Bitcoin (BTC) starts a key week for macro markets with a bump as the weekly close gives way to a sharp 7% BTC price correction.

The largest cryptocurrency broke down toward $40,000 in a fresh bout of volatility, reaching its lowest level in a week.

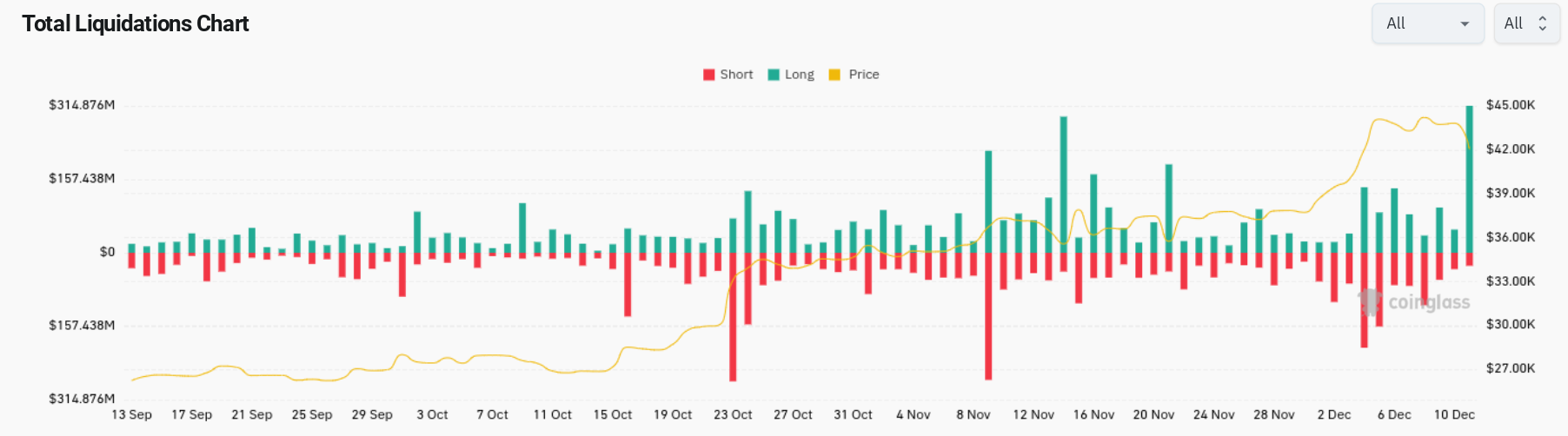

Arguably long overdue, Bitcoin’s return to test support nonetheless caught bullish latecomers by surprise, liquidating almost $100 million in longs.

The snap move provides a rude awakening for BTC investors at the start of a week, which already holds a multitude of potential volatility triggers. These come in the form of United States macro data that will immediately precede the Federal Reserve’s next decision on interest rate policy.

A bumper collection of numbers coming in swift succession means anything can happen on risk assets — and crypto is no exception.

Fresh from its first downward mining difficulty adjustment in three months, meanwhile, it appears that Bitcoin is finally cooling after weeks of practically unchecked upside.

What could happen before the year is out?

Traders and analysts alike are gearing up for curveballs into the 2023 candle close, and with just three weeks to go, BTC price action suddenly feels a lot less certain.

7% BTC price correction wipes longs

Bitcoin volatility returned immediately after a flat weekend as soon as the weekly close was done.

This time, however, it was bulls who suffered as BTC/USD fell more than 7% in hours to bottom at $40,660 on Bitstamp. This included a 5% drop in a matter of minutes, data from Cointelegraph Markets Pro and TradingView shows.

The sudden downturn, which punctured an otherwise “up only” trading environment, was not the expected outcome for leveraged long traders.

Data from the statistics resource CoinGlass had the long liquidation tally at $86 million for Dec. 11 at the time of writing. Cross-crypto long liquidations for the day stood at over $300 million.

A substantial BTC price correction was already anticipated. Nothing goes up in a straight line, as the popular crypto saying goes, and seasoned market participants were not shy in expressing relief.

“The daily and weekly close was at $43,792. Pullbacks are normal and even healthy. Hourly fluctuations mean nothing,” popular commentator BitQuant told subscribers on X (formerly Twitter) in part of his reaction.

An accompanying chart still predicted new higher highs to come over the course of the…

Click Here to Read the Full Original Article at Cointelegraph.com News…