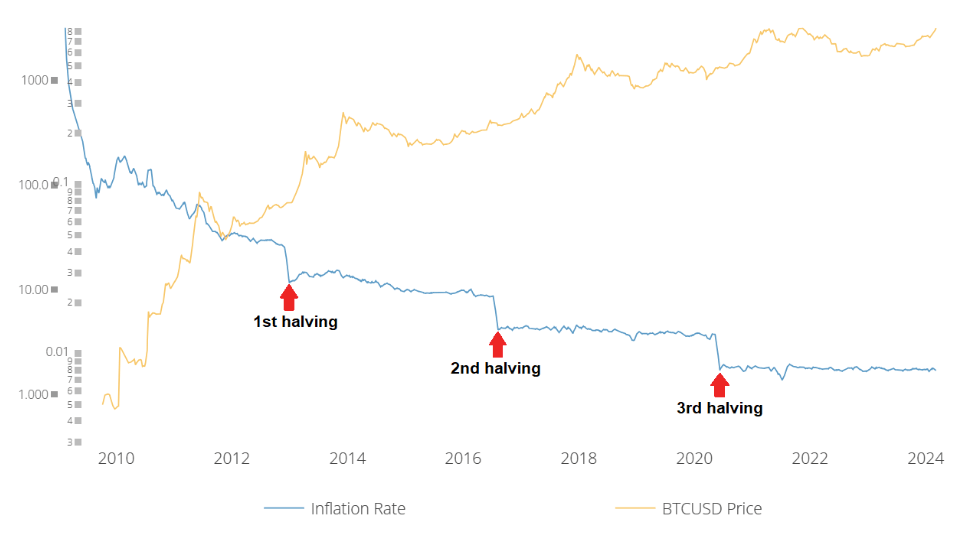

Bitcoin halving is there as an algorithmic monetary policy. Unlike the arbitrary central banking, halving predictably controls the inflow (inflation) of new bitcoins by cutting in half the miner BTC rewards. The very first Genesis block in 2009 delivered 50 BTC to miners. After the fourth halving, miners will receive 3.125 BTC per block mined.

The stark difference in these rewards translates to Bitcoin’s inflation rate. From over 1,000% to present 1.7%, Bitcoin’s inflation rate will once again be cut in half. And as less BTC is available in the supply, each Bitcoin becomes more valuable.

Yet, Bitcoin halvings are just one of many factors impacting BTC price. One of the most severe halving impacts revolves around Bitcoin mining profitability. If BTC rewards become so low, would this force BTC selloffs from struggling mining companies? And if that is the case, wouldn’t the selloff pressure suppress BTC price?

Understanding the Halving and Its Impact on Miners

To understand the importance of something, it is best to imagine its absence. In the case of Bitcoin halving, its absence would mean that all 21 million BTC would have been immediately available upon the launch of the Bitcoin mainnet.

Conversely, that would greatly diminish BTC scarcity, especially given its initial unproven, novel proof of concept as a digital asset. After three halvings, Bitcoin scarcity has proven a successful foil against fiat currency debasement, as central banks tamper with their respective money supplies. In other words, halvings paced out the Bitcoin supply and demand dynamic, allowing for adoption to unfold.

And as Bitcoin adoption increased, the Bitcoin mining network became more secure. That’s because more Bitcoin miners elevate Bitcoin mining difficulty, which is auto-adjusted every two weeks. Following the…

Click Here to Read the Full Original Article at Cryptocurrency Mining News | CryptoSlate…