United States 10-year Treasury yields soared above 4.8% on Oct. 3, their highest level since 2007. DoubleLine Capital CEO Jeffrey Gundlach said in a post on X (formerly Twitter) that the spread between the 2-year and 10-year Treasury yields has narrowed from 109 basis points a few months ago to 35 basis points. He cautioned that this “should put everyone on recession warning.”

Arthur Hayes, former CEO of crypto exchange BitMEX, warned in a recent X thread that the government will have to print money to save the bond market as a faster bear steepener — a condition where long-term interest rates rise more quickly than short-term rates — will cause firms to collapse. Some investors believe that this could trigger a cryptocurrency bull market.

It also looks like the institutional investors have started to warm up to cryptocurrencies. CoinShares’ latest Digital Asset Fund Flows Weekly Report shows inflows of $21 million into digital asset investment products for the first time in six weeks.

In this uncertain macro environment, let’s take a look at the charts to determine the next potential move.

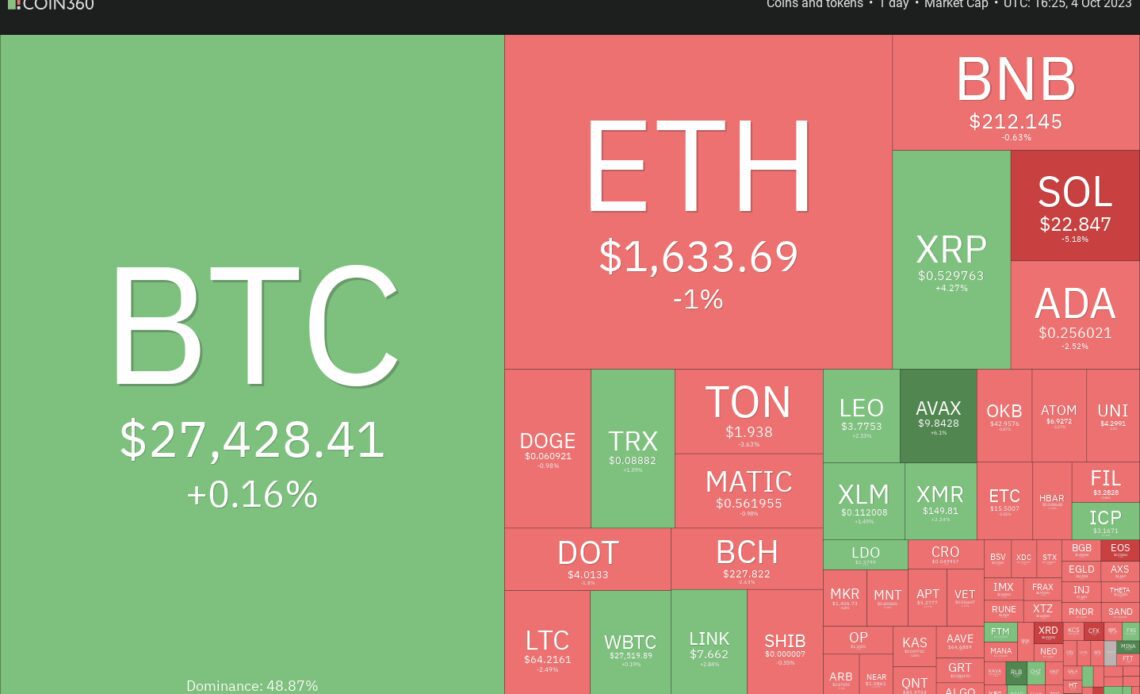

Bitcoin price analysis

Bitcoin (BTC) rose above $28,143 on Oct. 2 but the long wick on the candlestick shows the bears are aggressively selling at higher levels. The bears tried to build upon their advantage on Oct. 3 but the bulls held their ground at $27,160.

The upsloping 20-day exponential moving average ($26,903) and the relative strength index (RSI) in the positive territory indicate that bulls have the upper hand. Buyers will once again try to clear the overhead resistance at $28,143.

A close above this level will complete a short-term double bottom pattern, which has a target objective of $31,486.

This positive view will be invalidated if the price once again turns down from the overhead resistance and plummets below the 20-day EMA. That could yank the price to $26,000. The BTC/USDT pair could then continue to consolidate between $24,800 and $28,143 for a while longer.

Ether price analysis

Ether (ETH) turned down sharply from the overhead resistance of $1,746 on Oct. 2, indicating that the bears are fiercely guarding this level.

The 20-day EMA ($1,640) is flattening out and the RSI is near the midpoint, indicating a balance between supply and demand. If the price turns up from the current level, the bulls will again try…

Click Here to Read the Full Original Article at Cointelegraph.com News…