Bitcoin (BTC) starts a new week at comfortable highs as traders square off over BTC price action to come.

As macroeconomic uncertainty continues to grow, Bitcoin is cementing its new trading zone above $30,000.

The highest weekly close since early May 2022 is the latest achievement for bulls, and so far, bid support has allowed the market to avoid a deep retracement after last week’s snap 15% gains.

How could the environment change for BTC/USD this week?

As Bitcoin heads into the October monthly close, would-be volatility catalysts are brewing — not least thanks to the increasing geopolitical instability in the Middle East.

Adding to the hurdles for risk assets to overcome is the United States Federal Reserve, which will decide on interest rate adjustments on Nov. 1.

Under the hood, Bitcoin is looking better than ever, and the numbers prove it — network fundamentals are either at or circling all-time highs, continuing a trend in place for much of this year.

As price survives a mass profit-taking event at the hands of speculators, faith in further upside is proving hard to shake — but for some, the specter of a $20,000 crash is still firmly in play.

Cointelegraph takes a look at these factors and more in the weekly rundown of potential BTC price influencers for the coming days.

Countdown to the end of “Uptober”

After its highest weekly close in 18 months, Bitcoin continues to consolidate near $34,000 as the week begins.

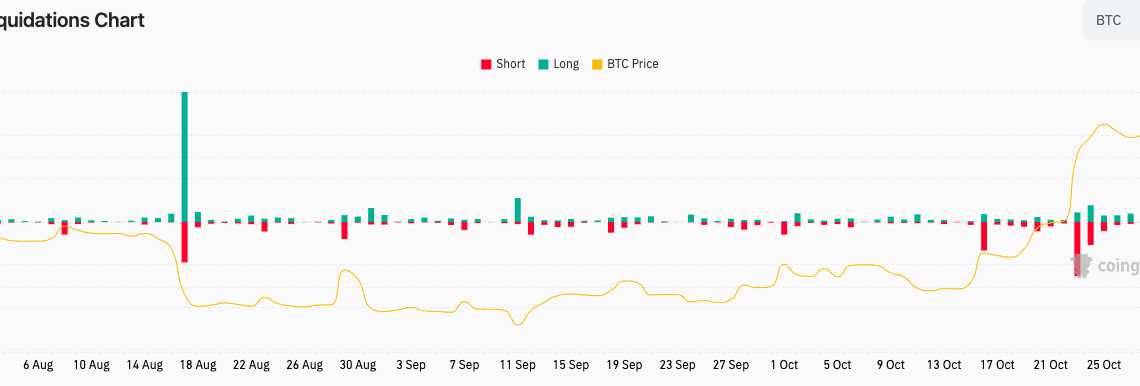

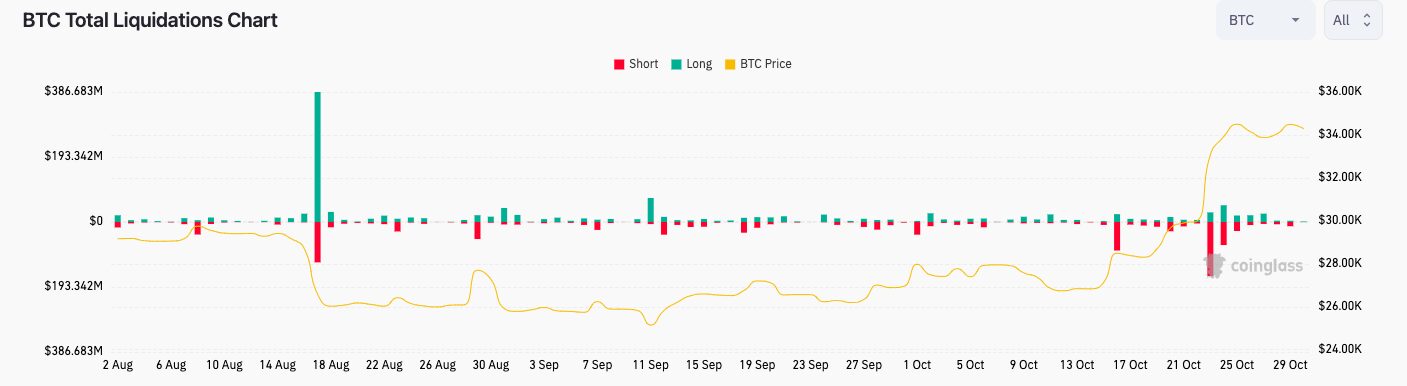

A late-weekend surge took BTC price action to $34,700, helping add to the day’s BTC short liquidations, per data from monitoring resource CoinGlass.

Despite this, the last weekly close of October was a calm event compared to a week prior, and with the monthly close now in focus, market participants will be keen to see if “Uptober” retains its bullish status.

Eyeing relative strength index (RSI) behavior, popular analyst Matthew Hyland was optimistic on the day.

“Current Bitcoin position would eliminate any possibility of bearish divergence forming on the weekly later on off the prior RSI high,” he wrote in an X post.

“This is extremely good for the bullish side and worst possible close for the bearish side.”

An accompanying chart showed RSI hitting higher highs on weekly timeframes. In a previous post, Hyland said that a weekly close at current levels would constitute a wider breakout.

#Bitcoin Weekly closes tommorow

It will potentially confirm a massive breakout of a 6 month+…

Click Here to Read the Full Original Article at Cointelegraph.com News…