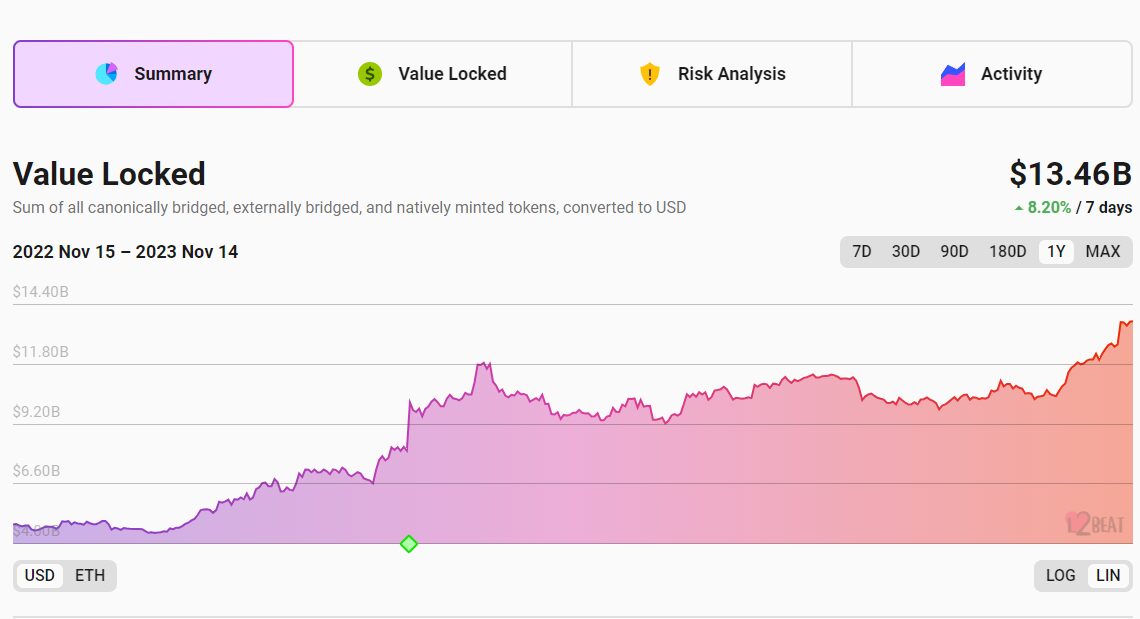

Ethereum Layer 2 networks reached a new milestone on November 10, reaching $13 billion of total value locked (TVL) within their contracts, according to data from blockchain analytics platform L2Beat. According to industry experts, this trend of greater interest in layer 2s is likely to continue, although some challenges remain, especially in the realms of user experience and security.

According to L2Beat, there are 32 different networks that qualify as Ethereum layer 2s, including Arbitrum One, Optimism, Base, Polygon zkEVM, Metis, and others. Prior to June 15, all of these networks combined had less than $10 billion of cryptocurrency locked within their contracts, and their combined TVL had been declining since April’s high of $11.8 billion.

But beginning on June 15, layer 2 TVL growth turned positive. And by October 31, these networks had reached a new high of nearly $12 billion combined TVL. From there, investment in layer 2 apps continued to climb, passing the $13 billion TVL mark on November 10 and continuing to nearly $13.5 billion at the time of publication.

This rise in TVL is even more dramatic when compared with the rate that existed during the bull market of 2021, when overall crypto investment was much larger than it is today. On November 12, 2021 when the market cap of all cryptocurrencies reached an all-time high of $2.82 trillion, layer 2s had less than $6 billion locked within their contracts. Today, the total market cap of cryptocurrencies is a more modest $1.4 trillion, according to Coinmarketcap, yet the TVL of layer 2s is greater than ever.

In a conversation with Cointelegraph, Metis CEO Elena Sinelnikova proposed a theory for why layer 2s are growing in spite of the continuing bear market. According to her, Ethereum’s high gas fees during the bull market left an indelible impact on users, leading to a desire for alternatives when demand started to come back, as she stated:

“At the time of [the] bull market, Ethereum at peak times was very non-scaleable, which meant that transactions were slow and very expensive because of the bull market. It would be hundreds of dollars just in transaction fees for one transaction, so therefore it was not sustainable.”

According to Sinelkova, another reason that layer 2 networks have thrived in the bear market is because of the successful marketing efforts of their development teams, which has led to high user activity and therefore, high yields. “They are…

Click Here to Read the Full Original Article at Cointelegraph.com News…