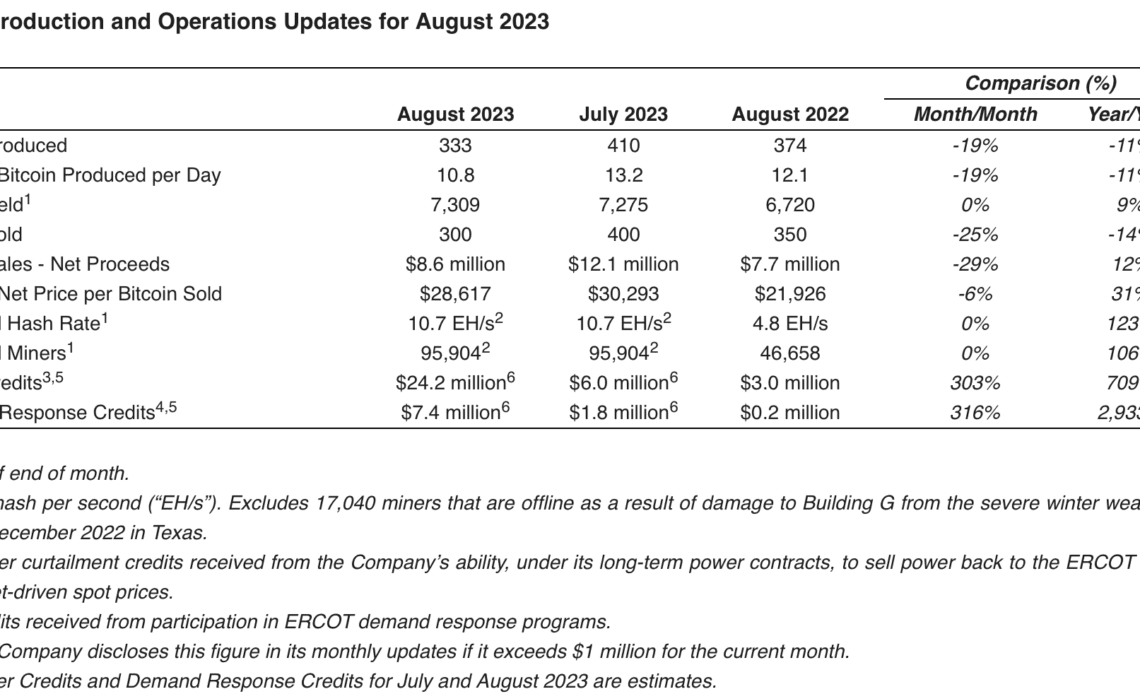

Bitcoin miner Riot Platforms mined fewer Bitcoin (BTC) in August than July, but received over $31 million in power credits. That is the equivalent of around 1,136 BTC, CEO Jason Les pointed out in a statement.

Riot received an estimated $24.2 million in power curtailment credits under its contract with Texas grid operator Electric Reliability Council of Texas (ERCOT) and $7.4 million from ERCOT’s demand response program. Those monthly credits are greater than the credits the company received for all of 2022, Les said.

According to a presentation released by Riot on Sept. 6, the company’s power strategy is based on three mechanisms, and all depend on its long-term ERCOT contract. Power credits are received when the company curtails operations and returns power to ERCOT when the price of electricity makes mining unprofitable.

Related: Marathon Digital blames weather conditions for mining 21% less Bitcoin in June

Demand and response credits are received when Riot “competitively bids to sell ERCOT the option to control Riot’s electrical load,” whether or not the electric company chooses calls on Riot to reduce consumption. Les said:

“The effects of these credits significantly lower Riot’s cost to mine Bitcoin and are a key element in making Riot one of the lowest cost producers of Bitcoin in the industry. Riot’s power strategy is a key competitive advantage.”

Texas experienced particularly harsh weather in August, with temperatures near or above record high levels for days on end. Riot’s presentation noted, “Bitcoin Mining is one of the few industries that can lower energy consumption and support the grid during times of demand stress.”

#Bitcoin miners are having a banner 2023: with costs to mine below the current price of bitcoin and rising production, margins are expanding, revenues are exploding, and profitability is turning the corner. @RiotPlatforms @MarathonDH @Hut8Mining @HIVEDigitalTech @BitDigital_BTBT… pic.twitter.com/kqN022CmTz

— Juan Leon (@singularity7x) August 30, 2023

Riot Platforms saw a loss of $27.7 million in the second quarter of this year, but that is a vast improvement year-on-year — the company was down $353.6 million in Q2 2022, during the depths of the crypto winter. The company plans to install thousands of new miners before the Bitcoin halving.

Magazine: Crypto City: Guide to Austin

Click Here to Read the Full Original Article at Cointelegraph.com News…