The Dollar Strength Index (DXY) achieved its highest level in nearly 10 months on Sep. 22, indicating growing confidence in the U.S. dollar compared to other fiat currencies like the British pound, euro, Japanese yen, and Swiss franc.

DXY “golden cross” confir

Moreover, investors are concerned that this surge in demand for the U.S. dollar might pose challenges for Bitcoin (BTC) and cryptocurrencies, although these concerns are not necessarily interconnected.

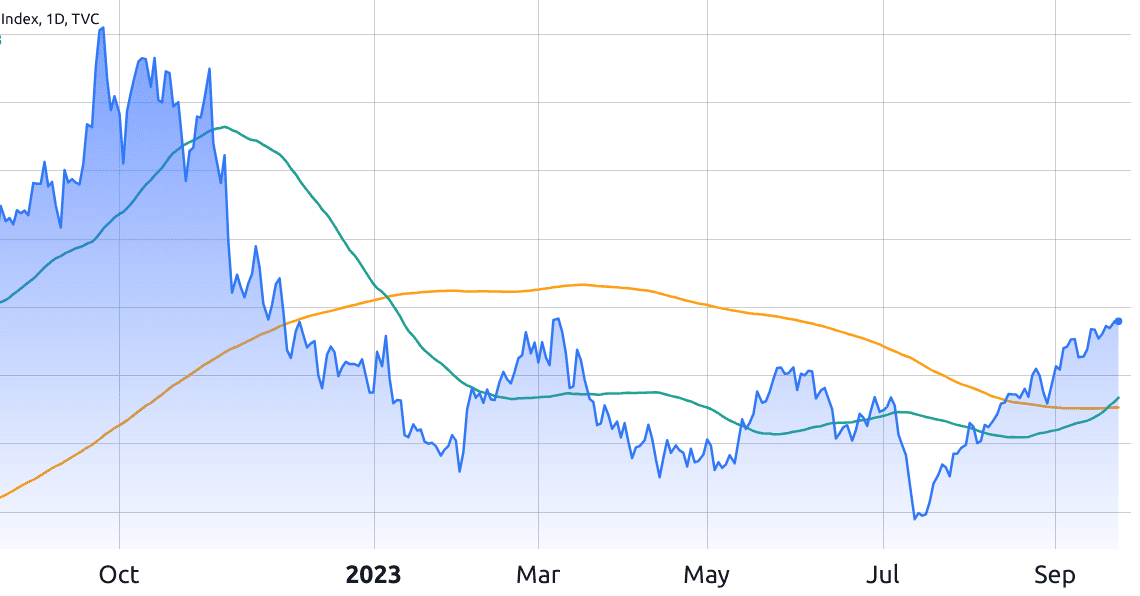

The DXY index confirmed a golden cross pattern when the 50-day moving average surpassed the longer 200-day moving average, a signal often seen as a precursor to a bull market by technical analysts.

Impacts of the recession and inflation risks

Despite some investors believing that historical trends are determined solely by price patterns, it’s important to note that in September, the U.S. dollar exhibited strength, even in the face of concerns about inflation and economic growth in the world’s largest economy.

Market expectations for U.S. GDP growth in 2024 hover at 1.3%, which is lower than the 2.4% average rate over the preceding four years. This slowdown is attributed to factors like tighter monetary policy, rising interest rates, and diminishing fiscal stimulus.

However, not every increase in the DXY index reflects heightened confidence in the economic policies of the U.S. Federal Reserve (Fed). For example, if investors opt to sell U.S. Treasuries and hold onto cash, it suggests a looming recession or a significant uptick in inflation as the most likely scenarios.

When the current inflation rate is 3.7% and on an upward trajectory, there’s little incentive to secure a 4.4% yield, prompting investors to demand a 4.62% annual return on 5-year U.S. Treasuries as of Sep. 19, marking the highest level in 12 years.

This data unequivocally demonstrates that investors are avoiding government bonds in favor of the security of cash positions. This may seem counterintuitive initially but aligns with the strategy of waiting for a more favorable entry point.

Investors anticipate that the Fed will continue raising interest rates, allowing them to capture higher yields in the future.

If investors lack confidence in the Fed’s ability to curb inflation without causing significant economic harm, a direct link between a stronger DXY and reduced demand for Bitcoin may not exist. On one hand, there is indeed a decreased appetite for…

Click Here to Read the Full Original Article at Cointelegraph.com News…