Bitcoin (BTC) has experienced a remarkable 15.7% price surge in the first six days of December. This surge has been heavily influenced by the anticipation of an imminent approval of a spot exchange-traded fund (ETF) in the United States. Senior Bloomberg ETF analysts have expressed a 90% probability for approval by the U.S. Securities and Exchange Commission, which is expected before Jan. 10.

However, Bitcoin’s recent price surge may not be as straightforward as it seems. Analysts have failed to consider the multiple rejections at $37,500 and $38,500 during the second half of November. These rejections have left professional traders, including market makers, questioning the market’s strength, particularly from the perspective of derivatives metrics.

Bitcoin’s inherent volatility explains pro traders’ reduced appetite

Bitcoin’s 7.6% rally to $37,965 on Nov. 15 resulted in disappointment as the movement fully retracted the following day. Similarly, between Nov. 20 and Nov. 21, Bitcoin’s price declined by 5.3% after the $37,500 resistance proved more formidable than anticipated.

While corrections are natural even during bullish markets, they explain why whales and market makers are avoiding leveraged long positions in these volatile conditions. Surprisingly, despite positive daily candles throughout this period, buyers using long leverage were forcefully liquidated, with losses totaling a staggering $390 million in the past five days.

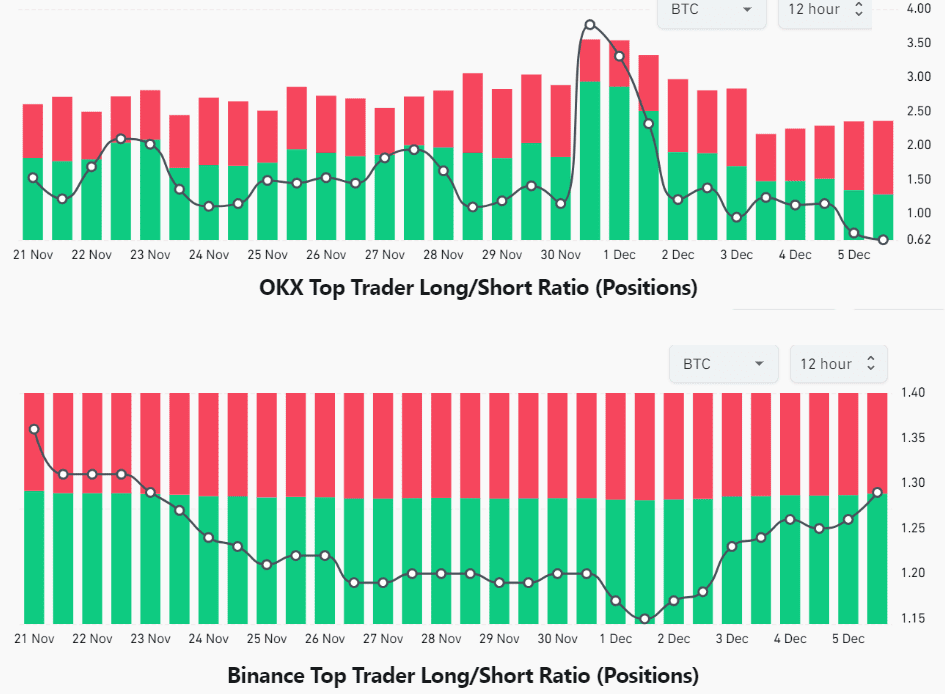

Although the Bitcoin futures premium on the Chicago Mercantile Exchange (CME) reached its highest level in two years, indicating excessive demand for long positions, this trend doesn’t necessarily apply to all exchanges and client profiles. In some cases, top traders have reduced their long-to-short leverage ratio to the lowest levels seen in 30 days. This indicates a profit-taking movement and reduced demand for bullish bets above $40,000.

By consolidating positions across perpetual and quarterly futures contracts, a clearer insight can be gained into whether professional traders are leaning toward a bullish or bearish stance.

Starting on Dec. 1, OKX’s top traders favored long positions with a strong 3.8 ratio. However, as the price surged above $40,000, those long positions were closed. Currently, the ratio heavily favors shorts by 38%, marking the lowest level in over 30 days. This shift suggests that some significant players have stepped back from the…

Click Here to Read the Full Original Article at Cointelegraph.com News…