Blockstream will look to raise more capital to buy Bitcoin (BTC) mining hardware through a second series of its Blockstream ASIC (BASIC) Note offering, which aims to accumulate and sell ASICs based on the predicted demand for miners over the next two years.

Speaking exclusively to Cointelegraph, Blockstream CEO Adam Back highlighted a surplus of Bitcoin mining hardware on the secondary market as a critical driver for a second series of its investment offering.

Series 1 sells out

Blockstream wound up an initial $5-million raise, which saw the firm purchase unused, boxed Antminer S19k Pro ASIC miners for $4.87 million. The company managed to secure the hardware, one of the Chinese manufacturer’s most popular miners, through SunnySide Digital.

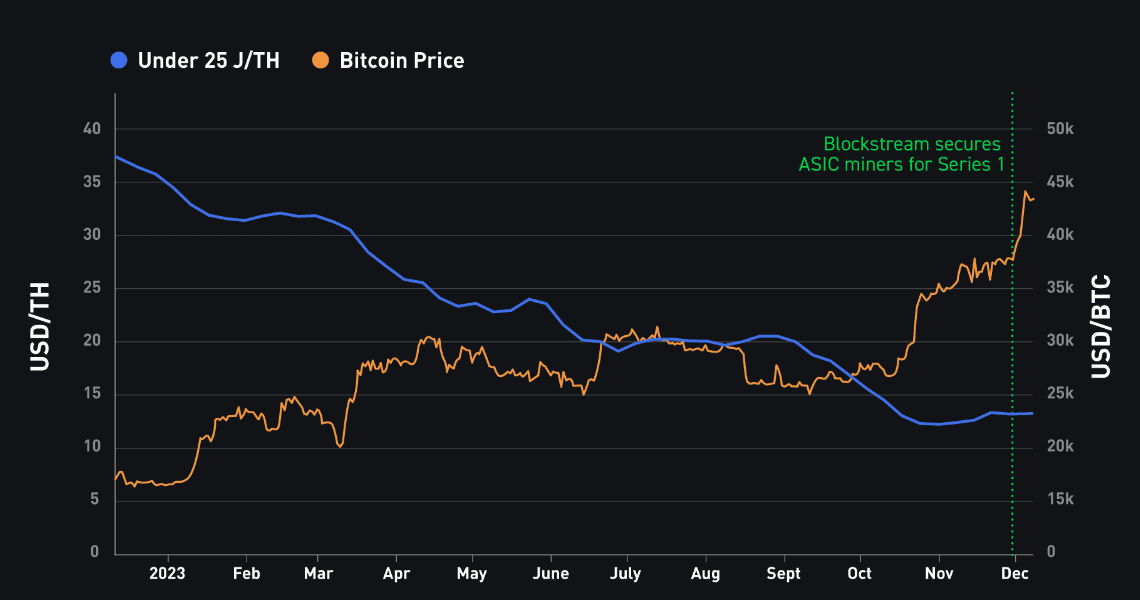

“It presents an opportunity because the Bitcoin price is up 2.8 times, and the miner price is down. Regarding a reference point, ASICs were selling at $35 per terahash at the beginning of the year and now $13.5 per TH on this purchase,” Back explained.

Related: Perfect storm for undervalued ASICs: Blockstream plans $50M raise to buy miners

The CEO added that ASIC prices are down 2.6 times their dollar cost from January 2023 and 6.6 times in Bitcoin. The latter is what matters to Back, who said Blockstream will store the hardware in warehouses and sell it on the market as miners look to bring more hardware online as profitability increases alongside the projected upside value of Bitcoin:

“The fund is not looking for the highest dollar price for the miner; it is looking for the highest Bitcoin price for the miner.”

“Accidental beneficiaries” of BASIC Note’s strategy

Timing the sale of miners is another consideration altogether, which will have to factor in several metrics. One potential tipping point could be the reduction of available miners on second-hand markets. Back said this will force buyers to go directly to manufacturers, driving the price per terahash of units to rise.

Blockstream experienced this firsthand in 2021 when it acquired miners for its hosting service. However, the company ran out of capacity to run the hardware for clients and eventually sold some surplus miners for “three to four times” higher than it had bought the miners.

Related: Blockstream CEO Adam Back talks Bitcoin over a game of Jenga

“That wasn’t our plan to get into the miner reselling…

Click Here to Read the Full Original Article at Cointelegraph.com News…