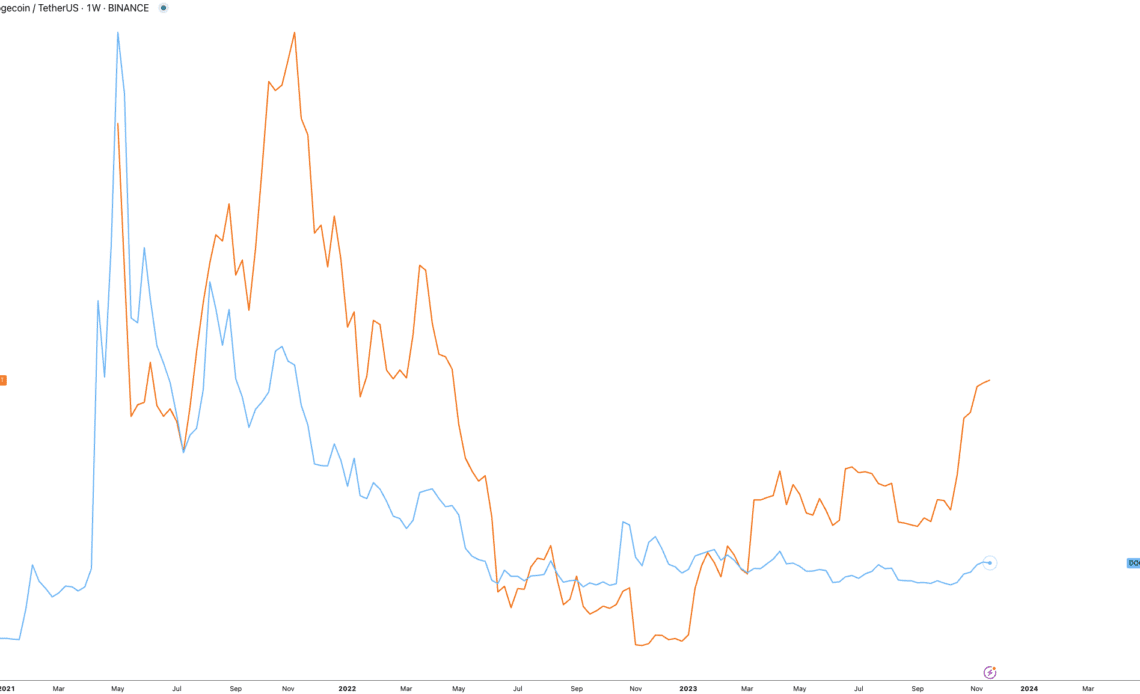

When memecoins go parabolic, it’s usually a market top signal and a warning that investors’ euphoria has peaked. The market witnessed similar speculative fury in the 2020 to 2021 bull market when Dogecoin (DOGE) chased after $1, Shiba Inu (SHIB) rallied by tens of thousands of percent, and NFT prices hit eye-watering six to seven-digit highs.

Despite only being up 13.6% for the year, DOGE’s 33.2% gain over the last month has put the asset on some analysts’ radar.

Take, for example, crypto trader Tony “The Bull,” who pointed out that DOGE price rallied into the one-month parabolic SAR indicator, a move that the trader says was previously followed by a 23,000% rally.

For traders who use technical analysis, the parabolic SAR is generally used to pinpoint “stop and reverse” signals from an asset. In short, it is used to determine the price levels where an asset could stop in its current direction and begin a trend reversal.

This dog is ready to bite #Dogecoin tags 1M Parabolic SAR

Last signal produced a $DOGE 23,000% rally pic.twitter.com/ZGr9eFCaea

— Tony “The Bull” (@tonythebullBTC) November 16, 2023

Traders have also pointed to DOGEs Fibonacci levels as a guide to where price could head in the medium term. Citing the monthly time frame, $0.12 at the 0.618 Fib level has been identified as a medium-term target, whereas the 1.618 Fib level suggests $0.23 as the terminus of the current DOGE swing trade.

Related: Price analysis 11/20: SPX, DXY, BTC, ETH, BNB, XRP, SOL, ADA, DOGE, LINK

Trading volumes and open interest were another pair of notable metrics that traders zoomed in on last week as DOGE open interest soared to a 2-month high and trading volume hit a 6-month high.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Click Here to Read the Full Original Article at Cointelegraph.com News…