Bitcoin (BTC) targeted $37,000 at the Nov. 14 Wall Street open as the latest United States inflation data undercut expectations.

CPI offers Bitcoin, stocks a pleasant surprise

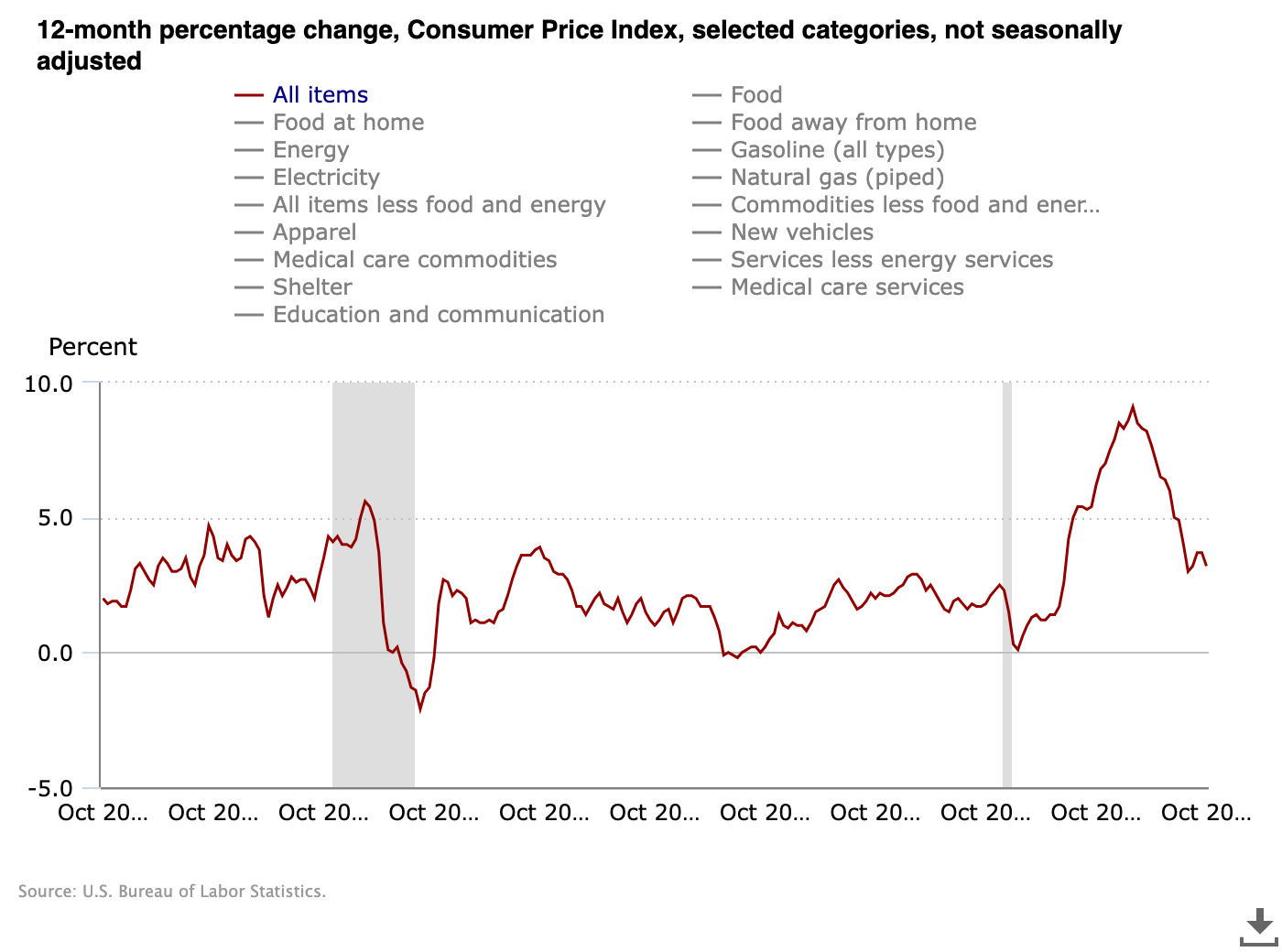

Data from Cointelegraph Markets Pro and TradingView showed BTC price strength returning as the Consumer Price Index (CPI) reflected slowing inflation in October.

CPI came in 0.1% below market forecasts both year-on-year and month-on-month. The annual change was 3.2%, versus 4.0% for core CPI.

“The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September,” an official press release from the U.S. Bureau of Labor Statistics confirmed.

“The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021.”

Versus the month prior, where CPI was just one inflation metric, which overshot versus market consensus, the situation was palpably different. Stocks immediately offered a warm reaction at the Wall Street open, with the S&P 500 up 1.5% on the day.

“This is the 31st consecutive month with inflation above 3%. But, inflation seems to be back on the DECLINE,” financial commentary resource The Kobeissi Letter wrote in part of a reaction.

