As we approach Bitcoin’s (BTC) halving in April, a phenomenon that historically triggers significant market shifts, companies within the space are at a critical juncture. This event is surrounded by speculation and strategic planning, and for some, a sense of uncertainty. While it’s laden with opportunities, it’s vital for businesses to adopt a balanced approach, integrating a long-term perspective rather than catering to market euphoria.

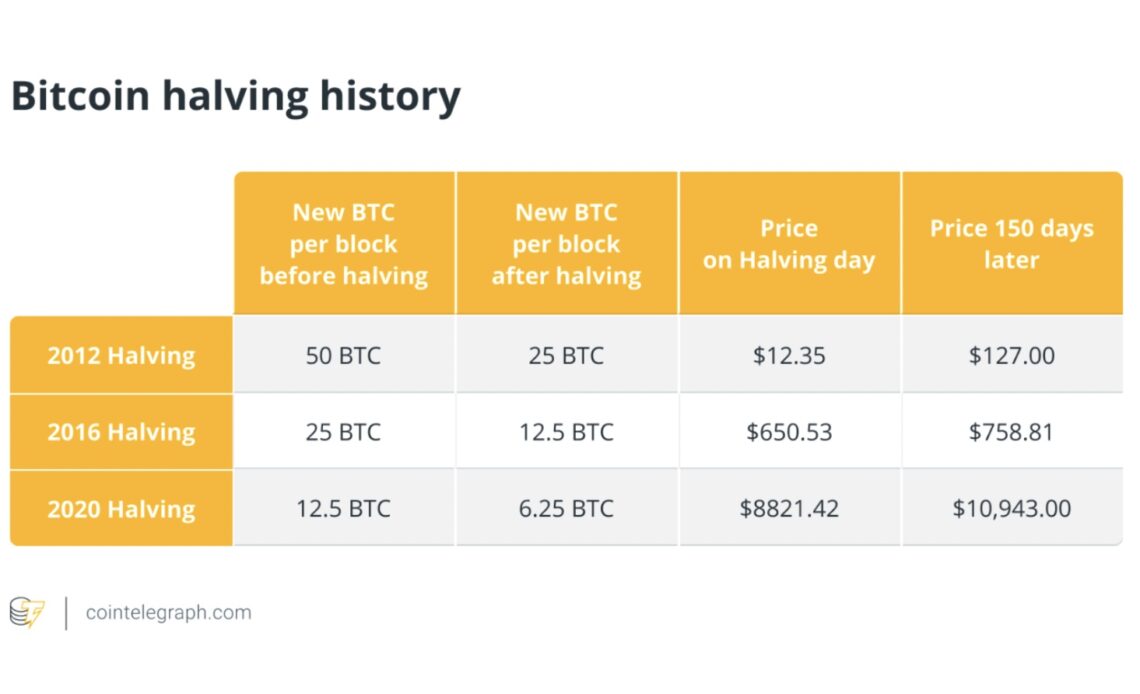

Historically, Bitcoin halving events — which reduce mining rewards by half — have triggered substantial changes in the crypto landscape. These changes often lead to increased market activity and heightened investor interest. However, basing an entire business strategy on the outcomes of the halving can be a double-edged sword. Focusing solely on short-term gains could lead to missed opportunities or strategic errors that endanger a company’s future viability.

The recent layoffs by layer-2 blockchain Avalanche underscore the volatility and unpredictability inherent to the crypto sector. Such developments highlight the necessity of robust risk management strategies. Companies must be prepared for any eventuality, ensuring their survival beyond the halving event. This calls for a focus on sustainable growth, solid financial planning and a reluctance to overextend in pursuit of fleeting opportunities.

Related: History tells us we’re in for a strong bull market with a hard landing

In light of this, crypto companies are increasingly channeling their efforts into product development and halting marketing efforts. The goal is to diversify offerings and cater to an evolving customer base, which is expected to expand post-halving. This strategy is not only about capitalizing on the immediate upsurge in halving-related interest but also about building a foundation that can withstand market fluctuations.

A possible consequence for some companies? Products will be rushed to release — without adequate cybersecurity preparations. The crypto industry, by its very nature, is a prime target for cyberattacks. History has repeatedly shown what happens to projects that fail to learn from our long list of predecessors who have fallen to hackers.

Moreover, the current landscape of venture capital in the crypto sector presents a complex picture. The AI hype and the recent crypto winter led to a drying up of funds. However, there’s a renewed interest as investors look to capitalize on the halving event. This resurgence of investment must be…

Click Here to Read the Full Original Article at Cointelegraph.com News…