Ask 10 different people to define a decentralized autonomous organization (DAO), and you’ll likely get 10 different definitions. But there is at least one thing most agree on: DAO governance is a mess. At best, it’s an experiment in the works.

According to DeepDAO, DAOs today handle a whopping $17.2 billion in value. Yet many DAOs managing millions of dollars have proven hopeless at heeding even the most basic of lessons in business management 101. One does not have to look too far in the annals of crypto history to recall major DAO catastrophes.

Recall Wonderland DAO, an Olympus fork that birthed arguably one of the most notorious scandals in DAO history. At its peak, Wonderland enjoyed a near $2 billion in total value locked, which came to a skidding halt in January 2022 when its treasury manager — who went by the pseudonym 0xSifu — turned out to be none other than Michael Patryn, co-founder of the failed crypto exchange QuadrigaCX and a convicted criminal for financial fraud.

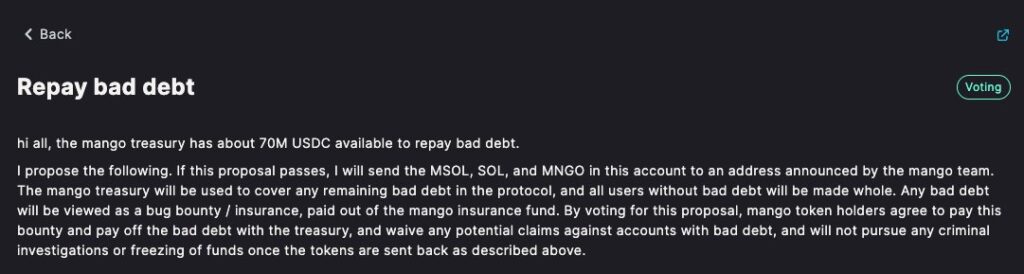

Or consider a more recent exploit with the Solana-based trading protocol Mango Markets. In October, attackers exploited the DAO’s loosely governed parameters to acquire a disproportionate chunk of the DAO’s MNGO tokens. In an absurd turn of events, the attacker proceeded to propose on governance forums an offer to return half their heist in exchange for the DAO not to prosecute him, then voted “Yes” on it with the stolen tokens. The vote eventually failed, but Mango still ended up paying off $47 million to the attacker.

Case studies of DAO failures are not exclusive to outrageous one-off spectacles like the ones above. Despite the Libertarian rhetoric of self-sovereignty and self-custody, dozens of DAOs that kept their monies on centralized exchanges also saw their treasuries implode during the carnage of 2022’s blow-ups like FTX.

The truth is, DAO governance isn’t easy. Founders have to balance a multitude of priorities, like solving voter apathy, committing to decentralization and product market fit. A “best practices” manual doesn’t exist, and where there is one, it’s not widely shared.

The good news? Die-hard DAOists are hard at work to rid these problems, one experiment at a time.

The problem of voter apathy

Take voter apathy, for instance, arguably DAO governance’s most widespread problem. As a “decentralized” community, tokenholders must vote…

Click Here to Read the Full Original Article at Cointelegraph.com News…