Solana’s native token (SOL) experienced a remarkable 58.6% surge in just five days, reaching an $64 high on Nov. 11. However, the subsequent two-day retracement of 11.3% to $54 has prompted investors to question whether this signals a fading bullish momentum or merely a temporary price adjustment.

To put Solana’s performance into context, let’s compare it to other leading altcoins. Since its peak on Nov. 11, Avalanche (AVAX) has rallied by 17%, Ether (ETH) gained 1%, while BNB Token (BNB) traded down 2%. This comparison underscores the fact that SOL has underperformed in the broader altcoin market. Therefore, the 5.5% daily decline on Nov. 13 is unlikely to be tied to macroeconomic or sector drivers, such as the potential approval of a spot BTC exchange-traded fund (ETF).

Solana remains a top contender in terms of performance and on-chain activity

Despite the recent decline in SOL’s price, a 7-day gain of 35% suggests that investors should not hastily adopt a bearish outlook, as this could merely be a natural correction following Solana’s significant outperformance. However, it’s essential not to disregard Solana network’s fundamentals, which include on-chain metrics and SOL’s derivatives markets. Excessive leverage use by traders could potentially lead to forced liquidations, especially in perpetual contracts or inverse swaps, where funding rates play a crucial role.

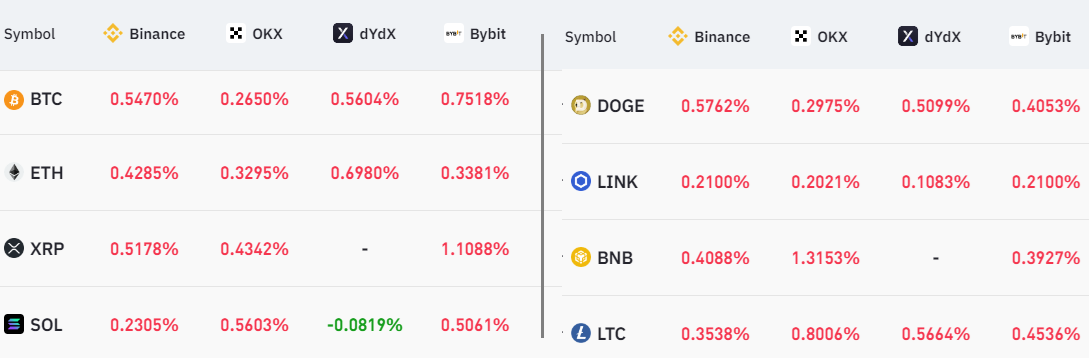

Perpetual contracts, also known as inverse swaps, carry an embedded rate that is typically charged every eight hours. A positive funding rate indicates that longs (buyers) are seeking more leverage, while the opposite situation arises when shorts (sellers) require additional leverage, leading to a negative funding rate.

The 7-day funding rate for SOL aligns with that of BTC and ETH, pointing to a slightly higher demand for leverage longs. The 0.4% weekly cost is standard, considering that the cryptocurrency market capitalization has grown by 10.5% over the past two weeks, reaching $1.4 trillion, its highest level since May 2022.

Analyzing on-chain data from semi-centralized networks with very low transaction fees carries inherent risks, as inflating these metrics is relatively easy, particularly those related to decentralized finance (DeFi). A case in point is the revelation in August 2022 by a former developer from Saber, a previously esteemed decentralized exchange (DEX) on Solana, who disclosed that a significant portion of the…

Click Here to Read the Full Original Article at Cointelegraph.com News…