Bitcoin (BTC) is headed for a long-term support retest, data suggests after BTC price action fell into the August monthly close.

BTC price: Roads point to $23,000

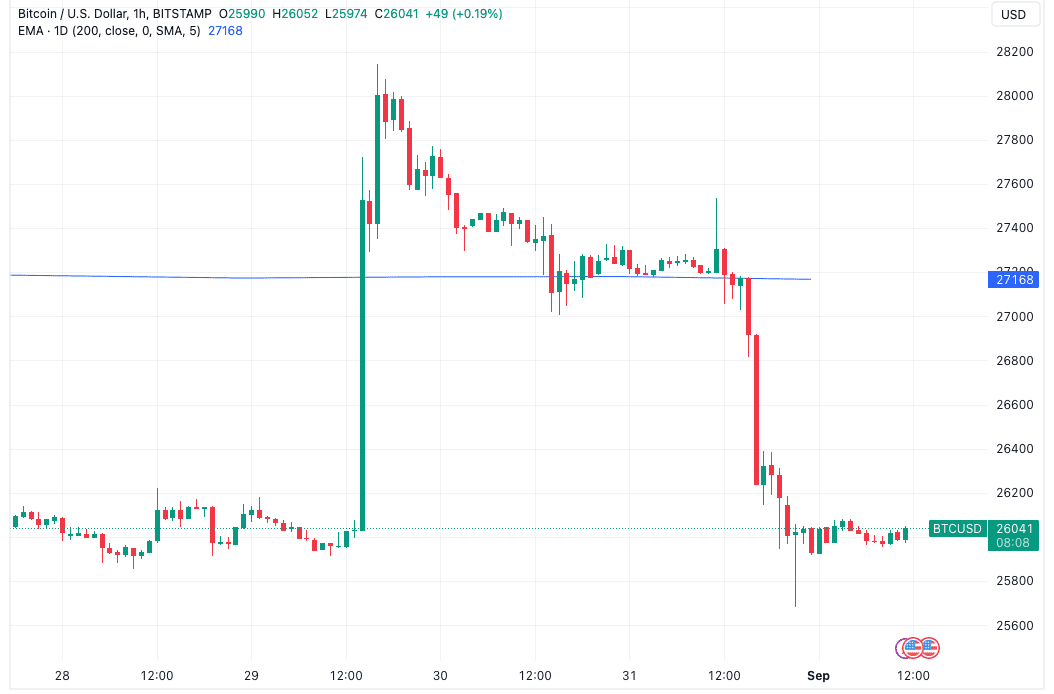

Reversing gains seen last week, BTC/USD is back below $26,000 as of Sep. 1, data from Cointelegraph Markets Pro and TradingView shows.

Market participants had seen cause for bullishness into the close, with Bitcoin holding a key long-term trendline and preserving $27,000.

A decision by United States regulator, the Securities and Exchange Commission (SEC), to delay a slew of Bitcoin spot price exchange-traded fund (ETF) applications forced a rethink — Bitcoin then shed $1,000 over just two hourly candles.

Now, observers are concerned that even current levels may fail to hold the market up for long.

