Real estate-backed stablecoin USDR lost its peg to the U.S. dollar after a rush of redemptions caused a draining of liquid assets such as Dai (DAI) from its treasury, its project team has revealed.

USDR — backed by a mixture of cryptocurrencies and real-estate holdings — is issued by Tangible protocol, a decentralized finance project that seeks to tokenize housing and other real-world assets.

USDR is mostly traded on the Pearl decentralized exchange (DEX), which runs on Polygon.

An update on $USDR

Over a short period of time, all of the liquid $DAI from the $USDR treasury was redeemed.

This lead to an accelerated drawdown in the market cap.

Combined with the lack of DAI for redemptions, panic selling ensued, causing a depeg.

We’re working on…

— Tangible (@tangibleDAO) October 11, 2023

In an Oct. 11 tweet, Tangible explained that over a short period of time, all of the liquid DAI from the USDR treasury was redeemed, leading to an accelerated drawdown in the market cap, adding:

“Combined with the lack of DAI for redemptions, panic selling ensued, causing a depeg.”

USDR experienced a flood of selling at around 11:30 am UTC, driving its price as low as $0.5040 per coin. It recovered slightly, to around $0.53 shortly afterward.

Despite the coin losing nearly 50% of its value, the project’s developers have vowed to provide “solutions” to the problem, saying it was merely a liquidity issue that has temporarily challenged redemptions.

“This is a liquidity issue,” they stated. “The real estate and digital assets backing $USDR still exist and will be used to support redemptions.”

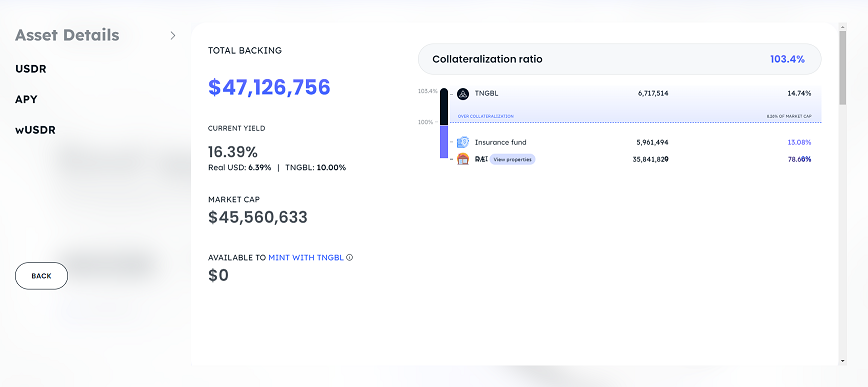

Despite this loss to the treasury, the app’s official website stated on October 11 at 9:57 pm UTC that its assets are still worth more than the entire market cap of the coin.

14.74% of USDR’s collateral consists of Tangible (TNGBL) tokens, which are part of the coin’s native ecosystem. The team claims that the remaining 85.26% are collateralized by real-world housing and an “insurance fund.”

Related: Insurance, real estate: How asset tokenization is reshaping the status quo

Stablecoins are intended to always be worth $1 on the open market. But they sometimes lose their peg under extreme market conditions.

Circle’s USDC (USDC), the sixth-largest cryptocurrency by market cap as of October 11, fell to $0.885 per coin on March 11 when several banks in the U.S….

Click Here to Read the Full Original Article at Cointelegraph.com News…