Bitcoin (BTC) will hit a new all-time high in late 2024 on the backdrop of a long-feared United States recession and regulatory shifts after the next U.S. presidential election, asset manager VanEck predicts.

On Dec. 8, VanEck made 15 crypto predictions for 2024, including price forecasts, timings of a spot Bitcoin ETF launch, the impact of the Bitcoin halving, and emerging dominant crypto platforms.

VanEck 15 Crypto Predictions for 2024

Prediction #1. The US recession will finally arrive, but so will the first spot #Bitcoin ETFs. Over $2.4B may flow into these ETFs in Q1 2024 to support Bitcoin’s price.

— VanEck (@vaneck_us) December 7, 2023

VanEck is among several firms including BlackRock and Fidelity, which are vying for an approved spot Bitcoin exchange-traded fund, as well as a spot Ethereum ETF.

$2.4B to flow into Bitcoin ETFs in Q1

VanEck is confident that the first spot Bitcoin ETFs will be approved in the first quarter. However, it also had a gloomy prediction for the U.S. economy.

“The US recession will finally arrive, but so will the first spot Bitcoin ETFs,” it stated before predicting that “more than $2.4 billion may flow into these ETFs in Q1 2024 to support Bitcoin’s price.”

The firm also stated that the BTC halving, due in April or May, “will see minimal market disruption,” but there will be a post-halving price rise.

VanEck predicts that Bitcoin will make an all-time high in Q4 2024, “potentially spurred by political events and regulatory shifts following a U.S. presidential election.”

The United States presidential elections are scheduled to be held on Nov. 5, 2024.

Ether won’t flip Bitcoin

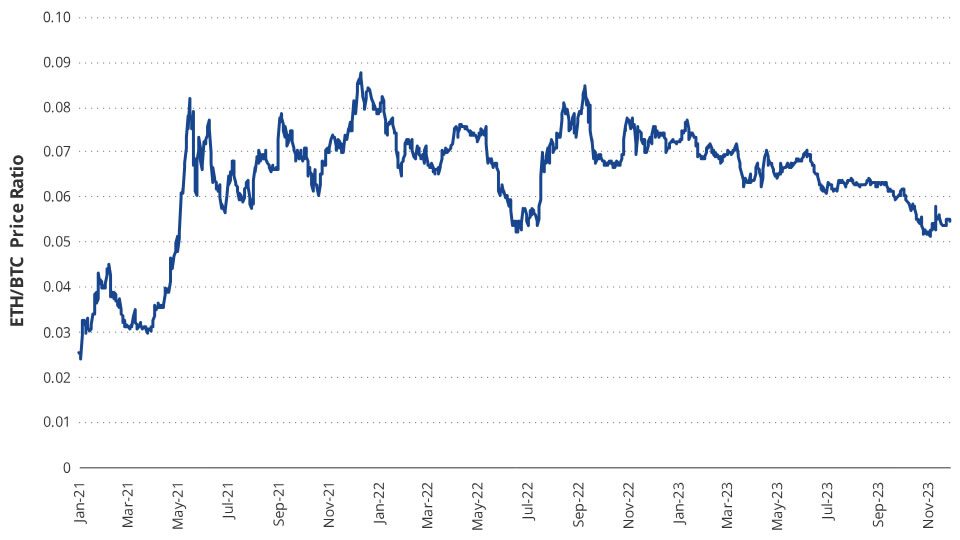

The firm also said it believes Ether (ETH) won’t likely flip Bitcoin in 2024 but will still outperform major tech stocks.

“Like past cycles, Bitcoin will lead the market to rally, and the value will flow into smaller tokens just after the halving. ETH won’t begin outperforming Bitcoin until post-halving and may outperform for the year, but there will be no ‘flippening,’” wrote VanEck.

Despite this, Ether’s market share will be challenged by other smart contract platforms such as Solana, which has “less uncertainty surrounding their scalability roadmap,” it predicted.

Ethereum is the current industry standard for smart contracts with a market capitalization of $285 billion. Solana is a rival high-throughput blockchain with a market cap of $30 billion.

However, Ethereum layer-2 networks…

Click Here to Read the Full Original Article at Cointelegraph.com News…