Bitcoin (BTC) starts the second week of October still up 4% month-to-date as geopolitical instability provides a snap market focus.

BTC price action continues to hold steady at $28,000 — what will happen next as markets react to the war in Israel?

In what could end up a volatile period for risk assets, Bitcoin has so far yet to offer a significant reaction, spending the weekend in a tight corridor.

That could soon change, however, as the Wall Street open comes amid a hike in both oil and gold, along with U.S. dollar strength.

Macroeconomic triggers are also far from lacking, with the coming days due to see the September print of the U.S. Consumer Price Index (CPI). In the wake of surprise employment data last week, the readout holds additional importance for the Federal Reserve.

Beneath the hood, meanwhile, on-chain metrics are pointing to interesting times for Bitcoin, as BTC/USD trades in a key range, which has formed a watershed area since 2021.

Cointelegraph takes a look at these factors and more in the weekly rundown of potential BTC price triggers to come.

Bitcoin “illiquid and choppy” as weekly close passes

The weekend saw market participants fully focused on the abrupt breakout of war in Israel, and as markets themselves reopen, change is already afoot.

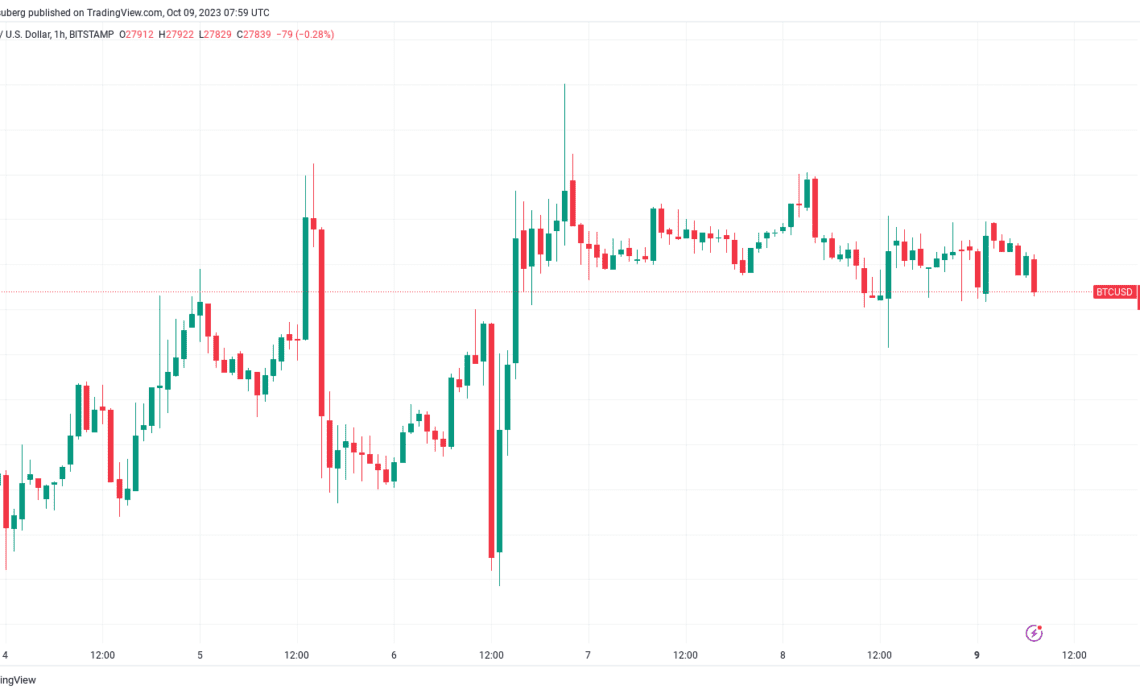

For Bitcoin, however, the ongoing events have yet to deliver a palpable chain reaction, data from Cointelegraph Markets Pro and TradingView shows.

BTC price action has centered on $28,000 since Friday, and that level remains key as traders hope for a resistance/support flip.

“Nothing special going on this weekend,” Daan Crypto Trades summarized on X into the weekly close.

“Would expect volumes to pick up a bit soon but ultimately we should be hovering around this price region until futures open back up tonight.”

A further post noted that Bitcoin had yet to decisively break through the 200-week moving average (MA), which sits at $28,176 at the time of writing.

Analyzing the 4-hour chart, popular trader Skew described BTC price behavior as “illiquid and choppy.”

$BTC 4H

these wicks really say how illiquid & choppy price action is pic.twitter.com/Qq13GsuqfB— Skew Δ (@52kskew) October 9, 2023

“Bitcoin’s bullish flag is still in play — but it is taking too long to play out,” fellow trader Jelle continued, zooming out to monthly performance.

“October is generally the most bullish month of the year, thus I’m still expecting this one to break out…

Click Here to Read the Full Original Article at Cointelegraph.com News…