Argentina has grappled with hyperinflation for several decades due to populist policies that have led to budget deficits. As time marches on, the likelihood of Argentina, home to 47 million Latin Americans, facing a full-scale currency collapse looms. But what are the prospects for increased adoption of Bitcoin (BTC), given its outstanding track record when priced in the local Argentine Peso (ARS) currency?

Throughout its history, the Argentine government has frequently resorted to the practice of inflating the money supply, be it through bank deposits or government bonds. Notably, Argentina’s aggregate money supply M1, comprising currency, demand deposits, and other checkable deposits, has surged from 2.81 trillion ARS in July 2019 to a staggering 10.66 trillion ARS, marking a substantial 277% increase over the span of three years.

What happened to Bitcoin’s price in Argentine Peso (ARS)?

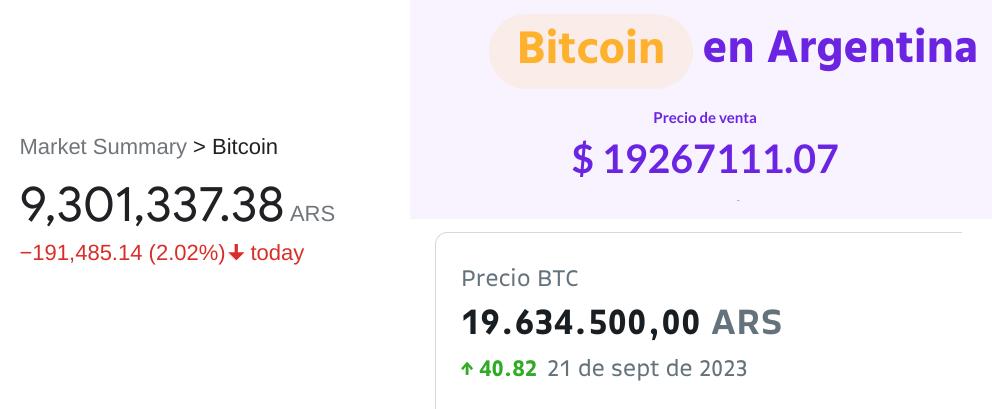

Bitcoin’s price on domestic exchanges has soared to 19.6 million Argentine Pesos (ARS), up from 14.2 million when BTC reached its all-time high in U.S. dollars in November 2021. This means that despite a 61.5% drop from $69,000, investors in Argentina have still managed to accrue gains of 38% when measured in the local currency.

However, one may encounter a different result when consulting Google or CoinmarketCap for Bitcoin’s price in ARS. The answer to this discrepancy lies in the official currency rate for the Argentine Peso, which is more intricate than what most investors are accustomed to.

To begin with, there is the official rate, known as the “dollar BNA,” set by the Central Bank of Argentina and used for all government transactions, as well as for imports and exports.

Observe how the Bitcoin price in Argentine Peso, as effectively traded on cryptocurrency exchanges, is nearly double Google’s theoretical price.

This theoretical price is calculated by multiplying the BTC price on North American exchanges in US dollars by the official Argentine Peso (ARS) rate provided by the local government. This phenomenon is not unique to cryptocurrencies; it also affects other highly liquid international assets, such as stocks, gold, and oil futures.

By artificially strengthening the official rate in favor of the Argentine Peso, the government aims to stabilize the economy, reduce capital flight, and curb speculative trading by making it more…

Click Here to Read the Full Original Article at Cointelegraph.com News…