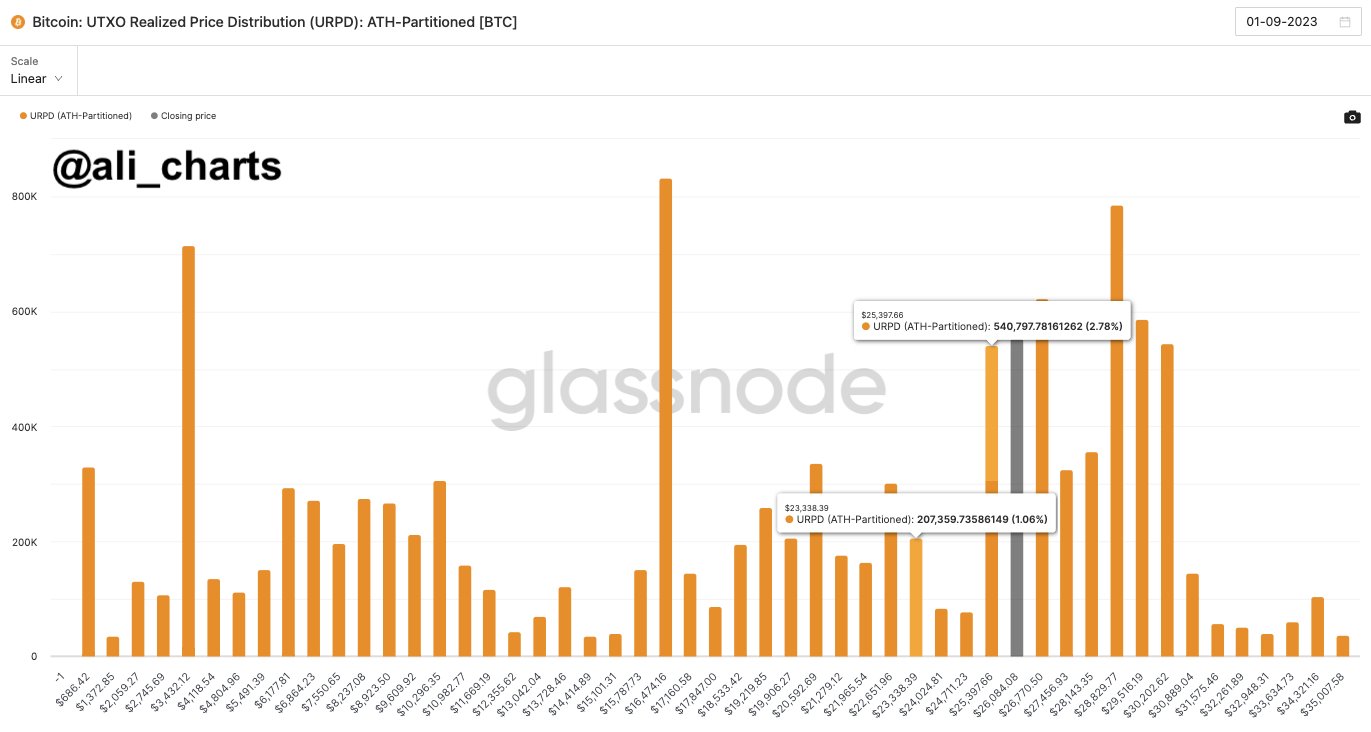

“On-chain data suggests that $BTC lacks strong support below the $25,400 mark,” popular trader Ali told X subscribers.

“If BTC breaks below this threshold, it could swiftly correct down to $23,340.”

Ali uploaded a chart of the UTXO Realized Price Distribution (URPD) metric from on-chain analytics firm Glassnode.

This tracks the price at which the current set of transaction outputs were created, and functions as a roadmap for likely price support and resistance levels.

A breakdown to $23,000 would not come as a surprise to some, with that target already on the radar for various traders and analysts.

Bitcoin inches toward key support battleground

Continuing, on-chain monitoring resource Material Indicators delivered a similarly grim picture for BTC/USD on daily (D), weekly (W) and even monthly (M) timeframes.

Related: Bitcoin metric with ‘100% long hit rate’ predicts $23K BTC price floor

Using signals from one of its proprietary trading tools, Trend Precognition, Material Indicators advised that $24,750 needed to hold for bulls to have a chance at clinching a rebound.

“If price moves and holds below $25,350 the W signal will invalidate, however, if support holds above the LL at $24,750 there will be a good foundation to rally from and retest resistance,” part of X commentary explained.

“We will look to the Monthly candle open for a signal from the Trend Precognition algos to gain insight to whether we can expect an extension of the downtrend or a monthly momentum shift to the upside.”

Click Here to Read the Full Original Article at Cointelegraph.com News…