Artificial intelligence (AI) and blockchain technologies have reached a “tipping point” and are set to shrink established industries while creating new ones, forecasts a report from Moody’s Investors Service published on Sep. 6.

According to the authors, the combined impact of AI and distributed ledger technologies (DLTs), such as blockchain, has effects “far beyond corporate balance sheets,” and “will likely reshape entire sectors, leading established industries “to shrink or disappear altogether while creating new markets from scratch.” The report notes:

“History has shown that transformative technologies can shrink established sectors shrink or wipe them out entirely […] AI will drive the emergence of new sectors, possibly in content generation, mobility, education, or healthcare fields. DLT has already led to the emergence of cryptocurrencies and decentralized finance, although the track record of these segments has been uneven over the past 18 months.”

The report highlights that AI will boost economic growth by increasing productivity through task automation, partially offsetting the effects of aging and shrinking populations in many countries. As for DLT, the benefits include fostering financial inclusion and modernizing payment systems. However, it is unlikely that these benefits will materialize before the next decade.

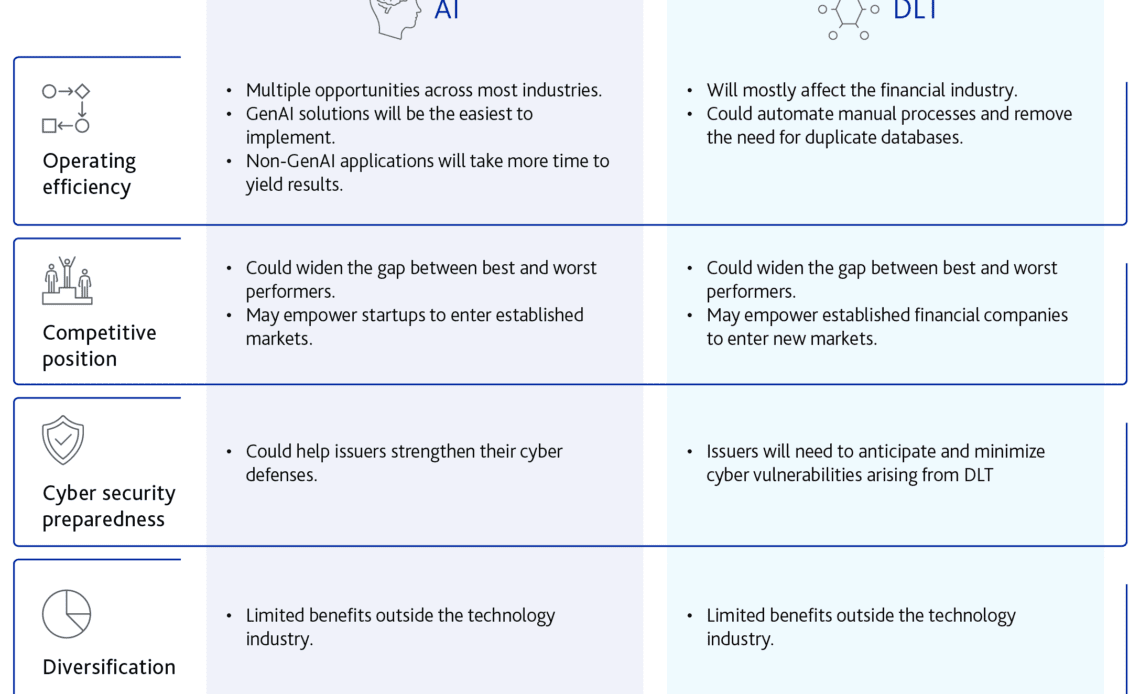

When considering the impact on global financial markets, the authors outline that AI and DLT will improve process efficiency and create new products, thereby enhancing credit profiles for financial firms, as long as financial, regulatory, and cybersecurity risks are properly addressed.

“The coming transformation will bring process efficiency and new products, but also amplify existing risks and give rise to new ones,” reads the report, adding that the “interaction of risk and opportunity will be transmitted to debt issuer credit profiles through five broad channels, with impact varying by sector and issuer strategy.”

Measures of credit risk that will be influenced by the technologies include business strategy and implementation, financial performance, governance and risk management, and industry and economy-level changes.

“The overall economic and financial effects of technological changes, including the policy and strategic shifts they prompt, are likely to be positive. However, there will be considerable differences in how the costs and…

Click Here to Read the Full Original Article at Cointelegraph.com News…