Arbitrum (ARB) has emerged as a leading contender within the Ethereum network’s layer-2 scalability solutions, boasting a significant total value locked (TVL) and notable activity. However, between Sept. 9 and Sept. 11, the price of ARB tokens experienced a sharp decline of 14.5%, marking its lowest point in history.

Investors are now eagerly seeking insight into the factors driving this movement and questioning whether Arbitrum still possesses the competitive edge, especially considering that irrespective of ARB token performance, the network TVL exceeds $1.6 billion.

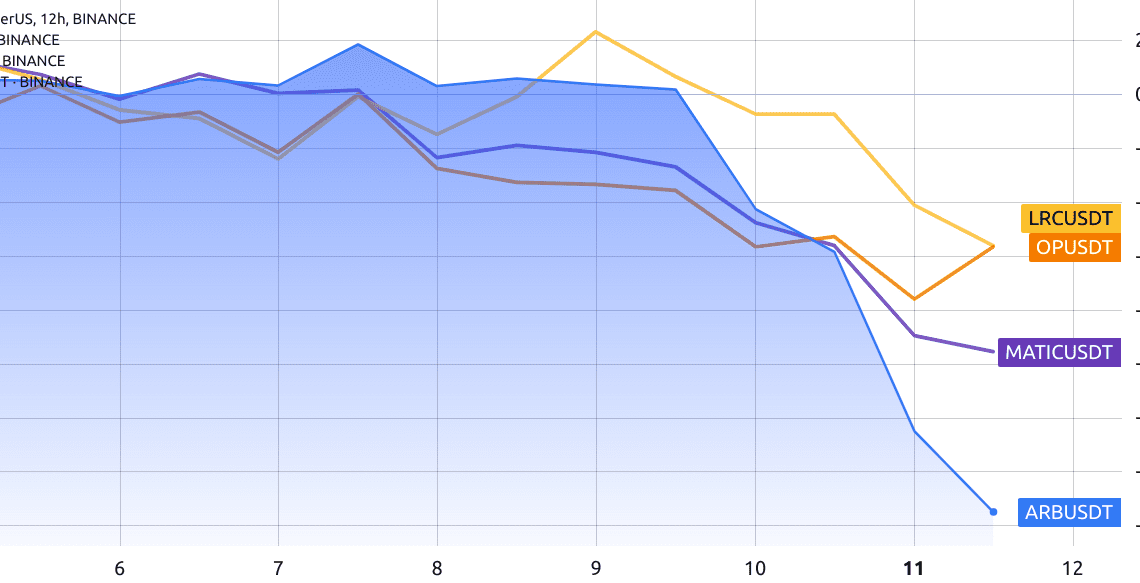

It is worth noting that the past week has been challenging for most cryptocurrencies but among Ethereum’s scaling solutions, none experienced a drop exceeding 9%, except for Arbitrum.

ARB governance proposals bring questionable benefits

One potential source of concern stems from the absence of any instances of fraud proof issuance since the launch of the Arbitrum mainnet in August 2021. Offchain Labs confirmed this information to Cointelegraph on Sept. 4. Developers, however, have explained that this situation aligns with the intended operation of the system, as validators with malicious intentions risk losing their entire stake. Consequently, this data is unlikely to have significantly impacted the price in the past week.

Additional factors that may help elucidate the recent price downturn are associated with governance proposals. The first proposal, posted on Sept. 2, aims to allocate up to 75 million ARB tokens from the project’s treasury to address “short-term community needs” for active decentralized applications (dApps) within the ecosystem. However, even if approved, this allocation represents less than 2% of the DAO treasury holdings and is unlikely to have triggered the ARB token price correction, regardless of one’s stance on the proposal.

Another governance proposal that has garnered attention was introduced on September 9th by PlutusDAO. This proposal seeks to return tokens from the DAO treasury to ARB holders through the activation of a staking mechanism, creating a native yield for participants, which could involve up to 2% of the total supply annually. Nevertheless, some investors view this inflationary approach as unnecessary and argue that it only exerts downward pressure on prices.

im not a VC so i’d “benefit” from this but..

dilution through inflation would be a PVP proposal,…

Click Here to Read the Full Original Article at Cointelegraph.com News…