Kobeissi, traditionally skeptical of Fed policy in the current inflationary environment, nonetheless called the print a “good” result.

In line with other recent CPI releases, meanwhile, Bitcoin reacted only modestly, revisiting an intraday low before rising toward $37,000 while still rangebound.

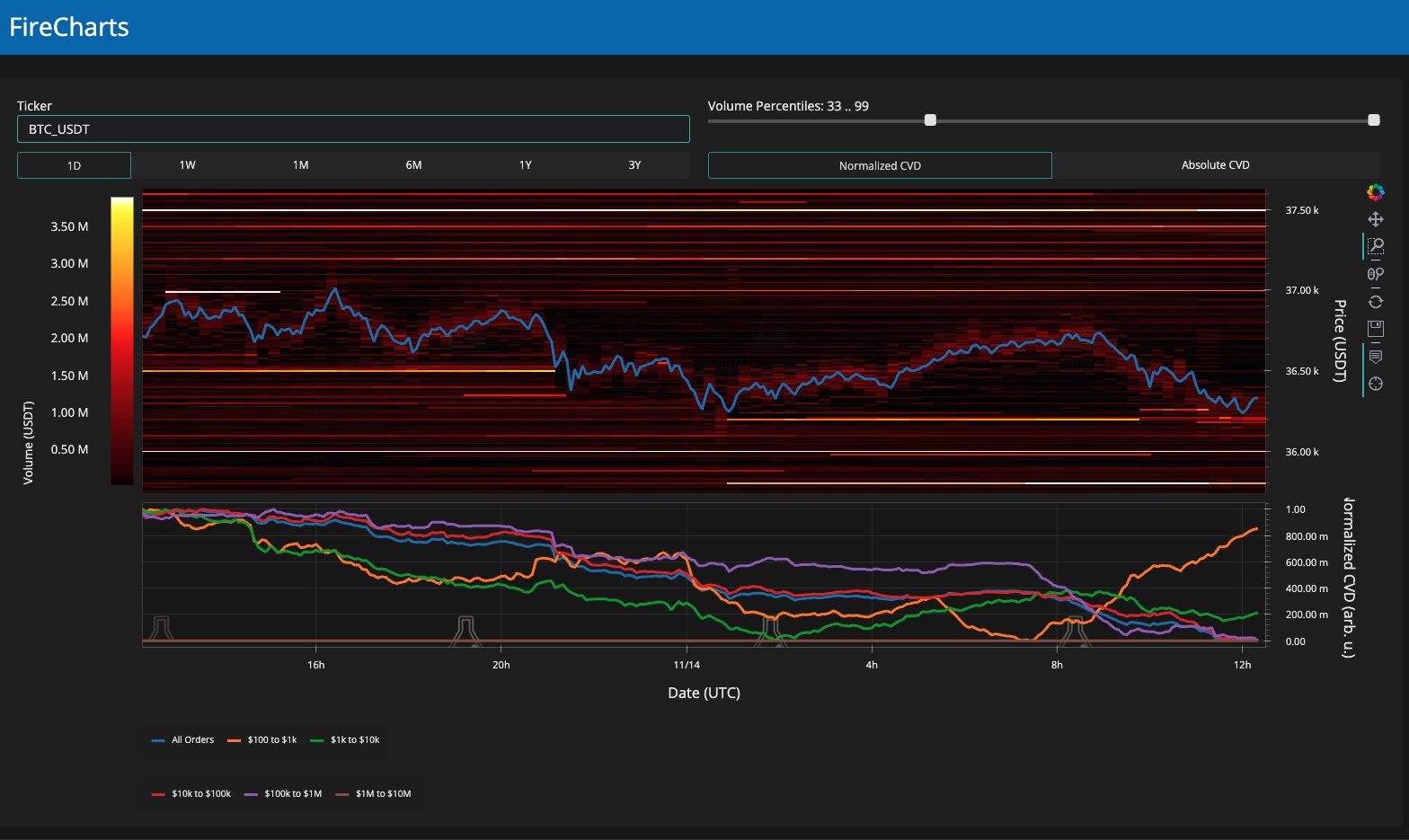

Analyzing market composition, however, on-chain monitoring resource Material Indicators noted that liquidity was overall thin — a key ingredient for aiding volatility.

With whales quiet on exchanges, it added, retail investors were increasing BTC exposure.

“It’s no coincidence that the 2 smallest order classes are buying,” it commented alongside a print of BTC/USDT order book liquidity on largest global exchange Binance.

“Upside liquidity around the active trading zone is so thin, whales can’t make large orders without major slippage. Watching the smaller order classes on the FireCharts CVD bid BTC up as support strengthens above $36k.”

Analyst: Accept BTC price retracements

Down around 4% from the 18-month highs seen…

Click Here to Read the Full Original Article at Cointelegraph.com News…