Bitcoin’s (BTC) price action is the talk of the town this week and based on the current sentiment expressed by market participants on social media, one could almost assume that the long-awaited bull market has started.

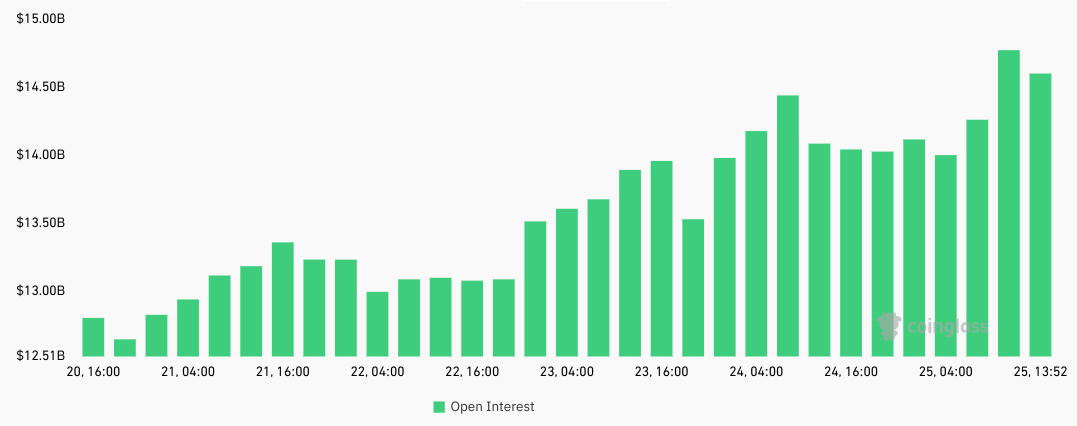

As Bitcoin’s price rallied by 16.1% between Oct. 22 and Oct. 24, bearish traders using futures contracts found themselves liquidated to the tune of $230 million. One data point that stands out is the change in Bitcoin’s open interest, a metric reflecting the total number of futures contracts in play.

The evidence suggests that Bitcoin shorts were taken by surprise on Oct. 22 but they were not employing excessive leverage.

During the rally, BTC futures open interest increased from $13.1 billion to $14 billion. This differs from August 17, when Bitcoin’s price dropped by 9.2% in just 36 hours. That sudden movement caused $416 million in long liquidations, despite the lower percentage-size price move. At the time, Bitcoin’s futures open interest decreased from $12 billion to $11.3 billion.

Data seems to corroborate the gamma squeeze theory that is circulating, which implies that market makers had their stop losses “chased.”

The $BTC “god candle” lines up with where dealers got blown out of short positioning ($32k-$33k).

This was a gamma squeeze, not organic. pic.twitter.com/NXM8z8mNDa

— Not Tiger Global (@NotChaseColeman) October 24, 2023

Bitcoin personality NotChaseColeman explained on X social network (formerly Twitter), that arbitrage desks were likely forced to hedge short positions after Bitcoin broke above $32,000, triggering the rally to $35,195.

The most significant issue with the short squeeze theory is the increase in BTC futures open interest. This indicates that even if there were relevant liquidations, the demand for new leveraged positions outpaced the forced closures.

Did Changpeng Zhao and BNB play a role in Bitcoin’s price action?

Another interesting theory from user M4573RCH on X social network claims that Changpeng “CZ” Zhao used BNB as collateral for margin on Venus Protocol, a decentralized finance (DeFi) application after being forced to sell Bitcoin to “shore up” the price of BNB token.

maybe im nuts but what we just saw is

cz has BNB collateral on Venus

bnb dumping

cz sells btc to shore up bnb

cz unwinds loans and pays back debt on Venus

bnb on venus no longet vulnerable to liquidation

cz buys back btc with bnb to rebalance his btc position@cz_binance…

Click Here to Read the Full Original Article at Cointelegraph.com News…