The decentralized finance (DeFi) market has been one of the most exciting and volatile sectors in the crypto outside of Bitcoin (BTC). In 2020, the DeFi sector experienced a bull market that saw the total value locked (TVL) in decentralized finance protocols surge from $1 billion to over $100 billion. However, the DeFi market has also been prone to significant corrections. In 2021, the DeFi market experienced a correction that saw the TVL fall from $100 billion to $40 billion.

Despite the volatility of the DeFi market, there are ways for traders to catch onto when the niche crypto sector begins to show sustained bullish momentum. Three of the most important metrics to watch are TVL, a platform’s fee revenue and the number of non-zero wallets holding tokens.

Let’s dig in a bit deeper to explore how these metrics can be used to guage the health of the DeFi sector.

Increases in the total value locked

TVL is one of the most widely used metrics to measure the overall health of the DeFi ecosystem. TVL represents the total amount of cryptocurrency assets locked in DeFi protocols. When TVL rises, it suggests increasing demand and use of DeFi services, which can signify a bull market.

While current TVL is slightly below the 2023 peak set on April 15 of $52.9 billion, it has risen since the start of the year. Since Jan. 1, TVL across the crypto market is up $7 billion, eclipsing $45 billion.

Increased fee reveunue points to increased usage and interest

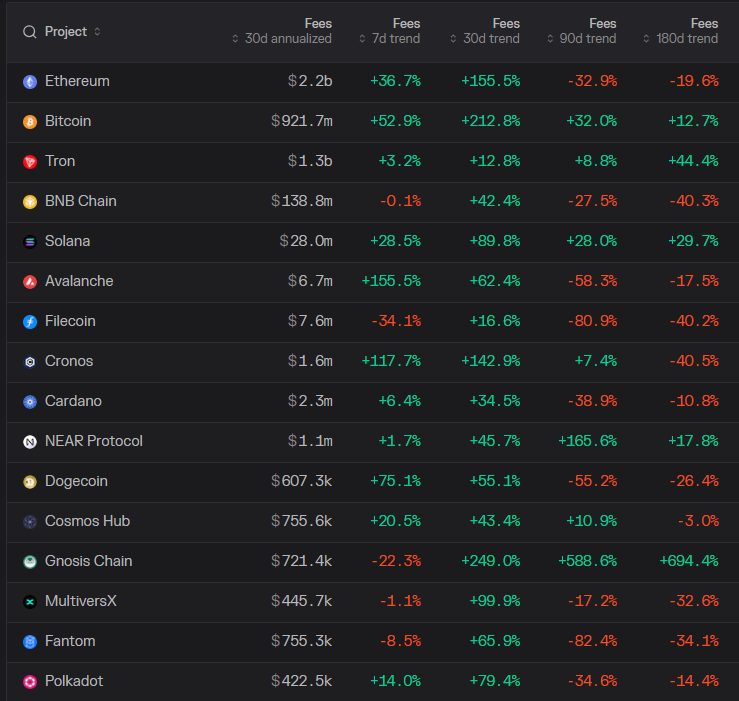

Protocol fees measure the amount of fee revenue received by blockchains for completing transactions. Layer-1 blockchains are a key part of the DeFi ecosystem, as they allow for the building of decentralized applications (DApps) in which users can interact without a centralized intermediary.

When layer-1 fees are rising, it suggests that there is increasing interest in DeFi and that traders are utilizing DApps to interact with blockchains. In the past 30-days, the top 16 layer-1 blockchains by market cap all have shown a positive increase in fees. The 30-day fee total collected by Ether (ETH) is over $2.2 billion when annualized.

Related: Breaking into Liberland: Dodging guards with inner-tubes, decoys and diplomats

Non-zero DeFi wallet addresses rise

The number of non-zero addresses is a good indicator of the number of people who are actively participating in crypto. When the number of non-zero addresses increases, it suggests that…

Click Here to Read the Full Original Article at Cointelegraph.com News…